The driving forces for gold price surge

Considering the holding rate of countries in gold reserves worldwide, the US is holding the most with more than 8,100 tonnes, equivalent to 22.85 per cent of gold reserves worldwide. The next is Germany with 9.41 of holding rate. China, which has been continuously increasing its reserves recently, is holding only 6.36 per cent.

|

| Trinh Ha, a financial market analyst from Exness Investment Bank |

In addition, the gold price is often mentioned and compared with the USD values, so all changes in the US economy will make a significant impact on gold price.

The first driving factor driving gold prices is the US economic status. The US Federal Reserve cutting interest rates will cut down the USD strength and gold priced in USD will increase the amount accordingly.

In fact, gold is a non-yielding asset, so when the Fed cuts interest rates from the high level to 5.25-5.5 per cent, the appeal of non-yielding assets like gold will increase correspondingly.

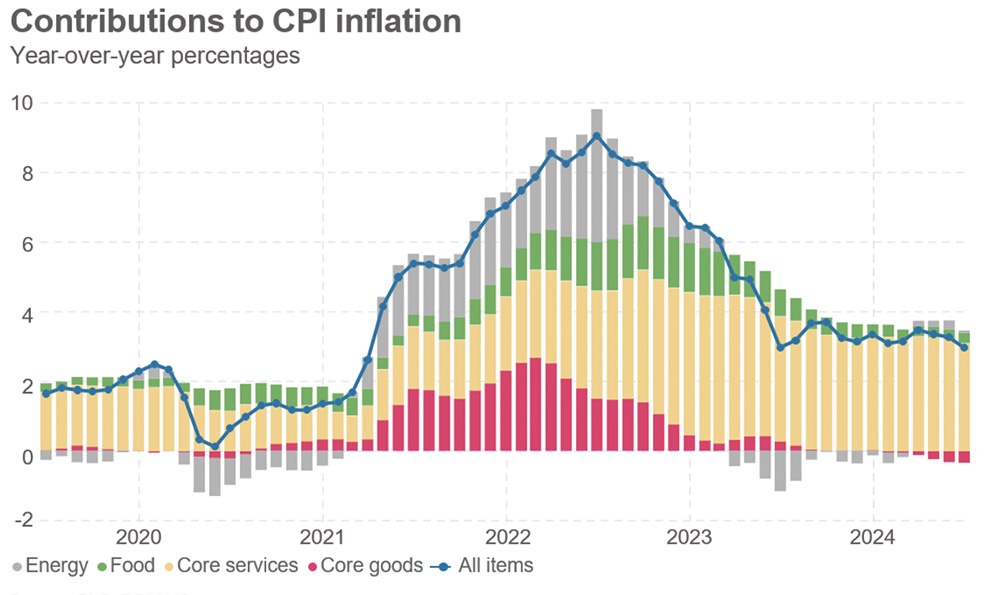

After a long time of raising interest rates, US inflation is also on track with the Fed’s target of 2 per cent. Consumer price index (CPI) inflation continued to decrease in June to 3 per cent on year and -0.1 per cent on month.

Services inflation, the most important and persistent component, actually decreased in June after maintaining high continuously previously. So the Fed gets more confidence that general inflation will go ahead of the 2 per cent target set forth.

Other factors such as energy or core goods falling their prices or decelerating their speed also contributed to the mitigation of general CPI. Moreover, the unemployment rate also increased continuously over the last three months to 4.1 per cent, the labour market weakening is the driving force for the decline in service inflation.

In our predictions, the personal consumption expenditures inflation data - the preferred number to decide the Fed’s policy in the last week of June - is expected to decline along with the right movement of employment, unemployment, and CPI inflation’s figures.

With the down movement of inflation factors in right expectations, the probability of an interest rate cut by the Fed in September according to CME’s interest rate tool has increased to 100 per cent. And the market even expects three more times cutting interest rate totalling 0.75 percentage points, compared to just one time after the Federal Open Market Committee’s mid-June meeting.

Common features

The second factor is that the market is worried that after the Fed cuts interest rates, the US economy may fall into recession and gold will be a safe haven asset.

When US government bond yields invert, the US economy may fall into recession a few months later. We consider the spread between a US government bond with maturity of 10 years (reflecting the capital market) and a government bond with maturity of three months (reflecting the money market). If this difference is negative, the yield curve is inverted.

Thus, the recessionary periods of the early 1990s, the early 2000s, and the 2007-2008 period all had a common feature that the Fed had consecutively increased interest rates and the bond yield curve went invert.

This often happens when investors realise the economy going worse and able to fall into crisis, causing cash flow to pour into long-term government bonds with a better safety. In this case, when demand raises sharply, long-term profits decrease and short-term profits increase but including risks. The rise in interest rates is also the level that the Fed expects and maintains around the target set forth.

The more negative the spread has, the sooner a crisis will happen like in previous periods, which will boost gold prices as a safe haven. And currently, the negative level is also the largest and lasts the longest, which makes investors worried. It is hard for the Fed to choosing time to cut down interest rates. If cutting too early, inflation can raise quickly and sharply, but if cutting enough late, the economy will deteriorate quickly and form a new crisis.

The negative spread lasts longer than usual, but there has not been a crisis yet, which can be explained through the fact that 30-year fixed interest rate loans in the past 5-7 years have maintained at a low level of 2.5-3 per cent. They have supported the US individuals and businesses a lot, causing the economy to maintain at good growth and consumption to grow well.

With the recent weakening trend in the labour market and inflation gradually stabilising, the Fed’s failure to cut interest rates in September could cause excessive tightening that could hurt the economy in danger.

|

|

|

Strong purchasing power

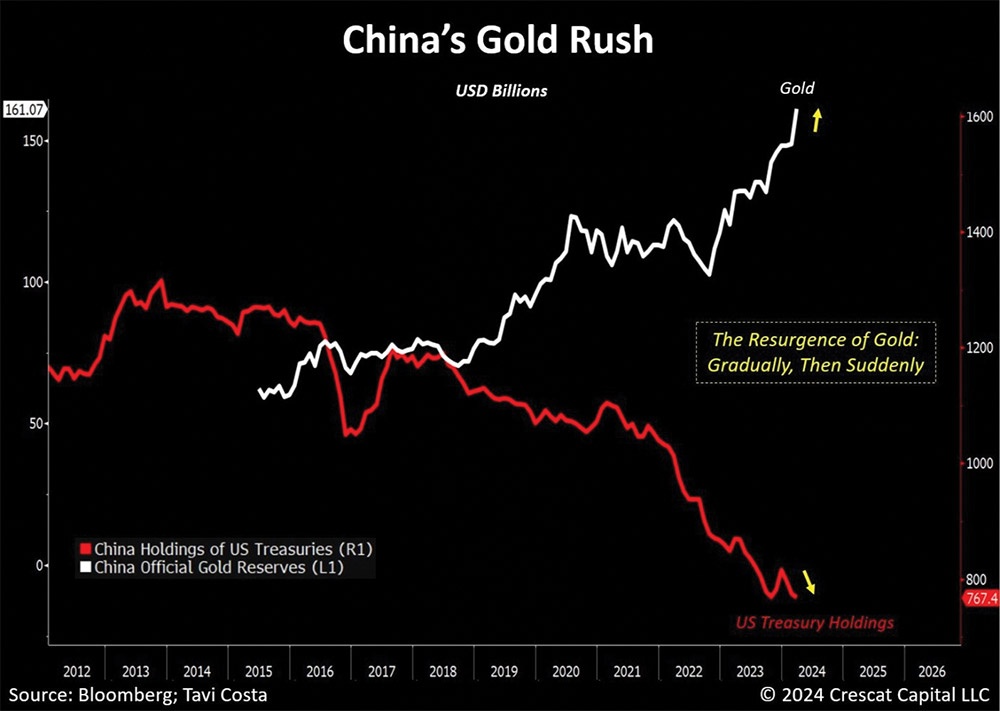

The third important factor driving up gold prices in the past and possibly in the near future is the good purchasing power of central banks such as China, Turkey, India, and some other nations.

Central banks in markets such as China, India, and Russia are tending to increase gold reserves to avoid being too dependent on the USD. In addition, Turkey has a large gold hoard in the context of hyperinflation and Poland is also the central bank’s net buyer of gold.

China’s central bank is the largest gold buying organisation in the last three years after a consecutive net purchase in the previous decade, with more than 108 tonnes. From January 2022 to May 2024 it stopped buying, and the total net purchase amounted to 316 tonnes of gold.

In the past year, China has net bought 172 tons and only stopped buying in May and June when gold prices were still quite high. With a strong effort to increase the amount of gold held, the total value of gold (equivalent to $161 billion at the end of Q1) only accounts for about 4.64 per cent of the total reserves of the Central Bank of China.

Recently, when China reduced its purchasing of gold, India still maintained a purchasing power of 4-6 tonnes per month. At the same time, the Central Bank of India also has the motivation to reduce its dependence on the USD by directly joining the BRICS bloc - a counterweight to the US and European countries.

With the recent sharp increase in price due to expectations of the Fed cutting interest rates, gold may also face profit taking and central banks gradually reduce hoarding. However, in the long term, gold is still an asset that stores value and avoids inflation, so gold prices continue to tend to increase in the long term.

In addition, if Donald Trump is reelected as US President, he will likely continue to maintain a harsh protectionist policy and his measures may cause inflation to return, causing the USD to increase again, and the Fed may have subsequent interest rate increases, reducing gold’s appeal. However, if the economic situation worsens due to potential inflation, the appeal of gold will increase later.

| Tightened status necessary for controlling gold market Experts are calling for stricter regulations and enhanced transparency to combat money laundering and market manipulation in Vietnam’s gold market. |

| Gold price hits record high on rate cut expectations The price of gold soared Tuesday to a record peak, propelled by trader expectations of falling US interest rates in September as inflation cools. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

- IFC to grant $150 million loan package for VPBank (February 13, 2026 | 09:00)

- Nam A Bank forms position as strategic member at VIFC through three key partnerships (February 12, 2026 | 16:39)

- Banks bolster risk buffers to safeguard asset quality amid credit expansion (February 12, 2026 | 11:00)

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

Tag:

Tag:

Mobile Version

Mobile Version