The cost of Asia’s renewable energy challenge

Take, for instance, El Niño, a cyclical weather phenomenon typically associated with droughts and water shortages. Intense El Niño episodes can harm Southeast Asian economies by spiking food inflation, disrupting trade, and causing energy outages with the potential to shut down entire industries.

|

| Frederic Neumann, Chief Asia economist, HSBC |

As climate change heats up the oceans, El Niño events are becoming increasingly severe, which will likely translate to more future natural disasters occurring in Asia.

Asian countries with costal economic hubs are particularly affected by rising sea levels caused by oceanic thermal expansion and melting polar glaciers. According to the Organisation for Economic Co-operation and Development, 15 of the world’s 20 most vulnerable cities to rising sea levels are located in Asia, including major economic and financial centres such as Shanghai, Guangzhou, Tokyo, Mumbai, Ho Chi Minh City, Bangkok, and Jakarta.

Many goods exporters – emerging Asia’s primarily growth driver – are also situated in vulnerable areas. In the apparel goods industry, the four most at-risk countries – Bangladesh, Cambodia, Pakistan, and Vietnam – are projected to collectively lose $65 billion in export earnings and one million new jobs due to extreme heat and flooding by 2030.

Even India, the region’s most promising growth story, could lose 2.8 per cent of its GDP per capita by mid-century due to rising temperatures and changing monsoon rainfall patterns, according to World Bank estimates.

To stave off worsening climate-related challenges, fulfil Paris Agreement commitments, and achieve carbon net-zero in the long term, it is essential that Asia’s transition to clean energy is successful. In a recent HSBC report, we assessed the future demand drivers and costs of what an incremental energy transition could look like in 2035.

Renewable electricity holds the key to Asia’s clean energy transition. According to BP and International Energy Agency estimates, electricity will make up between 45-50 per cent of final energy consumption if Asia reaches net-zero.

As Asia scales up electricity generation to meet the growing consumption needs of emerging markets and facilitate the greening of carbon emitting industries – such as through electric vehicles – it will be imperative that renewable sources constitute a larger share of the region’s fossil-fuel dominated electricity mix.

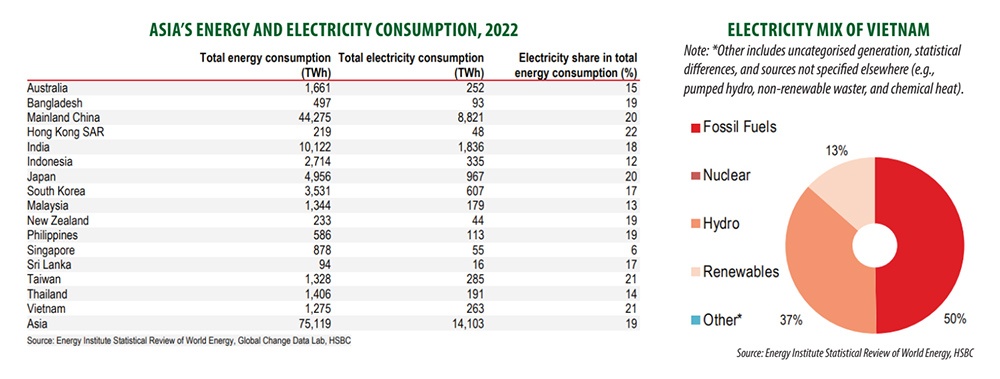

In 2022, Asia consumed approximately 14,000 terawatt hours (TWh) of electricity. To provide a sense of the enormous scale being discussed, one single TWh is equivalent to one trillion kilowatts and has enough power to light over a million homes for a year.

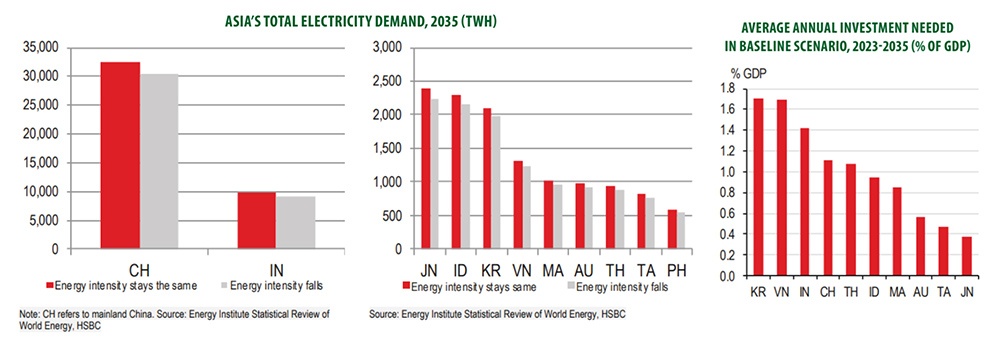

Assuming electricity makes up 45 per cent of final energy consumption, our projections indicate that Asia’s total electricity demand could reach between 50,800-54,000TWh by 2035. This massive growth will likely be propelled by major trends, such as China’s booming e-vehicle industry and India’s surging population dividend.

With the exception of Vietnam, every economy in the region relies on fossil fuels for the majority of their electricity generation. However, Vietnam generates over a third of its electricity from large hydro, a source that some experts argue is insufficiently clean enough to be considered renewable.

If one only considers pure renewables such as wind, solar, biofuel, biomass, and geothermal, then Asia’s clean electricity mix (13.8 per cent) falls behind the global, United States, and European averages. At the moment, the three major fossil fuels of oil, natural gas, and coal account for around two-thirds of Asia’s electricity mix.

To meet growing electricity demand while reducing emissions, Asia must raise its renewable share of electricity generation. In particular, China and India, the region’s largest energy producers and consumers, must take the lead in promoting renewable electricity. Fossil fuels currently make up nearly two-thirds of China’s electricity generation mix and over three-quarters for India.

Given their immense size, even an incremental change in the electricity mix would have a ripple effect on Asia’s overall energy transition.

|

|

We assess that Asia will require 8,120-12,340TWh of additional renewable electricity in 2035, depending on the level of renewable goal ambition and future energy intensity. Our recent report estimates that the investment required to generate this large amount of renewable electricity by 2035 will range around $4 trillion-6.1 trillion.

Under our baseline scenario, where economies increase their renewable share of electricity generation by 10 percentage points while energy intensity remains constant, Asia will require $5.7 trillion of funding. At the individual economy level under the same baseline scenario, China would require the most funding at around $3.4 trillion, followed by India ($921 billion) as a distant second.

South Korea, Indonesia, Japan, Australia, Vietnam, Thailand, Malaysia, and Taiwan combine for $1.36 trillion, or 40 per cent of mainland China’s investment needs. Vietnam’s estimated investment costs of $135.6 billion falls around the middle of the pack for ASEAN.

Asia’s energy challenge is enormous, as evidenced by our estimates of how much funding is required to incrementally increase the region’s renewable share of electricity, but achievable. When annualised, the funding costs for Asian economies to achieve our baseline scenario objectives amount to 0.4-1.7 per cent of GDP from 2023 to 2035.

The estimates we have laid out are certainly big numbers, but ones that need to be compared against the very substantial, if uncertain, costs that climate change adaption would require if no action was taken. Considering the consequences of intensifying climate-induced challenges, a one or two percentage point hit to GDP might seem like a reasonable price to pay.

| HSBC Vietnam partners with Dragon Capital on voluntary retirement programme HSBC Vietnam and Dragon Capital Vietfund Management (Dragon Capital) have announced their cooperation to implement the Huu tri an vui pension programme, a voluntary supplementary retirement scheme for all HSBC employees in Vietnam. |

| HSBC holds event on Vietnam business outlook At HSBC's workshop, "Vietnam: The Road ahead," held on October 10 in Hanoi, experts discussed the country’s business outlook, strategies for managing instability, and positioning enterprises for future opportunities. |

| HSBC aims to arrange $12 billion into Vietnamese market At the Sustainable Development conference on November 16, Lam Thuy Nga from HSBC Vietnam spoke to VIR's Bich Ngoc about the bank's ambitions. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- EVN awards EPC contract for Quang Trach II LNG project (February 10, 2026 | 09:00)

- Canada backs Vietnam’s green transition with AGILE project (February 09, 2026 | 17:41)

- Momentum is real in the race to net-zero emissions (February 02, 2026 | 08:55)

- $100 million initiative launched to protect forests and boost rural incomes (January 30, 2026 | 15:18)

- Trung Nam-Sideros River consortium wins bid for LNG venture (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Envision Energy, REE Group partner on 128MW wind projects (January 30, 2026 | 10:58)

- Vingroup consults on carbon credits for electric vehicle charging network (January 28, 2026 | 11:04)

- Bac Ai Pumped Storage Hydropower Plant to enter peak construction phase (January 27, 2026 | 08:00)

- ASEAN could scale up sustainable aviation fuel by 2050 (January 24, 2026 | 10:19)

Tag:

Tag:

Mobile Version

Mobile Version