The energy ecosystem’s tightrope to adaptation

|

Thorough transformation

The electrification of things is causing a fast increase in demand. Consumers will have increasing access to “things” – cars, appliances, industrial processes – made more efficient by electricity.

The largest consumer of fuel-based power is the transportation sector. With fuel costs for rail at $11 billion companies have huge incentives to shift towards electrified systems. Electric vehicles are also expected to more than quadruple by 2025.

Harsh environments and difficult access to fuel are also driving electrification in industrial sectors like mining, chemicals, and oil and gas exploration. Decarbonisation and declining technology costs will continue to drive the switch from fuel to electricity.

At the same time, today, more than one billion people over the world still lack access to electricity, one in three people do not have reliable energy sources, and 650 million people lack access to clean water. The world’s population is expected to exceed nine billion people by 2050, with 90 per cent of the growth occurring in developing countries – where energy use is predicted to double.

Power leaders need to continuously find better ways to get more power to consumers to meet this increasing demand. Meanwhile, within the power industry, three trends are shaping up to pose challenges as well as opportunities to power leaders.

First is digitalisation. Digital technology is disrupting and transforming the electricity industry, challenging old models, and creating unprecedented opportunities.

Digitally-enhanced power generation, with software and data analytics combined with advanced hardware, will deliver greater affordability, reliability, and sustainability.

Traditional participants in the electricity industry are recognising the momentous change taking place and are seeking solutions and partners in the new digital age. There are new and old players leveraging digital technologies, new policies creating new requirements, and new business models that are challenging traditional revenue sources and creating new growth opportunities.

The second trend to watch for is decentralisation, which is the shift from central power generation towards generation closer to the point of consumption. With decentralisation, more entities begin installing and operating distributed generation systems, and more electricity customers become producers. As distributed generation increases, electric utilities, particularly those with distribution systems, are faced with numerous challenges. They must continue to ensure reliable power delivery to all customers while being able to address changing power flows caused by distributed generation and lower revenues from self-generating customers. Distributed generation sources which are more variable and uncertain in nature can create more volatility in the system by creating voltage fluctuations outside the prescribed levels.

The third important shift is decarbonisation, which is the shift towards CO2 reduction through the increased use of lower or non-CO2-emitting technologies.

In December 2015, 196 countries signed the COP21 Agreement to limit the impact of climate change to less than 2°C above pre-industrial levels by reducing CO2 emissions from all sources. Each country that is part of the agreement is expected to put in place local policies and regulations to achieve their Nationally Determined Contribution (NDC). COP21 brought additional attention to global climate and environmental priorities in the energy sector, as the largest sources of man-made atmospheric CO2 are electricity and heat generation (42 per cent), transportation (23 per cent), and industry (19 per cent).

Irrespective of COP21, the power generation industry had already been on the path of reducing CO2 emissions. Methods to achieve lower CO2 emissions in the power industry include deploying nuclear and renewable energy sources (such as wind and solar), retiring coal-fired plants and/or switching from coal to natural gas as a fuel source, and improving the efficiency of existing fossil-fuelled generation.

The effects of these new or changing fuel sources have implications which resound throughout the energy ecosystem, including new grid infrastructure to accommodate renewables, and improvements to the natural gas transportation infrastructure.

Navigating a new landscape

Each year, $5 trillion is spent across the entire energy ecosystem globally to keep up with demand. The International Energy Agency estimates that $20 trillion will be invested in power and grid technology, $25 trillion will be invested to extract and transport energy resources to end-users, and $22 trillion will be invested in end-user efficiency by 2040.

Investment in the correct technologies and solutions will help lower costs, improve efficiency, and reduce the electricity industry’s carbon output. Power leaders need a supplier that has experience in all the stages of energy production and are able to deliver comprehensive solutions that help them meet the challenges and seize the opportunities posed by the transformation taking place in the industry.

“Access to electricity is a basic human right,” said Steve Bolze, president and CEO of GE Power. “We recognise the challenge ahead and welcome the opportunity to work with the Vietnamese government to bring the most innovative solutions available for this dynamic market.”

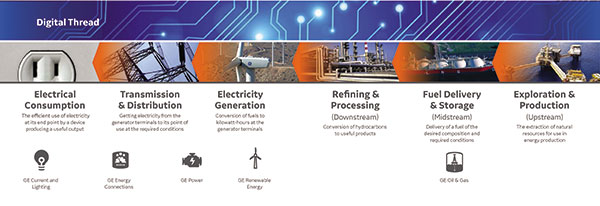

The company’s portfolio of products and services spans across all stages of energy production, including exploration and production, fuel delivery and storage, refining and processing, electricity generation, transmission and distribution, and electrical consumption and financing.

Besides GE’s expertise in the domain of technology and home-grown digital capability (see chart), GE makes it possible for customers to afford its solutions through access to third-party equity capital and debt financing from export credit agencies, development financing institutions and other equity providers, and commercial banks.

GE’s equipment and solutions have been deployed in 90 per cent of utilities worldwide, 85 per cent of offshore oil rigs, and 80 per cent of the world’s offshore wind installations. These technologies are at the heart of 33 per cent of all electricity generated globally and 20 per cent of the global renewable energy capacity – a total of 1,500 gigawatts of installed base power generation. 25 of the world’s leading utilities and power producers have also signed up as Predix customers.

With GE technologies, customers have added enough power capacity to support 100,000 people each day.

In renewable energy, by making wind farms more efficient with digitalisation, GE’s technologies will lead to 20 per cent more annual production, or $100 million in value over a farm’s lifetime. Meanwhile, for non-renewable energy, a 1 percentage point improvement in the efficiency of GE’s fossil fuels installed base would reduce emissions by 250 million metric tonnes per year, equivalent to removing about 50 million cars from the US. The world earns more than $2 trillion in societal benefits globally from reduced emissions.

GE customers have been making significant savings thanks to GE’s technologies. In the field of oil and gas, customers experience 36 per cent less unplanned downtime by using a data-based approach instead of a reactive one, resulting in $34 million saved per operator.

For grid transmission and distribution, storm response costs could be reduced by 30 per cent, and a $200 billion yield on global investments in transmission and distribution could be realised through GE Energy Connections solutions.

In addition, GE’s investments across projects’ life cycles from their early stages to the start of operations can help meet the $5 trillion infrastructure investment gap globally, according to calculation by management consultancy firm McKinsey.

As digitalisation is the main driver of industrial development, GE is undergoing a transformation into a digital-industrial company pairing its domain expertise in multiple industries with world-class digital solutions built upon Predix, the foundation for the Internet of Things. No other company has this combination of technology domain expertise and home-grown digital capability.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Addressing Vietnam's energy challenges with aeroderivative gas turbines (February 28, 2023 | 09:33)

- How to sprint ahead in 2023’s worldwide energy priorities (February 08, 2023 | 13:55)

- Boosting Vietnam's grid stability through gas turbine technology (November 22, 2022 | 20:02)

- Healthcare trio collaborates to provide thousands of free breast scans (October 27, 2022 | 17:19)

- GE Healthcare's vision for AI-backed radiology (September 29, 2022 | 11:53)

- GE brand trio to shape the future of key industries (July 19, 2022 | 15:35)

- GE unveiling brand names and defining future (July 19, 2022 | 15:16)

- GE: the shortest route towards sustainability (July 18, 2022 | 08:00)

- Be proactive in an uncertain world (May 20, 2022 | 11:40)

- GE secures first 9HA combined cycle power plant order in Vietnam (May 16, 2022 | 17:06)

Mobile Version

Mobile Version