All to play for in e-commerce rise

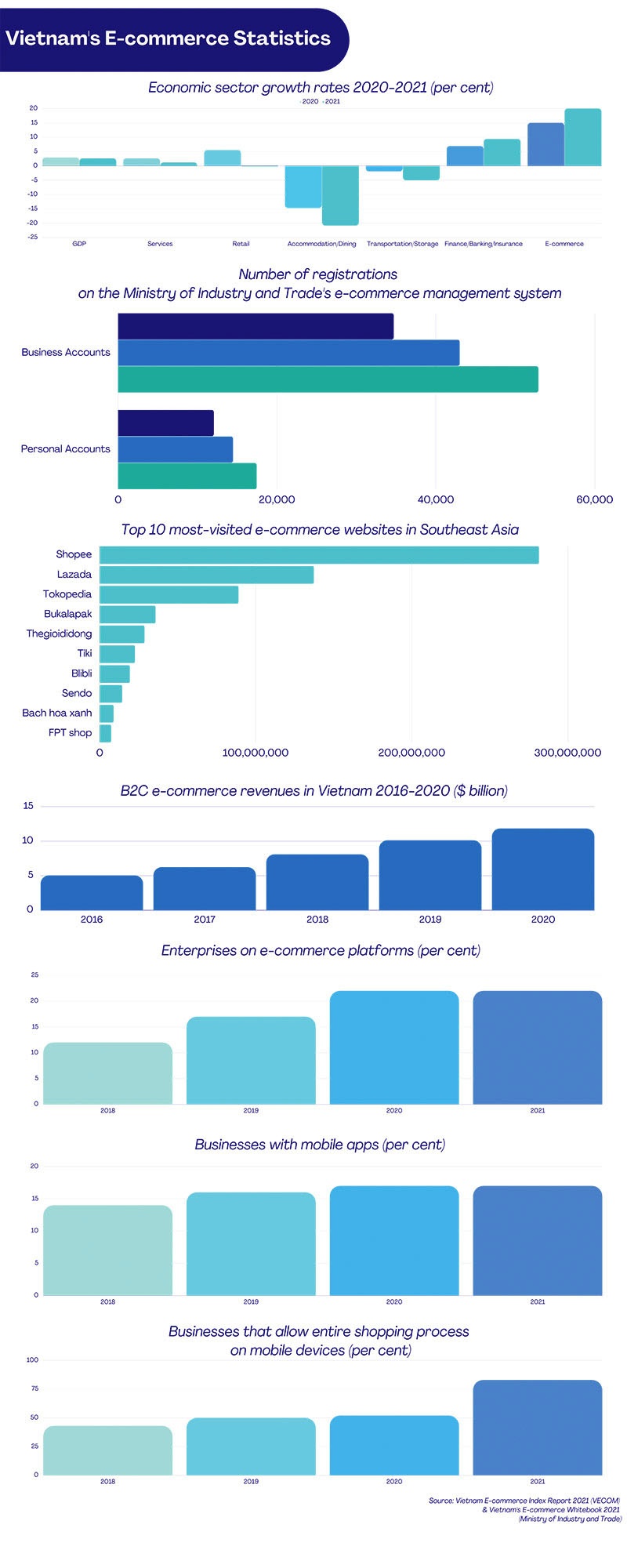

The pandemic has pushed forward the trends of e-commerce in Vietnam 2-3 years earlier than forecast with the sector growing in size four times over last year, according to a 2021 Lazada report.

|

“Some of the e-commerce trends we expected would happen in 2025, such as in edutech and fintech, have already happened in 2022,” noted Nguyen Huy Hoang, chief business officer at OnPoint E-commerce. “Hence, all e-commerce platform companies are investing hugely in Vietnam.”

However, as shopping centres and small brick-and-mortar stores are now reopened, many investors are concerned that the boom in e-commerce was just a short-term fad and the majority of consumers could quickly shift back to offline shopping.

On May 12 at the Vietnam Online Business Forum, the general consensus amongst experts was that e-commerce will continue to boost the economy after the pandemic.

Specifically, in the first quarter of 2022, the industry saw more than 8 million new online consumers. A survey conducted by Google in February showed that the ratio of e-commerce for overall retail consumers will tend to increase, with 97 per cent of consumers maintaining their online shopping habits post-pandemic and 99 per cent showing intentions to continue in the far future. Beauty products, women’s fashion, and household products are the categories that received the most interest.

According to the Vietnam E-commerce Index Report 2022 just released by the Vietnam E-commerce Association (VECOM), there are a number of reasons for the optimism in the sector’s long-term growth momentum.

Firstly, e-commerce has shifted consumers’ behaviours from traditional retail to smart consumers. During the lockdown period, many have familiarised themselves with omnichannel shopping and have become more proficient in online shopping skills.

“From 2022, omnichannel will become the mainstream shopping trend. This second wave of the e-commerce boom, which took place from June to September 2021, has created momentum for the development of e-commerce not only in 2022 but for the period of 2021-2025,” the report assessed.

Likewise, Le Minh Trang, senior manager at Consumer Insight Nielsen, noted that many merchants have moved many operations to the digital environment to accommodate a new era of commerce.

“With continuous updates and innovation from businesses to meet the needs of consumers and sellers over the years, concerns in terms of product quality, reliability, and delivery time have gradually disappeared. The rate of participation is increasing rapidly,” Trang said.

A second factor is that the market still has a lot of room for development both in terms of consumers and technology, with the middle-class population, currently at 10 per cent, being the fastest-growing in Southeast Asia. Among this group, 81 per cent consider online shopping an indispensable part of their daily lives.

“The e-commerce market is getting bigger and bigger based on data on e-commerce penetration as a share of retail,” said Emmanuelle Gounot, Intrepid Vietnam’s CEO. “New brands on the marketplace can now explore new channels such as social commerce, conversational commerce, quick commerce, or reaching their consumers directly via their websites.”

E-commerce companies are also actively creating their own growth momentum, through technology investments and partnerships.

“Enterprises are giving increasing importance to and making higher investments in digital transformation and e-commerce business. E-commerce platforms are also focusing on the vision of sustainable development,” explained Vu Thi Minh Tu, foreign affairs director at Lazada Vietnam.

VECOM chairman Nguyen Ngoc Dung forecaste that e-commerce trends that would boost the economy are involve digital transformation, online businesses, and blockchain. “E-commerce is one of the main drivers for economic development,” Dung said.

“VECOM has cooperated with localities to develop e-commerce in industries, from delivery and shopping to distance education. We expect to see a change in perceptions followed by habits, not only in big cities but in other localities.” Dung added that next year, VECOM will coordinate with the Vietnam Youth Union to train about 500,000 young people in the e-commerce business.

Nevertheless, certain obstacles remain for the relatively young industry. The rapid development has depended greatly on the ability to attract investment capital as well as high-quality human resources. In addition, the advancement in technology needs to be able to catch up with the rising demand.

“In recent years, most companies are aiming to enhance the user experience, especially e-commerce companies, because they have a very valuable treasure, which is user data,” said Ngo Tan Vu Khanh, director of the IDT graduate programme at the Ho Chi Minh City University of Economics.

“However, some technological barriers including slow adoption and dependence on foreign partners have created stagnation in enhancing the personalisation of the user experience. In order to do this, the analysis of customer behaviour and touchpoints must be automated.”

Another challenge is price competitiveness. Currently, the price segment from $8.50 to $215 is where more transactions are made on all e-commerce floors. For high-value products which require a long-term warranty, consumers still prefer to shop at physical stores and showrooms. According to Pham Thi Quynh Trang, commercial director of Lazada Vietnam, business owners should take advantage of the current e-commerce wave to equip themselves with a digital transformation mindset and stay ahead of sales trends.

“As for the competitive pricing problem, a sustainable development strategy is of crucial importance. As with all businesses, price is only one part of the competition. Other aspects of the consumer experience include policies, delivery and technologies, among others. These strategies need to be applied in a reasonable way, depending on different companies and products,” Trang noted.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version