Banks sharpen focus on scale-up of sustainability

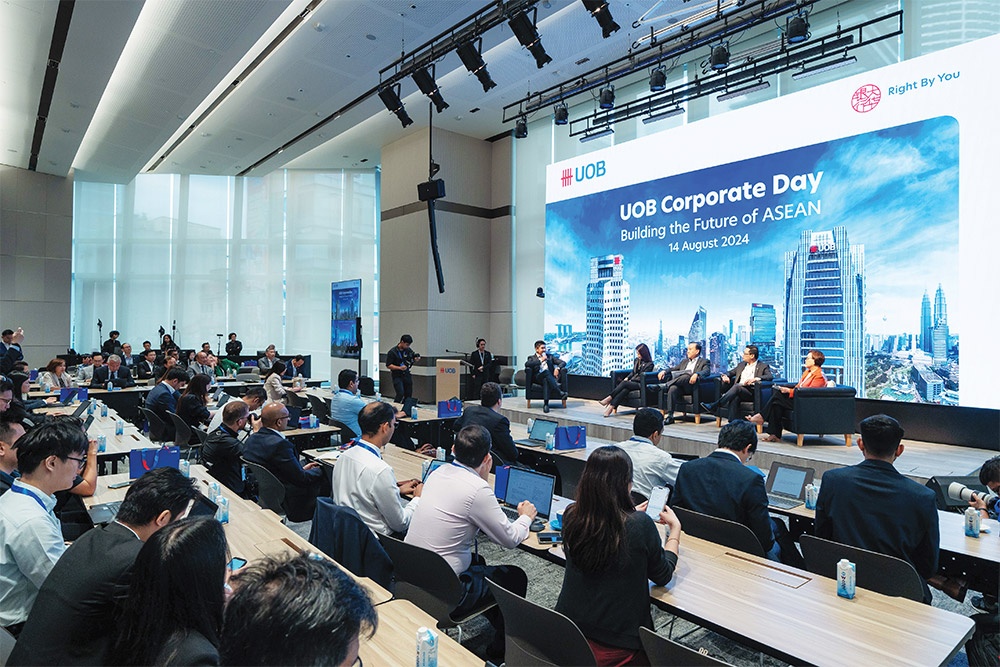

At UOB’s corporate day, themed “Building the Future of ASEAN” held on August 14, representatives from foreign banks and credit institutions firmly committed to responsible investment practices and partnering with Vietnamese businesses across various sectors through an eco-risk management framework and environmental, social, and governance (ESG) policies.

|

| Financial experts want to see enhanced use of green credit packages |

“Vietnam’s sustainable growth, particularly in the supply chain and AI sectors, presents exciting opportunities,” said Rangu Salgame, chairman and CEO of Princeton Digital Group. “Foreign investors are closely monitoring the market, waiting for the right moment.”

Recently, Vietnam has been regarded as a prime location for data centre investments, Salgame added. “Given the scale of our investments, Princeton Digital Group aims to enter once Vietnam reaches a significant market size, at which point we will begin constructing large data centres. The group has a strong affinity for Vietnam and looks forward to contributing capital to its development.”

In addition to green and sustainability-linked loans, transitional finance is critical for the decarbonisation of carbon-intensive sectors and companies. For instance, Buymed, a company in which UOB Venture Management’s funds invested last year, is the first online healthcare marketplace in Vietnam that efficiently connects small drug store owners, pharmacies, clinics, and hospitals in sourcing and procuring pharmaceutical and medical supplies.

Buymed’s end-to-end logistics and fulfilment infrastructure enables its services to cover all 63 provinces and cities, and 12,000 districts in Vietnam. “UOB will continue to collaborate with industry stakeholders, including regulators and international alliances, to advocate for greater clarity on transition pathways, policies, and guidelines, which are essential for both financial institutions and corporations to be held accountable for achieving collective net-zero ambitions,” said Wee Ee Cheong, deputy chairman and CEO of UOB.

In an interview with VIR regarding the scale of green credit UOB is providing in Vietnam and how domestic businesses are receiving and absorbing such capital flows, Lim Lay Wah, head of Sector Solutions and Global Financial Institutions at UOB, stated, “While sectors like AI and high-end semiconductors hold significant promise, UOB’s green credit priority remains focused on green financing in the real estate and hospitality sectors. Our green mortgage loans cater to both commercial and regional clients, reflecting our comprehensive approach. Additionally, data centres driven by AI growth and energy transition are key focus areas.”

Future investments are expected to grow significantly, with a focus on financial services and digital infrastructure,” Wah added. “Our regional presence and collaborations will continue to drive progress, with ongoing efforts to address market needs and investment opportunities,” Wah said.

As financial intermediaries providing capital to the economy, an increasing number of banks and financial institutions in Vietnam are adopting ESG practices in their operations to align with the shared goal of promoting sustainable development.

In 2024, BIDV will continue to enhance the implementation of green credit packages introduced last year, and develop new green credit programmes, such as mid- to long-term credit packages for special regions like the Central Highlands and the Mekong Delta.

“We will also encourage loans for crop development, including replanting and transitioning to higher-value crops. Simultaneously, BIDV is exploring a green bank branch model, which ties into the goal of promoting green credit growth and managing environmental and social risks in credit activities,” said BIDV’s CEO Le Ngoc Lam.

In terms of capital for expanding green financial products, BIDV was the first bank to successfully issue over $100 million in green bonds, following the principles of the International Capital Market Association in the domestic market.

According to a 2024-2026 report for Vietnam on its transition to a climate-resilient and sustainable economy, published by the Asian Development Bank in July, Vietnam requires substantial financial resources of approximately $368 billion by 2040, equal to $20 billion annually, to meet its green growth targets.

However, statistics from the Ministry of Finance show that Vietnam has only issued around $1.16 billion in green bonds since 2019.

Nguyen Thi Thu Ha, deputy head of the ESG Steering Committee at Agribank, acknowledged that implementing ESG in Vietnam still faces challenges from both within and outside the banking sector.

“Within the sector, green lending requires deep environmental technical expertise, posing challenges for credit officers in assessing project efficiency and customers’ repayment capabilities,” she explained. “Outside the sector, investing in green industries often entails long payback periods and high investment costs, while the funding of financial institutions primarily comes from short-term deposits. This creates difficulties for financial institutions in balancing capital and ensuring compliance with regulations on short-term capital for mid- to long-term loans.”

| Driving ASEAN’s supply chains through connectivity The ASEAN region’s supply chains are being driven through both connectivity and sustainability. Leong Yung Chee, head of Group Corporate Banking at UOB, gave VIR’s Hanh Vy his insights on capturing connectivity flows and the various opportunities available in fast-growing trade corridors in Vietnam. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Mobile Version

Mobile Version