Investors in Asia’s wealthiest markets struggle to balance risk with expectations

The survey revealed that investor risk appetite across the region is at odds with behaviour, with investors expressing a preference for more stable investments, while in reality many choose to invest in higher risk investment vehicles.

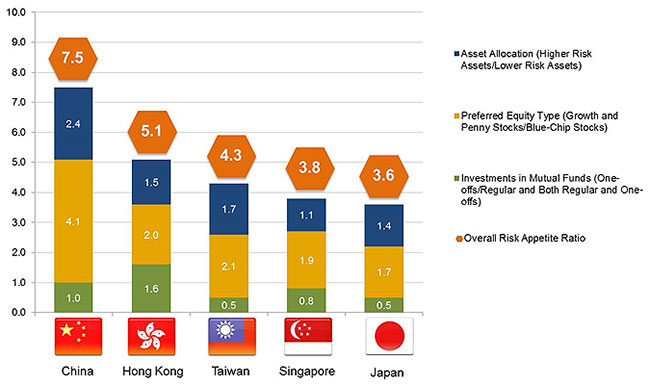

In terms of existing asset allocation, investors in China are willing to take the most risk among Asia’s wealthiest markets including China, Hong Kong, Taiwan, Singapore and Japan, holding a larger proportion of relatively higher risk assets in their household portfolios (44 per cent compared with 32 per cent in Japan). In addition, despite almost a third of investors in China raising concern about market volatility (29 per cent), they still have the greatest appetite among the five markets surveyed for investing in more risky penny stocks (27 per cent in comparison to only 12 per cent in Japan).

On the other hand, investors in Japan have the lowest risk appetite and are the most conservative with their household balance sheets, keeping 41 per cent of assets in cash. Even when they do choose to invest in equities, the Japanese prefer to invest in more stable blue chip stocks (75 per cent in comparison to only 51 per cent in China), rather than riskier penny stocks.

Fig 1. Manulife Risk Appetite Index

Further highlighting the different risk profiles of the two markets, the survey revealed that investors in China are more likely to make one-off investments in mutual funds, suggesting a desire to capitalize on market buoyancy for short-term gains. Meanwhile, the Japanese tend to invest in mutual funds via regular instalments, suggesting a more disciplined approach. They are also less concerned about trying to market time their investments, an approach that’s rarely successful.

“The recent stock market slide in China can be considered a cautionary tale for investors taking on too much risk,” said Ronald CC Chan, chief investment officer, equities, Asia (ex-Japan). “Many commentators were speculating that Chinese equities were in bubble territory by mid-March 2015. However, investors went on to accumulate an additional RMB1 trillion in debt to finance short-term investments in richly valued stocks before the market peaked in mid-June and began to lose ground. In the correction that followed, more than $3.4 trillion in equity value had evaporated over the three-week period.”

“This does not suggest that investors should avoid risk,” explained Michael Dommermuth, executive vice president, head of wealth and asset management, Asia, Manulife Asset Management. “Playing it too safe, like many of the highly risk averse investors in Japan, could hurt their ability to generate sufficient retirement income to maintain their living standards. Rather, we believe that investors should consider building a well-diversified portfolio that matches their risk appetite and has the potential to deliver returns that are commensurate to the level of risk.”

Investor appetite for risk at odds with behaviour

The survey showed that among Asia’s wealthiest markets, investors frequently express risk preferences that are contradictory to their actions. Investors from four of the five markets surveyed ranked guaranteed incomes and capital guarantees as the top two considerations when making any new investment. Yet investors in these markets still ranked stocks and equities as the most preferred investment vehicle, which are not necessarily the lowest risk in terms of guaranteed incomes.

While investors in China ranked top of the Manulife Risk Appetite Index, over half of investors in the same market (52 per cent) said they would want to see a guaranteed income before considering a new investment. This is in comparison to only 20 per cent of Japanese investors wanting to see guaranteed income, despite them being the most risk averse. This contradiction between investment attitude and behaviour suggests that the Japanese better understand the need to take measured risks to create a balanced and diversified portfolio, but are unwilling to part with their cash in order to achieve greater investment efficiencies.

Hong Kong, Taiwan, and Singapore were ranked second, third and fourth in the Risk Appetite Index respectively, displaying further contradictions between risk appetite and behaviour. Over a third of Hong Kong investors worry about making the wrong investment decision (36 per cent), yet their preference for direct investment in stocks is the highest amongst the wealthiest Asian markets, at 63 per cent. Meanwhile, nearly half of investors in Taiwan (48 per cent) say they are put off from investing in mutual funds because of concern about the risks involved, but conversely favour riskier penny stocks almost as much as investors in China (22 per cent). Investors in Singapore closely rivalled the Japanese in risk-averse behaviour, with 36per cent of assets held in cash.

More broadly, investors in Asia’s wealthiest markets are concerned about making the wrong investment decision, with most of them claiming this as the primary reason they withhold making new investments.

Dommermuth concluded: “The key to addressing the seeming contradiction between risk appetite and investment behaviour is to help educate investors on the actual risk and potential returns represented by individual asset classes and the market conditions in which they best perform. Armed with this knowledge, individuals can work with their investment advisors to construct portfolios that blend investments from multiple asset classes and geographies to match their risk appetite. Investors also have the option to make investments in professionally managed asset allocation funds that are carefully balanced to match specific risk and return profiles and also have the potential to deliver a recurring income stream. Investments in managed mutual funds can be made as a lump sum or via regular monthly instalments that take advantage of dollar-cost averaging to lessen the need to consider market timing as an investment factor.”

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Citi sharpens its focus on institutional banking (February 09, 2026 | 19:58)

- SSC steps up engagement with FTSE Russell on market reforms (February 09, 2026 | 17:33)

- IFC considers $50m trade finance guarantee facility for Nam A Bank (February 09, 2026 | 17:28)

- Hoa Phat Agricultural Development debuts shares on HSX (February 06, 2026 | 14:00)

- Vietcap’s VAD 2026 draws strong global investor turnout (February 06, 2026 | 13:30)

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- 0.1 per cent tax proposed on each transfer of digital assets (February 05, 2026 | 17:27)

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

Mobile Version

Mobile Version