BOD operations under scrutiny ahead of AGM season

|

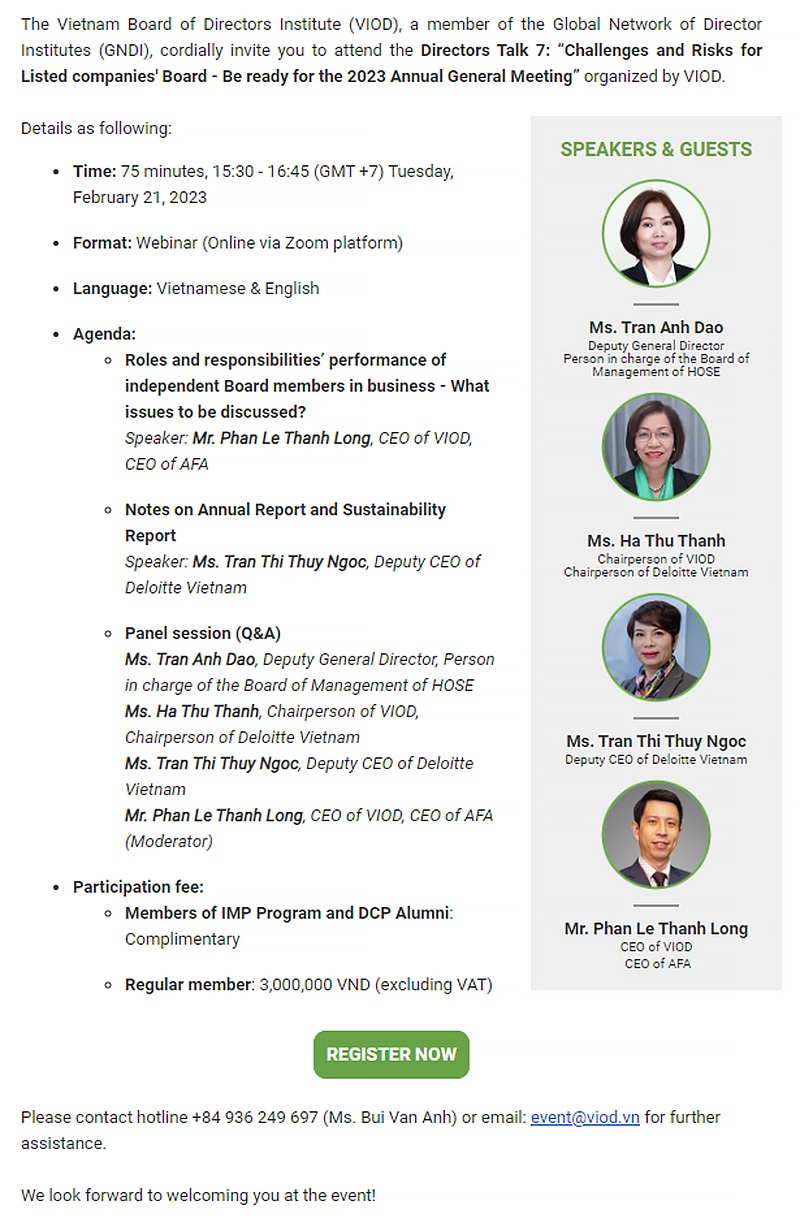

International practices have proven that capable independent members of the board of directors (BOD) can contribute effectively to the neutrality and transparency in businesses’ information disclosure and sustainable development. However, Ha Thu Thanh, chairperson of the Vietnam Institute of Directors, and chairperson of Deloitte Vietnam, pointed out that there is a gap in independent members’ competency.

“We are really lacking resources in terms of high quality and professional independent members. However, the BODs often want independent members who had prior connection with them to ensure they have critical thinking, but not objection,” Thanh said.

In addition, the awareness of the role of independent members in most Vietnamese companies is still quite vague. According to industry experts, public companies are related to the interests of many people and have wide social influence, so they need people who are neutral, independent and objective to prevent manipulation, and harmonise the interests of shareholders. Those who do not have capital in the company often have a more objective and balanced voice and can help investors avoid blind spots in terms of information.

In a number of cases, there is a lack of balance between executive and non-executive members, including independent. This leads to oversight that doesn’t make much sense as the orientation, monitoring, and executive roles are focused mainly on executive members, according to the experts.

Based on standard corporate governance practices in the world, there are currently two models for BOD monitoring. First is the one-tier model that Vietnamese businesses are gradually approaching, where the BOD itself is divided into executive members and non-executive members, so there is a mechanism to supervise each other among members.

A BOD is deemed to operate more effectively when the role of non-executive members and the independent members becomes clearer in overseeing and taking the main responsibilities for matters requiring high independence, such as auditing, board and top-level nomination, compensation and remuneration.

The second model is a two-tier governance version, which is common for businesses in the likes of Germany or Indonesia, where the BOD is divided into a supervisory board and executive board. A majority of Vietnamese enterprises also follow this model, with a slight different in maintaining the supervisory board with members not necessarily in the BOD but are elected by shareholders.

The supervisory board is not only for supervision but also for detailed inspection, implementation, and also appraisal. However, the current mechanism in many enterprises makes the supervisory board ineffective.

As for corporate’s annual reports, insiders believe that the focus this year is on sustainability reports, an concept that has, until now, received insufficient attention.

In Vietnam, according to the State Securities Commission (SSC), while the issuance of a sustainability report is considered a tool that could improve enterprises’ awareness of new business risks and opportunities, such issuance has not been taken full advantage of. In the 2022 reporting season, only 19 companies issued a separate sustainability report.

“Non-financial matters are placing their increasing importance into investors’ consideration. Progressive financiers do not only gauge a company’s success and performance by financial indicators like they did in the past,” noted Ta Thanh Binh, head of Securities Market Development at the SSC. “The concerted effort to launch a separate sustainability report, besides a sustainability section in an annual report, is an impetus, together with solid corporate governance.”

Last year marked 10 years since Vietnamese listed companies began publishing information on sustainable development. “Many businesses have kept pace with changes in legal regulations as well as trends in combating climate change in Vietnam and around the world. Quite a few enterprises have published information on total greenhouse emissions by different ranges, with most mentioned programmes to combat climate change,” said Nguyen Viet Thinh, head of Judging Panel, Sustainability Reporting Award, part of the Vietnam Listed Company Awards.

At December’s annual Corporate Governance Forum, co-hosted by VIR and the Vietnam Institute of Directors, international and domestic experts shared their insights of how sustainability-linked investments, particularly in the manufacturing and industrial segments, still come at a high cost premium, or “green cost premium”, which might impede businesses’ short-term profit. This, as a result, might trigger concerns among shareholders if skyrocketing costs related to environmental, social, and governance criteria were practical or not.

Some also argue that even consumers would not fancy the idea of sustainability living as they have to bear the cost of high energy prices, increasing inflating rates, and expensive living standards.

Likewise, research in June 2022 by Deloitte highlighted that just over half of consumers have yet to create a more sustainable lifestyle due to the cost of eco-friendly alternatives. A slightly higher percentage of people would not hesitate to switch if products were more affordable, the research pointed out.

|

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

Tag:

Tag:

Mobile Version

Mobile Version