The road to further improve connectivity across Vietnam

|

Vietnam is among the most open economies in the world, with a trade-to-GDP ratio of 190 per cent in 2018. Through the removal of both tariff and non-tariff barriers and fulfilling its commitment in several regional trade agreements, the country has made remarkable achievements in trade liberalisation.

|

| Senior transport economist at the World Bank Jen Jungeun Oh |

Vietnam’s major trade partners located in East Asia, North America, and Europe are reached mostly by sea or air. Trade with bordering neighbours is limited and thus trade across border-crossing points is minimal except for northern borders with China, which has seen growth in re-cent years.

The country’s trade flows are concentrated at 12 of its 48 border gates – two airports, five seaports, and five border crossing points – which collectively handled 86 per cent of total trade value in 2016. As trade grows, congestions at and near these international gateways and border-crossing points also increase.

In the meantime, Vietnam’s transport network has undergone a significant expansion over the past few decades. The most remarkable development in network expansion has occurred in the road sector. As of 2016, the total length of the road network, excluding village roads, reached over 300,000km, including about 1,000km of expressways – a fully access-controlled toll road system.

Vietnam is endowed with an extensive network of natural waterways, including nearly 16,000km of managed navigable routes carrying significant traffic around the Red River Delta and Mekong Delta areas. However, only about 2,600km of waterways can reliably handle barges greater than 300 deadweight tonnage, with rudimentary terminal infrastructure at most of its numerous river ports.

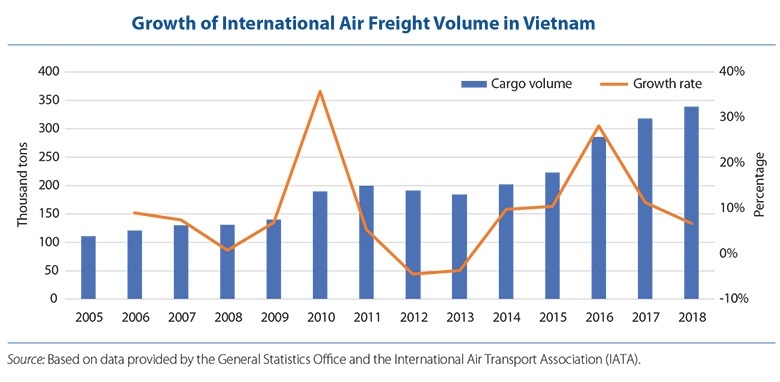

Vietnam’s extensive seaport system includes 45 ports and nearly 200 terminals. Maritime cargo throughput has continued to increase, along with domestic throughput via coastal or short-sea shipping. Some of the key seaports operate at or near capacity, with limited room for capacity expansion due to their confines within built-up urban areas. Traffic congestion around these ports and along the connecting national highway systems exacerbates cargo movement, causing delays and negatively affecting the urban mobility of these major cities. Vietnam’s aviation sector has seen rapid growth in recent years, with its air freight growing at an average rate of 10.8 per cent per year from 2009 to 2017. Despite the growing importance of air freight transportation, which accounts for about a quarter of Vietnam’s export and import value, infrastructure is still limited. Only four of 22 airports in Vietnam have separate cargo terminals, and two have onsite logistics centres.

Integrating globally

Vietnam’s trade has grown alongside its deepening global integration and participation into global value chains. The revolution in ICT and falling transportation and communications costs drove off shoring and unbundling of production from the developed to the developing world and gave rise to global value chains.

As an active participant in global value chains, Vietnam benefits from jobs and knowledge created from its involvement in multinational corporation production.

Vietnam’s integration with global markets can be further supported through a connectivity strategy, and the identification of “value chain critical” transport corridors for nine value chains, which combined account for over 70 per cent of Vietnam’s exports.

Geographically, these key corridors are located around the largest economic centres – Hanoi and Ho Chi Minh City – connecting nearby provinces that participate in the value chains; between the Mekong Delta region and Ho Chi Minh City; between Hanoi and the Chinese border; along the north-south coastal line; and between the Central Highlands region and the south. Ensuring quality infrastructure and necessary logistics services along these corridors would lower the trade and transport costs associated with these value chains, which are crucial for export competitiveness.

Vietnam’s international trade is predominantly handled at a handful of key airports, seaports, and border crossing points. With the rapid increase in air cargo, many stakeholders are increasingly concerned with the physical and operational capacities at key airports. Two historically dominant seaports in Ho Chi Minh City and the northern city of Haiphong operate near capacity, with connecting roads plagued with burgeoning congestion.

At the same time, the relatively new deep-sea ports in Vung Tau seaport complex in the south and Lach Huyen in the north present opportunities to further consolidate cargo, attract large intercontinental vessels, and hence lower transport costs and transit time. Investments in hinterland connectivity are critical for the success of these ports.

These challenges around international gateways – capacity constraints, congestion, and mismatch between supply and demand – point to the need to bring a network perspective in planning and developing gateways, moving away from the current decentralised planning whereby local authorities compete to host key gateways.

Economic clusters in Vietnam, in the form of industrial parks or economic zones, have been developed around main corridors, near primary international gateways, or around major urban areas. Their success, measured in terms of investments attracted and employment generated, is affected by connectivity, along with other factors.

As Vietnam develops a major high-capacity, high-speed transport network, such as the North-South Expressway, thereby shortening economic distances across the country, new transport nodes are created as potential candidates for future economic clusters.

Future investments in major connective infrastructure should therefore be closely co-ordinated with land-use plan to encourage the development of the land surrounding high-value transport nodes for high productivity activities. “Economic densities” should be created along these new corridors.

Key recommendations

Transport planning and investment strategies need to be informed by value chain criticality, so that connectivity can best serve Vietnam’s further integration with the global markets. The entire eco-system of trade and transport links needs to be created, including systematic collection of relevant trade and transport data, a system where such data are consolidated and analysed, and procedures by which the analytical outputs have tangible influence over the planning and investment decision processes.

Vietnam should address the capacity bottlenecks, congestion, and demand-supply imbalance at its international gateways, while offering flexibility to accommodate the evolving structure of its trade. The country needs to further develop new gateways with greater capacity and efficiency (in the case of the planned Long Thanh International Airport and Lach Huyen Seaport), while improving co-ordination across the central and provincial governments in ensuring hinterland connectivity of the main gateways.

Moreover, these critical gateways should be considered as a network with complementary roles and discouraging wasteful competition among various localities. Consolidation at gateways with the structure and capabilities to handle intercontinental vessels, supported by good domestic shipping and land connectivity, is beneficial for importers, exporters, and shippers alike as such an arrangement can significantly lower transit time and reduce trade costs with some of Vietnam’s major trade partners.

Vietnam’s newly developing high-capacity high-speed connective infrastructure provides a unique opportunity to reduce distances while creating economic densities. Both outcomes can be achieved by allowing targeted development around high-value transport nodes created around new infrastructure, such as expressways. Economic clusters, such as industrial parks and economic zones, have been instrumental in economic agglomeration.

However, signs indicated some of them have reached a point where congestion would lower the returns on further agglomeration and concentration. Land-use plans around these critical national connective infrastructures should be co-ordinated so as to give incentives for productive high-density use of lands that can generate jobs and reap the benefits of good connectivity.

Multimodal transport should be promoted as a resilient strategy. Vietnam’s economic activities rely heavily on its increasingly congested road network, part of which is vulnerable to natural disasters. At the same time, the country’s natural endowment such as an inland waterway net-work and long coastal lines is underutilised and not fully explored. Multimodal transport there-fore makes a good connectivity strategy, both in terms of transport costs and resilience of connectivity.

Even a modest modal shift from road to waterborne transport – economically beneficial given the lower transport costs of the latter – would reduce risk exposure and improve resilience of the overall transport network. Limitations in infrastructure development, regulatory framework, market incentives, and behavioural inertia present challenges to achieving true multimodal connectivity.

Vietnam needs to address the most critical barriers to multimodality – including the lack of containerisation in inland waterway transport – combined with the underutilised potential for coastal shipping and the lack of well-connected and well-equipped river ports to facilitate transshipment and handling of containers on barges.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version