Amendments to gold regulations on agenda

|

Maybank's strategy report for Vietnam was released on April 10 and reveals that gold has become one of the main drivers of the value of the VND as gold prices reached an all-time high in March.

According to the report, it is the widening spread between global and spot prices rather than increasing prices that explains the pressure on the USD/VND exchange rate in the grey currency market, as this increases the spread between the grey and official markets and eventually weighs on the official currency market.

Past data shows there has been a strong correlation between the USD/VND exchange rate and the price of gold. From a fundamental perspective, a widening price spread encourages gold importers, even through smuggling, to earn short-term arbitrage profit, raising demand for dollars.

The report pointed out that the gold spread has shot up and remained high since 2022 due to two main reasons. First, a gold rally amid a buying spree from central banks and investors amid economic uncertainties, and second, the loopholes in Vietnam’s gold market regulations.

The former will not fade quickly and may be even strengthened by the US Federal Reserve's upcoming interest rate cuts. However, it is actually the latter that has a greater impact on gold spreads, and this is why amendments that address loopholes are now firmly on the agenda.

Decree 24/2012/ND-CP regulated that the State Bank of Vietnam (SBV) would be the only entity in Vietnam permitted to import gold materials and produce gold bars under the SJC brand, which was one of many measures taken to fight local dollarisation in the 2000s and early 2010s.

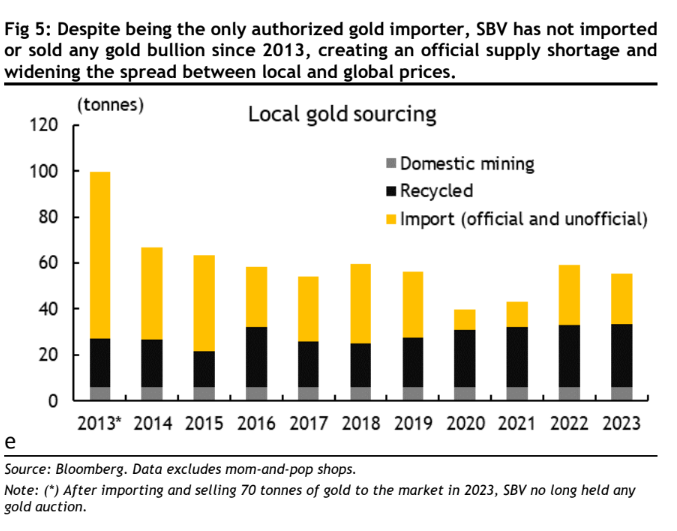

In 2013, the SBV had to import and offer 70 tonnes of gold to cool down the local gold market. It has not imported any gold or held any gold auctions since then, while demand has lingered.

|

According to data compiled by the World Gold Council, total gold consumption (gold bars and jewellery) of Vietnamese branded store chains was around 40–60 tonnes each year over the past 10 years. While local miners produced only 5-6 tonnes and jewellery stores recycled 20–30 tonnes, the remaining gap of 10–40 tonnes needed unofficial sources. Such a shortage of official supply is the root cause of the spread between global and local gold prices.

Vietnam’s currency market can generally afford around $1-3 billion each year for buying gold bullion if imports are steadily rolled out over the long term. But increasing imports is just a short-term fix, as the widening price spread will exert pressure on the VND. This is because the larger the gold spread, the higher the short-term arbitrage profit, and the higher demand for gold smuggling will be.

Therefore, to partly ease pressure on the VND, the SBV is seeking solutions to narrow the current gold price gap by improving local supply through official sources. As discussed, the state bank will not utilise its currency reserves to import gold but has actually suggested scrapping its monopoly on gold bar production.

Deputy Prime Minister Le Minh Khai recently directed the SBV to study and amend regulations to grant gold import quotas to the private sector. The change may transfer pressure from the grey currency market to the official one, as licensed gold importers will be allowed to buy USD from commercial banks. Speculation would be less severe if people knew that supply will increase, and from a statistical viewpoint, the narrowing of the gold price spread would generally cool demand for the USD.

| Pham Thanh Ha, Deputy Governor of the State Bank of Vietnam

In light of recent complex developments in global and local markets, domestic gold prices have seen major fluctuations and sharp increases due to the widening gap between domestic and global gold prices. To stabilise the market, the the State Bank of Vietnam (SBV) prepared intervention measures and inspections of gold trading activities among business and credit institutions nationwide in 2022 and 2023. Furthermore, the government issued Conclusion Notice No.160/TB-VPCP on April 11. In line with the prime minister's direction, the SBV will immediately implement the following solutions: First, the SBV will increase the supply of gold bars to narrow the gap between Vietnamese gold prices and global prices. Second, the SBV will ensure enough raw materials are available for the production and export of gold jewellery and fine art. Third, we will collaborate with the ministries and relevant authorities in requesting businesses adopt e-invoices for gold transactions, thereby enhancing transparency and management efficiency. The SBV will also monitor and inspect violations of the law such as cross-border gold smuggling, profiteering, speculation, and manipulation. The SBV has established an inspection team with the help of various ministries and government branches. Inspections will begin in April. |

| Gold hits another record high on Fed rate cut bets Gold hit another fresh record high Monday as investors grow confident that the Federal Reserve will cut interest rates this year, even after data showed a slight uptick in a key inflation report. |

| Gold hits record peak, oil rises on geopolitical tensions Gold prices hit another historic peak Tuesday and oil extended gains over rising tensions in the Middle East, while stocks wilted as traders worried whether the rally has run its course. |

| Gold hits fresh record above $2,300 Gold broke above $2,300 for the first time Thursday as it continued to surge on the back of expectations that US interest rates will come down this year and high geopolitical tensions. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version