Weak US dollar consequences

|

| By Manpreet Gill - Head of Fixed Income, Currency & Commodities Strategy, Standard Chartered Bank |

We are of the view that there is room for the USD to weaken further from here. This has significant implications for currency markets, of course, but we believe that weakness in the world’s dominant currency is likely to have a broader impact on equity and bond markets.

Our bearish USD view is based on key fundamental and technical drivers which, we believe, have started to weigh against the US currency. For one, interest rate differentials are no longer supportive for the USD – in fact, they arguably started moving against the currency well over a year ago.

Since then, the Fed’s efforts to boost global USD liquidity have likely raised supply to the point where it is no longer a constraint against a fall in the USD. Secondly, there are increasing signs of the global economy gradually recovering from the immediate shock caused by the COVID-19 lockdowns. A recovering global economy has historically led to a weaker USD as its safe-haven status fades.

Thirdly, there is now an increasingly attractive alternative to the USD as a global reserve currency – namely the euro, thanks to the efforts of Eurozone policymakers to overcome their differences and agree on a combined, region-wide fiscal policy to revive growth in the world’s second-largest economic entity.

This fundamental picture seems consistent with the signal from technical indicators, which also argue the US dollar is breaking lower.

|

Lessons from history

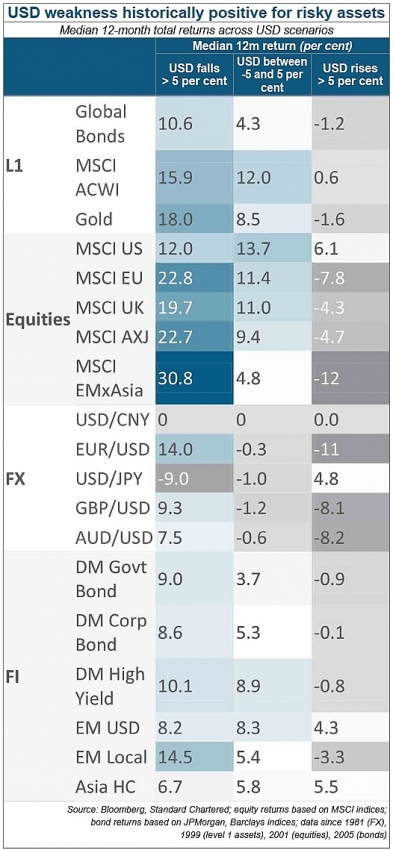

So what happens when the USD weakens? Historical data indicates periods of weakness (of more than 5 per cent) have been positive for risk assets on a 12-month horizon. Our analysis shows the following:

- Absolute returns from equities, corporate bonds, emerging market bonds, and gold have been strong;

- Equities outperformed bonds in relative terms;

- Within equities, emerging markets and Eurozone-led gains, in USD terms;

- In bonds, high-yield and emerging market local currency bonds outperformed, though government bonds still outperformed a number of other bond asset classes; and

- The euro and Japanese yen delivered strong returns, though they underperformed in emerging market foreign exchanges.

Are we set up for a repeat of this historical experience? Broadly, we believe the answer is yes on a 6-12 month horizon. We continue to expect corporate and emerging market bonds and equities to outperform cash and government bonds, led by the ongoing economic recovery, significant policy stimulus, and low bond yields.

While new US stimulus will be important, the agreement among Eurozone members on a combined European fiscal stimulus is arguably the most significant event over the past month. We believe it is a key step towards a more unified fiscal policy which could help revive long-term Eurozone and global growth potential.

Having said that, we do expect a few key differences with the historical record today. Firstly, we are slightly less bullish on broader emerging market assets than the historical experience would suggest, given today’s COVID-19 and related growth challenges are much greater for most emerging markets.

In our assessment, Asia ex-Japan equities and emerging market USD government bonds offer the best risk/reward trade-off today.

Secondly, within equities, we continue to expect US equities to outperform, given the strength of policy stimulus and the expected earnings recovery. Thirdly, within bonds, we are less confident about continued government bond outperformance. Falling bond yields in the post-2008 environment led to their good performance, but this becomes harder to repeat as bond yields fall closer to zero per cent.

Summer volatility

This constructive 12-month view notwithstanding, on shorter horizons of three months or less, we remain on watch for an equity market pullback (as in, a rise in equity volatility). From a seasonality point of view, equity volatility has tended to rise in August.

This is particularly important at a time when US-China relations appear to be deteriorating ahead of the US presidential election in November. Meanwhile, new daily COVID-19 infections are unlikely to peak without a drug or vaccine, which still appears at least a few months away. Finally, our proprietary market diversity indicator is starting to look stretched for select bond and foreign exchange markets (though not yet for equities). In our assessment, any pullback is likely to be temporary and relatively contained in size. Given our constructive medium-term view, this means we would consider using any such pullback to add exposure to our preferred asset classes.

Our historical analysis of market returns during USD weakness is consistent with recent economic and market performance – they both continue to support our positive 6-12 month view on developed market corporate high-yield, emerging market, and Asia USD bonds; preference for US, Asia ex-Japan, and Eurozone within equities; and, more broadly, multi-asset income strategies.

Gold remains an attractive asset class in this context as an extended economic recovery means inflation expectations are likely to rise, placing further downside pressure on “real” (net-of-inflation) bond yields, which is positive for gold.

| Michael Stark Analyst, Exness The bias in favour of emerging currencies and markets seem to have a solid base. Considering contract of differences in particular, the prices of currencies like the rand, peso, and so on are often affected by levels of government debt. For example, South Africa’s ratio of debt to GDP has hovered around 70 per cent over the last few years, but a weaker dollar effectively makes debt easier to repay as most of it is external and priced in dollars. Gold is also taking centre stage as the dollar has weakened. A weaker dollar means that it is cheaper for holders of other currencies to buy the yellow metal, so it would be possible to look for continuing strength for XAUUSD and, to a lesser extent, silver-dollar (XAGUSD) over the next few weeks at least. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version