Banks enlist eKYC capabilities to smooth out sign-up process

|

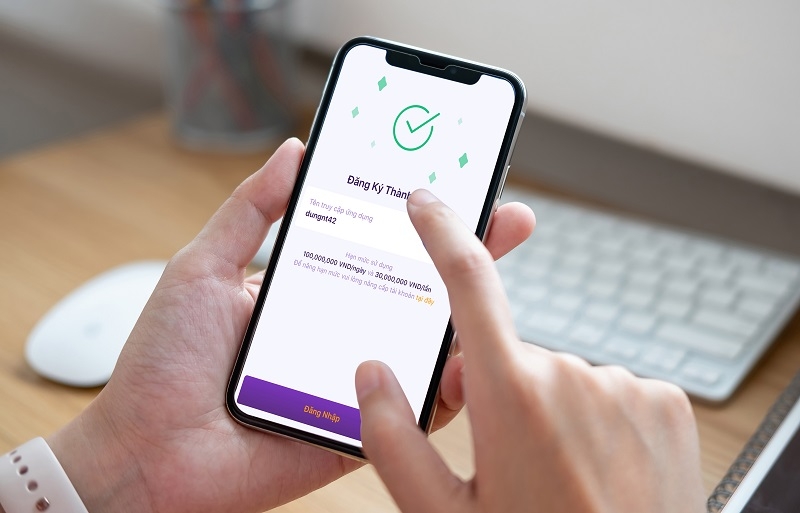

| eKYC solutions can automate customer IDs and serve as an added level of prevention against financial crime, source: TPBank |

Tran Hoang Duong, a 19-year-old freshman in Hanoi, told VIR that he is eager to open his very first bank account.

“As a first-year college student, I have jotted down a to-do list to make my college life more convenient. Obviously, bank accounts come in handy when I have to pay tuition fees or shop online.”

But Duong no longer has to go to a brick-and-mortar bank to do so, because he can now conduct the process of verifying his identity online through biometrics without face-to-face meetings. This feature is also known as e-Know-Your-Customer (eKYC).

“With the process I do not need to waste time on filling in lengthy paperwork or queue up at the bank,” he noted.

The unprecedented COVID-19 pandemic has further accelerated the digital transformation in Vietnam as recent reports have strongly indicated impressive growth of both online users and transactions.

Rolling out solutions

The newly-adopted solution is particularly relevant today as customers demand improved and fully-digital experiences. With the rise of digital banking and fintech, eKYC as part of an overall digital onboarding experience has become crucial for financial companies and startups.

“eKYC is considered one of the most important factors for the digital transformation of financial services and financial inclusion in Vietnam,” said Nguyen Thien Tam, director of the Digital Strategy Division at Orient Commercial Joint Stock Bank (OCB). “That’s why OCB has long prepared for the adoption and approval of eKYC since last year where we engaged and conducted proof of concept demonstrations with different eKYC vendors in order to find the most suitable technology for our business.”

Furthermore, OCB started to build different business cases using this innovative technology, not only for new account opening but also for 100-per-cent digital approval of credit cards and unsecured loans. Like other banks that have already launched new account opening processes using eKYC, OCB is preparing to launch this service in early November.

At HDBank, online identifiers officially moved into action from the beginning of August. After one month of eKYC implementation, HDBank has garnered over 35,000 new customers registering for iMoney and 15,000 verified accounts. Some 40 per cent of customers have conducted online transactions on the HDBank digital banking platform, increasing the transaction rate by a quarter compared to the period before eKYC was deployed.

A recent report by Irish consumer credit reporting firm Experian, also a partner of Techcombank, showed that eKYC allows banks to respond to new risks, such as identity fraud and account takeovers.

As the first institution meeting all the regulations of eKYC since July, VPBank has approximately 15,000 new registered accounts. The system allows VPBank to overcome all geographical and time barriers to identify all online customers based on biometrics without face-to-face meetings as per the current process.

Besides, Malaysia’s Hong Leong Bank plans to roll out more digital solutions to ease the transition and adoption of a digital lifestyle, and eKYC could be on its agenda.

According to Nguyen Hung, CEO of TPBank, this lender reported nearly 30,000 new registrations since the inception of eKYC, equivalent to 85 per cent of its traditional counterpart.

Along with LiveBank, eKYC is empowering TPBank to tap into the massive market and expand its outreach across Vietnam and even other countries, such as Thailand and South Korea.

“This shows that this technology has met the convenience, speed, and safety criterias of customers. More importantly, it demonstrates the new accessibility of our banking service, which could help TPBank achieve greater operational efficiency and scalability, increase financial access to remote communities, and enhance convenience without expanding the branch network,” added Hung.

A representative from Malaysia’s CIMB Bank said, “Live eKYC facilitates completion of the process online, eliminating the need for filling out physical forms and submitting physical documents. The main objective of eKYC is to register the customer with the least amount of paperwork and in the shortest possible time.”

With the adoption of different tools and processes paving the way for a landscape of greater digital trust and security, CIMB Bank Vietnam, the local franchise of CIMB, has launched eKYC for customers to open a bank account and Visa debit card within minutes, using OCTO, a digital bank application developed by CIMB.

Recently, eKYC was also applied to support the bank’s partners, namely Toss and SmartPay, to offer a continuous multi-channel experience for customers.

Other lenders are following suit with their already-launched or upcoming eKYC systems, such as Military Bank, Viet Capital Bank, LienVietPostBank, and BIDV.

As one of the leading foreign banks in Vietnam, South-Korea backed Woori Bank has every confidence in technology capabilities as well as data management, and is trying to catch up with the evolving trend. The lender has ramped up efforts for this campaign for more than a year, and in the first quarter of 2020, a new mobile banking application named Woori WON Vietnam was launched as a premise for eKYC adoption down the road.

Jeong Ku Young, deputy general director of the Digital Unit at Woori Bank Vietnam emphasised, “We are trying our best, step by step, to ensure that eKYC will be launched in early 2021. We firmly believe that we will be the first international bank which challenges the leading digital banking services in Vietnam.”

|

| Source:MBBank |

Ensuring security

The proliferation of digitally-led eKYC solutions are exposing lenders to a variety of roadblocks. In addition to some initial achievements, since eKYC has just been deployed, there is still much room for improvement.

Experts stated that products and services based on eKYC accounts are not as diverse as traditional accounts, they mainly focus on payment or savings services. Additionally, banks still offer transaction limits, thus restraining the number of transactions via this venue. In addition, the possibility of security risks has not been ruled out.

According to Nguyen Hong Trung, director of the Digitalisation Centre at VPBank, there are cases of Vietnamese users using deep-fake technology to bypass the liveness detection step. “These risks force banks to continuously monitor activities and update themselves to prevent repercussions,” he said, adding that VPBank has recently updated its deep-fake blocking feature.

Jeong Ku Young of Woori Bank cautioned that there are challenges for banks’ digitalisation journey, ranging from incomplete legal provisions, information management regulations, network security, and outsourcing problems.

“However, lenders are still under pressure of many restrictions from the State Bank of Vietnam (SBV). For example,we still need to gather the many loan documents from customers,” he said. “If regulations were bank and customer friendly, banks could provide fast-tracked and tailor-made services to customers through diverse digital channels.”

CIMB puts eKYC processes at the forefront of financial crime prevention, helping to halt fake accounts and transactional fraud in their tracks. eKYC will be integral to building digital trust into the system by design, helping CIMB manage their mushrooming data responsibilities.

“The breakneck speed of fintech and banks’ digital product development are often beyond the traditional scope of the financial landscape, and this roadblock makes it hard for regulators to respond in a timely fashion,” Nguyen Hung of TPBank told VIR.

“The SBV should actively bridge the gap between traditional products and digital innovations by creating a level playing field, offer favourable conditions for digitally-led services and most importantly, complete a comprehensive legal framework to encourage eKYC adoption.”

Tam of OCB added that the three biggest challenges for eKYC are the legal framework, corporate culture, and legacy systems.

“Bankers have longed for the SBV’s support to enhance synergies between traditional and technology-enabled products, and eKYC could be an exemplary case. This may encourage both local and foreign banks alike to launch innovative solutions, while being able to monitor the accompanying risks in a controlled environment,” Tam said.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version