Burgeoning offshore deposits no cause for alarm

|

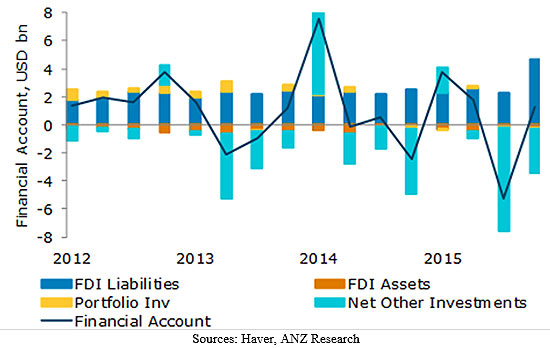

In the third quarter of 2015, the State Bank of Vietnam (SBV) revealed the offshore deposits under the other investment element in the balance of payments financial account, which added up to a massive $7.3 billion. Should one worry over such figure and Vietnam's foreign currency drain?

Indeed, the net other investment account in the BOP posted a significant rise in the outflow of $7.3 billion in the third quarter. However, on an annual basis, total net outflow in other investments reached $9.1 billion in 2015, after the slow down in Q4. While the outflow in Q3 seems oversized, it is not unusual. Given that the tendency slowed down in Q4, in our view, the risk of sustained deposit outflow has eased. Now that the upside pressure on the USD/VND rate has been eased, we see little risk of further capital outflow.

Although the central bank said that it was normal for the offshore deposits to be boosted to $7.3 billion, as the result of the Chinese yuan devaluation last August and expectation over a Fed rate hike last September, do you think it was normal practice for local banks to make overseas deposits, to ensure high liquidity across the local banking system?

The surge in outflow in Q3 to $7.3 billion could have been triggered by the unexpected devaluation of the CNY and the subsequent devaluation of the USD/VND rate. At the time, the upside pressure on the USD/VND rate was still strong, so the risk off sentiment was unusually high. Since the start of 2016, the trade balance has been posting a year-to-date surplus and the expectation of a delay in Fed hikes has taken the pressure off the USD/VND rate. However, the 0 per cent cap in deposit rates in USD accounts will temper USD deposits’ return to Vietnam.

While the local government yearns to issue some $3 billion worth of international G-bonds, why would it not issue through Vietnamese commercial banks to take advantage of the $7.3 billion available in offshore deposits?

By issuing international bonds to tap into global resources, the government is diversifying its sources of funding. It also ensures that the local credit market is not crowded out by government. In case these offshore deposits come back to Vietnam, USD liquidity may be used to finance the needs of the local market.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Citi sharpens its focus on institutional banking (February 09, 2026 | 19:58)

- SSC steps up engagement with FTSE Russell on market reforms (February 09, 2026 | 17:33)

- IFC considers $50m trade finance guarantee facility for Nam A Bank (February 09, 2026 | 17:28)

- Hoa Phat Agricultural Development debuts shares on HSX (February 06, 2026 | 14:00)

- Vietcap’s VAD 2026 draws strong global investor turnout (February 06, 2026 | 13:30)

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- 0.1 per cent tax proposed on each transfer of digital assets (February 05, 2026 | 17:27)

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

Mobile Version

Mobile Version