Japanese eye up local estate market

Tokyo-based investment fund Creed Group became the first foreign investor in the Vietnamese property sector so far this year via its participation in a $500-million residential project in Ho Chi Minh City’s District 7. Along with its partners Phat Dat Real Estate Development Corporation and An Gia Investment, Creed Group will develop the River City project in the southern part of the city, which will comprise of 8,000 apartments in 12 blocks.

This not the first time that Creed Group has invested in Vietnam’s real estate sector. Last year, the group gave $200 million to An Gia to develop the Angia Skyline and Angia Riverside properties which, combined, will supply 2,000 units to the Ho Chi Minh City market. A source from the company said that more than 90 per cent of the projects’ units have already been sold.

According to Toshihiko Muneyoshi, chairman of Creed Group, the real estate market in Vietnam has similar potential to those in a handful of other Asian countries. Creed spent more than ten years researching the Vietnamese property market, and found similarities between the local market and the initial period of real estate development in countries such as Japan, South Korea, and Singapore.

“We succeeded in our previous projects, so we decided to participate in this new project,” said Muneyoshi, adding that “the demand for real estate among people and enterprises is huge, requiring the participation of professional investors”.

He also noted that Vietnam was becoming more deeply integrated into the world’s economy, with many trade agreements already signed and taking effect, opening up chances to woo foreign investors to the country. Another draw for property investors are the laws on Housing and Real Estate Business, which have relaxed real estate ownership rules for foreign entities and individuals, and opened up the rights of foreign property firms to conduct business in Vietnam.

According to the Japanese Consulate in Ho Chi Minh City, out of all global investors, Japan last year had the third-largest investment capital sum in Vietnam at a total of $1.84 billion, with 281 newly-registered projects and 129 expanded projects. Real estate is the third-largest sector for Japanese investment, following the manufacturing and construction industries.

Alex Crane, general director of Cushman & Wakefield Vietnam, said that in the past few months, two significant commercial transactions in Ho Chi Minh City and a large debt transfer in Hanoi indicated very strong interest from international groups in Vietnam’s real estate market – particularly South Korean and Japanese firms.

“The cap rate in Ho Chi Minh City is extremely aggressive, with deals reported at a Net Initial Yield below 8 per cent, the first time this has been achieved in an on-market transaction. This level of return is comparable with those in second-tier cities in Australia,” Crane said at a recent seminar on real estate held in Ho Chi Minh City.

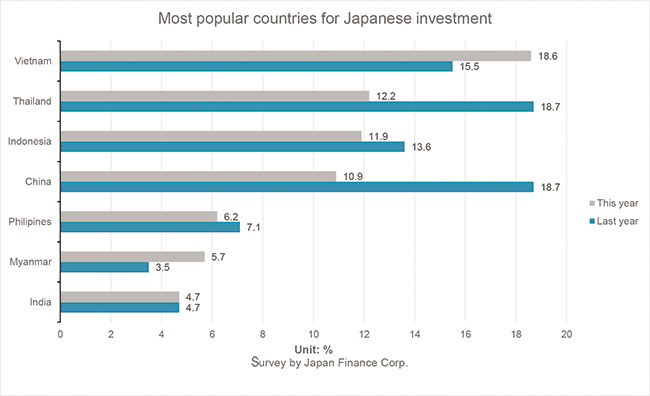

The government-owned Japan Finance Corp’s survey of 676 mainly small and mid-size Japanese overseas subsidiaries shows that in its list of the most popular countries for Japanese investment in 2015, 18.6 per cent of Japanese investors expressed an interest in Vietnam, compared to 15.5 per cent in 2014 (see box).

Truong Thi Hoa, a lawyer in Ho Chi Minh City, said that investment capital from Japan would continue coming to Vietnam’s real estate market this year. However, she also warned that Japanese investors were meticulous, so domestic developers must carefully prepare their portfolios before showing them to Japanese partners in order to have a better chance of clinching investment deals.

In 2015, a range of Japanese companies participated in Vietnam’s property sector, including Daiwa House, Nomura Real Estate Development, Sumitomo Forestry, Hankyu Realty, and Nishi-Nippon Railroad.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Vietnam breaks into Top 10 countries and regions for LEED outside the US (February 05, 2026 | 17:56)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

- Dong Nai experiences shifting expectations and new industrial cycle (January 28, 2026 | 09:00)

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

Mobile Version

Mobile Version