Britain ripe for new business with Vietnamese agro imports

It is expected that authorised agencies of Vietnam and the UK will work together over the next 18 months to devise new mechanisms for the Southeast Asian nation to boost agro-forestry-fishery (AFF) products to the UK, where demands for tropical products sourced from countries like Vietnam are surging.

“The UK-Vietnam Free Trade Agreement (UVFTA) will help boost such exports to the UK. Vietnam has emerged as a major Southeast Asian provider of farm produce and aquaculture products to the UK thanks to the agreement,” said Deputy Minister of Agriculture and Rural Development Phung Duc Tien.

|

Vietnam earned an AFF export turnover of $48.6 billion last year, up from $41.25 billion in 2020. The products were exported to over 200 nations and territories.

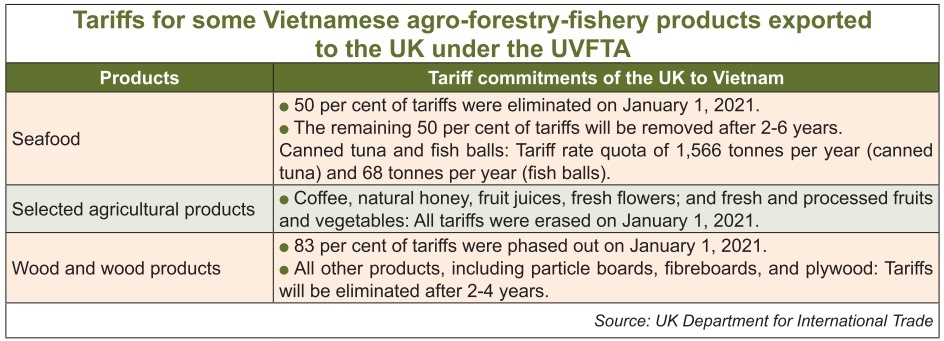

“The UK is Vietnam’s third-largest trade partner in Europe. Last year, Vietnam’s AFF exports to the UK grew 71 per cent as compared to 2020. For example, Vietnam’s coffee exports to the UK reached 34,650 tonnes worth $66.16 million – the figure grew 180 per cent in the first half of this year,” Tien said. “Under the UVFTA, favourable tariffs are offered to businesses from both nations (see Table).”

According to the Trade Agency at the Vietnamese Embassy to the UK, under the UVFTA, items with an immediate exemption of non-quota import tariffs include coffee, rambutan, mango, lychee, longan, dragonfruit, coconut, and pickles. Other items include shrimp, tuna, groundfish, fragrant rice, cassava starch, and other agricultural products, which will also be exempted from tariffs under quotas.

Nguyen Canh Cuong, trade counsellor at the embassy told VIR, “Currently big supermarkets and retailers from the UK tend to place direct orders from prestigious producers in order to diversify their product portfolios, seek innovation, and better control product quality and origin. So, Vietnamese firms can register to become these supermarkets’ and retailers’ suppliers via their websites.”

The Trade Agency said that when it comes to sanitary and phytosanitary measures (SPS), the UVFTA creates favourable and transparent conditions for the import of agricultural products, food, beverages, and other products subject to SPS measures.

For goods from the UK exported to Vietnam, the latter has committed to ensuring scientific bases for any new SPS measures. Vietnam shall only adopt measures that are scientifically justified, consistent with the risk involved, and that represent the least restrictive measures available and result in a minimum impediment to trade.

In addition, Vietnam shall make available information about the frequency of import checks carried out on products. This frequency may be adapted as a consequence of verifications or import checks, or by mutual agreement with the UK.

At a meeting with the outgoing British Ambassador to Vietnam Gareth Ward a few weeks ago, Deputy Minister Tien suggested that both nations soon sign an MoU on boosting AFF cooperation, laying a firm groundwork for the two countries to devise more mechanisms and incentives for businesses of both sides.

Tien also proposed that the UK support Vietnam in training and capacity improvement in the pesticide and crop production sectors which remain weak in development.

“In addition, Vietnam also wishes to attract more investment from the UK in high-tech agriculture, including cultivation, processing, preservation, and distribution of farm produce and foods,” Tien said.

At present, though Vietnam is now home to $4.16 billion in British registered capital for 475 valid projects, very few are in the AFF sector, according to the Vietnamese Ministry of Planning and Investment.

According to the US Department of Agriculture, last year, the UK imported $1.3 billion of processed fruits, a decrease of $106 million from the previous year. The top processed fruit imports are dried grapes, jams, and dates. The EU holds the largest market share of 45 per cent, followed by Turkey (16 per cent) and South Africa (5 per cent). UK imports of processed fruits had been stable until 2021 when imports dropped 8 per cent from 2020.

Regarding fresh fruits and vegetables, also last year, the UK imported $5.1 billion of fresh fruit, mainly comprised of bananas, grapes, apples, cranberries, and avocadoes. Also, in the same year, the UK imported $3.3 billion of fresh vegetables (tomatoes, peppers, mushrooms, and cucumbers). UK fresh fruit and vegetable imports have generally increased year-to-year, growing at an average of $140 million per year from 2011-2021.

| UK ramps up Global Britain agenda with new dialogues As the United Kingdom is further cementing its cooperation with ASEAN in various sectors including trade and investment, this nation is deepening the similar ties with Vietnam on the back of a bilateral trade agreement and an upcoming $11 trillion Asia-Pacific free trade deal. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

Tag:

Tag:

Mobile Version

Mobile Version