Trade promotion can ease delicate state of exports

How does maintaining export volume exert pressure on trade promotion activities?

|

| Le Hoang Tai, deputy director of the Vietnam Trade Promotion Agency under the Ministry of Industry and Trade |

Inflation on a global scale continues to impact Vietnam’s export volume, putting pressure on trade promotion initiatives. The good news is that a trade promotion strategy is already in place. In the case of the Chinese market, we have collaborated with Chinese agencies to conduct face-to-face and online trade promotion efforts. This allows trade promotion operations to continue uninterrupted despite the restrictions of the past few years.

When markets reopen, Vietnamese commodities face intense competition from nations selling comparable items. In order to enhance exports, particularly agricultural exports, we want to capitalise on our geographical advantage of being closer to China than ASEAN nations.

Each area in China has distinctive traits. Guangxi and Yunnan share a border with Vietnam, which is the entryway for commodities entering the Chinese market. Sichuan, on the other hand, is a province with over 83 million inhabitants and no coastline. Now, we have a railroad to move products from Vietnam to Sichuan, one of the EU’s logistical centres. This is a great chance for Vietnamese enterprises to export agricultural and aquatic goods to the Chinese market at more affordable logistics costs than other countries.

In addition, Chinese enterprises can purchase agricultural raw materials from Vietnam, process them, and export them to the European Union.

In reality, trade promotion initiatives have an effect on Vietnam’s exports. In 2022, the National Trade Promotion Programme had a budget of around $5.54 million, leading to an export turnover of $371.85 billion. Meanwhile, the same programme received just $3.96 million in financing, which contributed to an export turnover of $114.6 billion 10 years ago.

In addition to the effect of falling market demand, does the export slowdown demonstrate that trade promotion has not been viable?

Each nation implements trade promotion strategies based on its own assets. To promote and introduce goods, particularly those with national brands, the majority of nations use conventional channels such as exhibiting, holding trade conferences, and sending trade delegations.

Several governments in the area invest a substantial amount of money on national trade promotion initiatives. Nowadays, Thailand’s government budget for trade promotion is 20-30 times greater than Vietnam’s. As mentioned, Vietnam’s national trade promotion budget is only $5.54 million per year, despite the existence of more than 100 industrial groups in 63 provinces.

Obviously, the government budget for trade promotion never fully covers a company’s product promotion operations; hence, firms need counterpart funding. Yet, the quality of Vietnam’s trade promotion initiatives has suffered due to present budget constraints.

Considering the existing circumstances, will it be more difficult to promote trade with distant markets?

Markets that are further afield, such as the United States and the European Union, need enormous trade marketing expenses. Many companies need trade promotion assistance to facilitate exports. Nevertheless, the state only contributes a portion of the trade promotion budget due to a limited budget; the remaining amount must come from businesses.

Nowadays, several multinational corporations have made substantial investments in trade promotion initiatives in the areas they see as crucial.

Does Vietnam need new models to promote commerce in the current setting?

If we do not take advantage of export prospects, aggressively undertake trade promotion operations, and fulfil technical requirements, the competitiveness of Vietnamese products will decline. Vietnamese businesses are used to exporting to high-standard markets such as the EU, the US, and Japan.

Once regarded as an accessible market, China’s traceability and food safety requirements are becoming more stringent. While sending their goods to the global market, Vietnamese firms in the sector of agricultural products, including processing and farming, must pay particular attention.

Our agency is collaborating with industry and local organisations to explore and propose innovative trade promotion initiatives that would assist Vietnamese businesses in efficiently penetrating global markets. The development of promotion programmes is centred on identifying important markets, strong and prospective product groupings, and competitiveness.

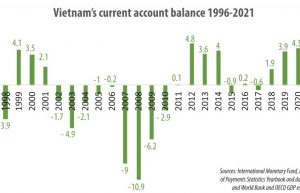

| Trade slowdown indicating current account deficit A slowdown in Vietnam’s trade is expected to dent the country’s current account this year due to waning global demand and domestic production snags. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

- Innovation breakthroughs that can elevate the nation (February 19, 2026 | 08:08)

- ABB Robotics hosts SOMA Value Provider Conference in Vietnam (February 19, 2026 | 08:00)

- Entire financial sector steps firmly into a new spring (February 17, 2026 | 13:40)

- Digital security fundamental for better and faster decision-making (February 13, 2026 | 10:50)

- Aircraft makers urge out-the-box thinking (February 13, 2026 | 10:39)

Tag:

Tag:

Mobile Version

Mobile Version