An internet economy: a golden treasure trove?

|

|

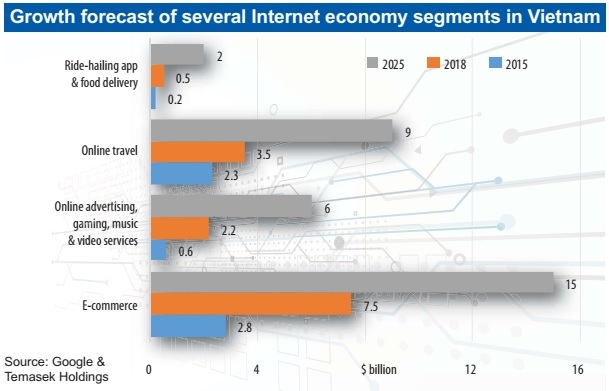

The alleged top ‘gold mine’ of the Vietnamese Internet economy, e-commerce, which was valued at $7.5 billion in 2018 and is anticipated to reach $15 billion by 2025, is being dominated by foreign players.

Of the five largest e-commerce players in the Vietnamese market at present - Shopee, Lazada, Tiki, Sendo and Adayroi - the top and the second largest firms are foreign-owned. Both Tiki and Sendo are controlled by foreign investors, with only Adayroi being truly Vietnamese with management coming from leading Vietnamese conglomerate Vingroup.

Last year, Alibaba injected an additional $2 billion into Lazada Southeast Asia. In total, Alibaba has poured $4 billion into the leading e-commerce firm in the region. Its recent change of CEO and intensive investment into online payment means the company has ambitions to become the leading player in the Vietnamese market.

Alibaba’s rival in the Vietnamese market, Shopee, is being supported by parent company SEA and China’s Tencent Group, which is valued at $500 billion, holds about 40 per cent stake in SEA.

The parent company pumped $50 million into Shopee Vietnam last year, and is increasing its total investment to $500 million to carry out network expansion across Vietnam, Thailand, Malaysia, Indonesia, the Philippines, Singapore and Taiwan.

SEA enjoyed sound successes with its initial public offering (IPO) on the New York Stock Exchange in October 2017 and raked in $884 million.

In August 2018, Sendo received a $51 million investment from eight investors led by Japan’s SBI Holdings.

In early January 2018, Tiki endorsed a $44 million investment from JD.com, China’s largest online retailer in revenue. In the same month, global search engine Google announced its own $550 million investment into JD.com to improve its retail infrastructure across multiple markets, including Southeast Asia, America, and Europe.

Although e-commerce sites have faced constant losses, money flow has continuously poured into the sector as businesses strive for a larger slice of the market through intensive investment into support services ranging from payment to logistics.

In addition, last April US e-commerce giant Amazon officially entered the Vietnamese market. The move is expected to fuel market competition which is anticipated to greatly increase this year and in the next few years.

“The race between the trio still remains the leading factor for the market in the near future. Lazada, Tiki and Shopee will have great opportunities to take off as more money has flowed into these three players. Competition will drive market growth and the consumers benefit the most,” said Nguyen Manh Dung, chief representative of CyberAgent investment fund.

The fledgling online travel market

The second largest ‘gold mine’ of the Vietnamese digital economy comes in the form of online travel agency (OTA), which reported $3.5 billion in total revenue during 2018 and has an estimated revenue of $9 billion by 2025.

Recent figures by the Vietnam E-commerce Association show that global OTAs such as Agoda.com, Booking.com, Traveloka.com, and Expedia.com are holding 80 per cent of the nation’s market share. A large proportion of international visitors use services provided by foreign OTAs. Many local visitors have also used services provided by foreign OTAs.

Vietnamese OTAs such as Gotadi.com, Ivivu.com.vn, VnTrip.vn, Chudu24.com, Mytour.vn, and Vinabooking.vn have arrived late to the domestic market and face fierce competition from technology and capital-intensive foreign players.

A single bright point in the context of foreign players dominating the online travel scene in 2018 comes in the form of local hotel booking app Vntrip.vn which successfully received $45 million worth of capital from IHAG Holding from Switzerland.

Simultaneously, VnTrip has merged with budget air-ticket provider Atadi.

According to iViVu CEO Nguyen Trung Cong, local consumers have provided the bedrock for robust development in the online travel sector. The market, however, remains dominated by foreign players. To boost the market share, local players need to provide something unique that shows a deep understanding of the domestic market and applies disruptive technologies.

The up-and-coming digital content and ride-hailing app market

The allegedly third largest ‘gold mine’ of the Vietnamese Internet economy comes in the form of the online advertising, gaming, music and video service market. The sector is currently valued at $2.2 billion and will reach an estimated $6 billion by 2025, despite this, foreign players dominate the scene.

Vietnam’s online advertising reported an estimated $550 million in revenue, with $235 million going to Facebook and $152 million to Google. Local players accounted for only $150 million.

The Vietnamese online gaming industry reported nearly $400 million in revenue last year. Aside from domestic game distributors such as VNG, VTC, and Soha, the market also counted the presence of foreign players such as Garena.

Most best-selling games in Vietnam are, however, of foreign origin. Local distributors have to pay heavily for the copyright and to game producers, who are mainly Chinese companies.

In respect to ride-hailing apps which posted $500 million in revenue during 2018 which will rise to an estimated $2 billion by 2025, the market is witnessing the dominance of cross-border ride-hailing apps that compete fiercely among themselves and with local firms.

Grab, after taking over Uber in April 2018, continued to call for $3 billion of capital in 2018 to develop into a mega app. Last August, Grab announced it had received $2 billion capital injection from Japan’s Toyota Motor Corporation as well as some of the world’s leading financial firms such as Ping An Capital, Mirae Asset-Naver Asia Growth Fund, Cinda Sino-Rock Investment Management Co, and more.

Grab’s heavyweight rival, Go-jek had officially entered the Vietnamese market last February under the name Go-Viet, with an initial investment of $500 million.

The most recent round of capital raising has brought Go-jek $1.5 billion, as well as driving up the company’s value to $5 billion. Go-Viet has reported being downloaded 1.5 million times and has a driver system of 35,000 partners.

Both Grab and Go-jek are expanding from a pure ride-hailing app into providing multiple services such as food delivery, laundry, travel, insurance, booked entertainment services, and also on-line payments. Both aim to grow into multi-modal platforms.

Last year also saw a booming development in local hailing apps. On August 30, leading investment management firm VinaCapital announced it had founded VinaCapital Ventures with a scale of $100 million to invest in tech start-ups.

The fund also announced initial investments into Logivan and FastGo, two technology enabled startups providing solutions for the transportation and logistics market.

The market also saw the emergence of a raft of other transportation apps such as Vato which was developed by Phuong Trang Limited which claimed to pour $100 million into the venture. There were also Mai Linh Bike, Aber, and newest ride-hailing app named Be.

The ride-hailing market is generally a ‘single market’ belonging to Grab, with only a ‘light’ threat from Go-Viet and FastGo. Without hefty financial investment, local ride-hailing apps will struggle to survive when faced with stiff market competition.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Middle East conflict raises risks for global coffee market (March 10, 2026 | 15:07)

- Resilient Vietnam economy faces Middle East headwinds (March 10, 2026 | 12:16)

- Fuel import tariffs temporarily cut to zero until April 30 (March 10, 2026 | 10:53)

- TVS invests $4 million in Dat Bike (March 09, 2026 | 14:38)

- Women face growing workforce gap as AI reshapes industries (March 07, 2026 | 11:55)

- Over 64,000 businesses enter market in first two months (March 07, 2026 | 10:00)

- Honda Vietnam marks 30-year milestone (March 07, 2026 | 08:00)

- Palm oil perspectives from nutrition experts (March 06, 2026 | 09:00)

- Global surge in critical minerals stockpiling: a strategic edge for Vietnam (March 05, 2026 | 17:21)

- Iran war to modestly impact Vietnam (March 05, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version