Bringing carbon pricing towards the design table

|

| Vietnam is committed under various agreements to curb the increase of GHG emissions |

This was one of the main factors pored over at a workshop last week in Hanoi on the role of carbon pricing and market instruments in nationally determined contribution (NDC) implementation and the potential for application in Vietnam, hosted by the Ministry of Natural Resources and Environment and the World Bank.

The workshop aimed to build a carbon pricing approach including support to develop market-based instruments and raise awareness, knowledge, and capacity of related ministries, businesses, and industry associations on carbon pricing tools.

“Around the world, a growing number of businesses are leading the transition toward a low-carbon future. A well-designed carbon is indispensable to reduce GHG emissions in a cost-efficient way, but carbon pricing alone is insufficient to address it,” said Rahuh Kitchlu, energy sector co-ordinator at the World Bank in Vietnam.

Carbon pricing is a market-based strategy for lowering GHG emissions. The aim is to put an actual monetary value on carbon emissions so that the costs of climate impacts and the opportunities for low-carbon energy options are better reflected in production and consumption choice.

There are two main types of carbon pricing – carbon taxes and emission trade schemes. Gasoline taxes, taxes for coal mining and natural gas or oil drilling feed-in tariffs, and reduction of fossil fuel subsidies are other examples of indirectly reflecting a price on carbon into consumer or business decisions, according to the World Bank.

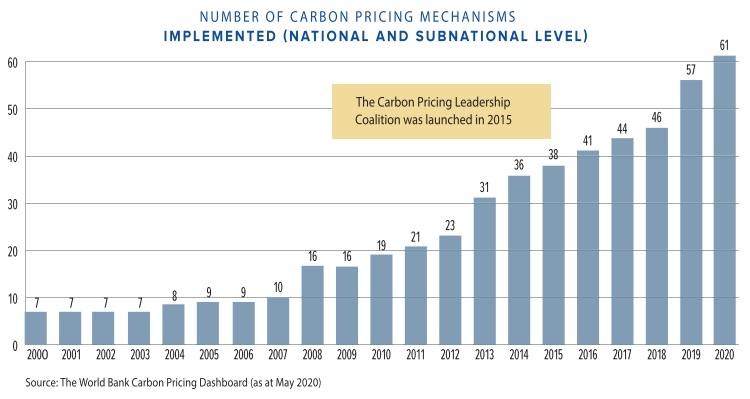

Truong Duc Tri, director of the Vietnam Partnership for Market Readiness Project, said that carbon pricing has played an important long-term role in helping jurisdictions and companies achieve zero emissions. He added that 30 countries and territories have been applying carbon taxes and thirty-one countries and territories have been applying emission trading system.

Selecting a national appropriate carbon pricing instrument is an important element, affecting the sustainable development of the country, business, and communities as well as ensuring the complacence with international commitments.

Thus, Tri said that carbon pricing requires a complete database on GHG emissions and other related matters such as transparency and accuracy of activity dates, business dates, GHG inventories, and also a registration system that falls under international criteria.

Besides that, researching carbon pricing requires comprehensive assessment on economic and social impacts as well as consensus among stakeholders including government, the economic sector, enterprises, and communities.

A representative of the Ministry and Planning and Investment said that a growing number of private sector players, particularly investors, are also driving the climate agenda forward by using carbon pricing tools to understand and manage climate risks. Many developing countries are looking to identify effective options to engage the private sector, including working with international partners.

He gave recommendations on carbon pricing tools that need a transparent legal framework to encourage the private sector, increase reliability, and share information as well as take advantage of international support.

Vietnam’s Green Growth Strategy provides a pathway to achieve its NDC goals. Private investment will play a significant role in meeting Vietnam’s demand for green finance, with 70 per cent of the $21 billion in total investment expected to come from the private sector.

In addition to supporting the achievement of the country’s mitigation and adaptation goals, the participation of the private sector will help advance the country’s sustainable development objectives, including promoting the more efficient use of natural resources, cutting costs for households and firms, and improving the competitiveness of the economy, according to the Center for Clean Air Policy, a global non-profit climate research and development group.

The NDC strategy highlights the key role that private sector finance will need to play beyond more traditional sectors for green investment, such as renewable energy. For example, $12 billion in international support will be needed in the agricultural sector to meet Vietnam’s NDC target, more than twice the amount needed in the energy sector.

“It is necessary to have a solid database and ensure data quality before the market can officially trade in carbon pricing,” said Hoang Van Tam, from the Energy Efficiency and Sustainable Development Department under the Ministry of Industry and Trade at the workshop.

“The participation of stakeholders in the design and pilot stage is an important factor to ensure the success of the programme. Besides that, incentives and penalties should be clearly stated in carbon pricing and market instruments,” Tam said.

So far, solid waste and steel are the two piloted fields for Vietnam joining the carbon market. The potential for facilities in two sectors in the coming time can be achieved at a level seen within groups of low-emission countries through improving process performance, managing raw materials, and upgrading technology.

Much more action will be needed going forward to meet the Paris Agreement commitments. In that, Vietnam commits to reducing at least 8 per cent of GHG emissions by 2030, and up to 25 per cent if it receives effective support from the international community.

|

| Nguyen Thi Huyen - Deputy head, Environmental and Sustainable Development Institute of Energy

Currently, Vietnam does not had a specific sanction, price, or market for CO2 so we do not have a basis for selling it. We can use market price of the clean development mechanism (CDM) but it is very cheap. Therefore, although we have pointed out different scenarios for fuel field, we have troubles with price. The current CDM is applied for all industries in the whole country but it should be made based on electric and energy so that we can have an orientation to follow. Moreover, the coefficient of CO2 is now different from the ones in the past. Now the energy industry is importing a large amount of coal and using types of mixed coal at different rates with different emission coefficients, so giving out clear indicators for each type and sector is very important and convenient. Regulations should also outline benefits and duty of enterprises from carbon pricing and market-based instruments so that they can implement it voluntarily, and contribute towards sustainable development. Le Thu - Environmental specialist, World Bank

Currently the Vietnamese government is striving to reduce GHG emissions. This is one of the highest commitments of Vietnam. Besides carbon pricing, there should be additional policies such as policy on reducing GHG emissions or promoting production of clean electricity. In the long term, building a carbon market will bring us a lot of benefits in the future. To do that, the government should help enterprises strengthen their ability and accompany them during implementation of carbon pricing. The carbon market has great impacts on the economy, and it is a chance for competition between enterprises. The carbon market also relates to all people so it should be understood by not only enterprises but also all citizens. We should let enterprises steadily get ready by changing technology or input material. There is a positive signal that the draft of the amended Law of environmental Protection is mentioning implementation of a carbon credit market in Vietnam. Luong Quang Huy - Deputy head of Climate Change and Ozone Protection, Ministry of Natural Resources and Environment

In the Law of Environmental Protection 2014 and the Party’s Resolution No.24-NQ/TW of June 03, 2013, on active response to climate change, regulations on reducing GHG emissions have been mentioned. However the ability of policy, technical, building, and implementing carbon pricing in Vietnam is still limited and not strong enough to join the global market. Along with lacking in experience, Vietnam’s budget for these activities is also limited. To reach targets, we must invest tens of billions of US dollars, change policies and orientation of economic development, and even alter the mindset of the political and socio-economic system. Besides these, challenges include human resources and a responsive ability that requires us to mobilise different resources, particularly in the private sector, to participate. Carbon pricing is necessary for sustainable development, and all market-based instruments like tax and credit need a synchronised action programme. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Themes: Towards Sustainability

- $100 million initiative launched to protect forests and boost rural incomes

- Decree opens incentives for green urban development

- European expertise to boost Vietnam’s sustainable logistics push

- Living with water: from policy to practice of the 'sponge cities' concept

- From climate pressure to new urban mindsets

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Mobile Version

Mobile Version