Vietnam’s banking industry set to be revolutionised by big data and cloud computing

February 09, 2021 | 16:54

AI, big data, and cloud computing are revolutionising industries and banking is no different. Banks in developing economies stand to benefit the most.

Local lenders prepare for pandemic shock

September 30, 2020 | 09:00

Public health challenges have thrown Vietnam’s banking system into gyrations, pushing lenders to become more risk averse and brace for a wave of defaults, amidst efforts to cut interest rates from the central bank to offset the economy.

Organisations rush to sell Sacombank shares to retrieve debts

July 27, 2020 | 08:00

Some organisations have rushed to sell shares of Sai Gon Thuong Tin Commercial Joint Stock Bank (Sacombank) to retrieve bad debts, but it was not easy to find buyers agreeing with the offered price.

Banks sell mortgaged assets to resolve bad debts

April 12, 2020 | 19:23

Many banks in Ho Chi Minh City are selling their mortgaged assets, mainly properties worth trillions of Vietnamese dong, to speed up the resolution of bad debts.

March portfolio rebalancing spells trouble for major tickers

March 02, 2020 | 11:18

March rebalancings of investment portfolios may impede shares of FLC Faros, Novaland, PetroVietnam Power, and Phat Dat Real Estate.

Vietnamese lenders set sail for lucrative lands

November 15, 2019 | 15:22

Vietnamese banks are following their corporate clients by expanding abroad. However, lenders could also confront a combination of hurdles when going abroad, including understanding cultural differences, local regulations, and meeting strict requirements.

South Korean business pours $700 million into POS system of Vietnam

September 23, 2019 | 17:00

Around 600,000 point of sales (POS) devices will be deployed in Vietnam by South Korean financial firm Alliex.

Banks step up bad debt recovery in 2019

July 31, 2019 | 10:34

Some banks have recovered trillions of Vietnamese dong in bad debt by selling off assets secured with non-performing loans in the first half of 2019.

Chip cards may minimise bank card crime

June 03, 2019 | 11:46

Replacing magnetic strip cards with chip cards is expected to resolve the long-going security issues affecting bank cards.

Sacombank partially resolves bad debts

May 04, 2019 | 16:45

Sacombank has managed to partially resolve its bad debts through the liquidation of its real estate project in the southern city of Can Tho.

Sacombank sell two big real estate projects to deal with bad debts

March 12, 2019 | 20:21

To resolve bad debts, Sacombank has just decided to discount two real estate plots it previously put on sale by nearly VND1.812 trillion ($78.78 million).

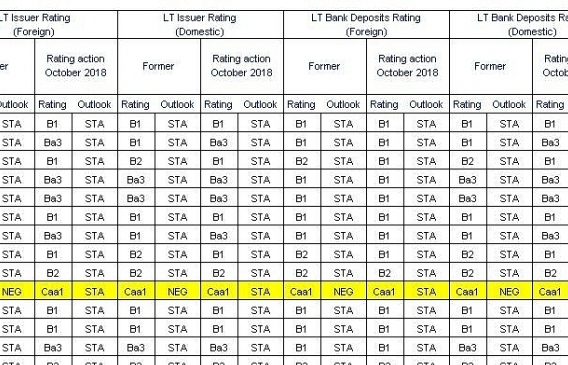

Moody’s upgrades ratings on Vietnamese banks

October 31, 2018 | 15:45

Moody's has upgraded and affirmed the long-term local and foreign-currency issuer ratings and deposit ratings of numerous Vietnamese banks.

Court returns documents of VNCB case for further investigation

February 07, 2018 | 17:11

The court has ordered further investigation into the crimes committed by Pham Cong Danh, Tram Be, and other defendants in the VNCB case.

Eximbank, Sacombank marriage

February 04, 2013 | 17:11

Vietnam’s two leading joint stock lenders, Eximbank and Sacombank, might merge in the next five years.

Eximbank, Sacombank eye merger in next 3-5yrs

January 29, 2013 | 19:30

Two leading commercial banks of Vietnam, Vietnam Export-Import Bank (Eximbank) and Saigon Thuong Tin Bank (Sacombank), will merge into one in the next 3-5 years.

Mobile Version

Mobile Version