Temptation across the board for M&A gains

|

| Private groups such as Vingroup took part in massive deals last year |

Tiger Global and famous venture capital funds such as Sequoia India, GGV Capital, and RTP Global have recently joined a $25 million Series A funding round in Telio, Vietnam’s first business-to-business e-commerce platform focusing on consumer goods, to acquire an undisclosed amount of stakes in the firm.

The venture funds target Telio as it has seen a sharp upward trajectory over the last eight months, with sales growing by 70 per cent on-month, and is making ambitious expansion plans in 2020 on the back of the high growth potential of the local retail market.

The acquisition is demonstrating the attractiveness of the retail sector to investors. Vietnam’s large retail landscape is still dominated by traditional, fragmented trade channels. Small family-run street shops account for over 60 per cent of fast-moving consumer goods sales in urban areas and over 90 per cent in rural Vietnam, according to Kantar Worldpanel, a world-leading data, insights, and consulting company.

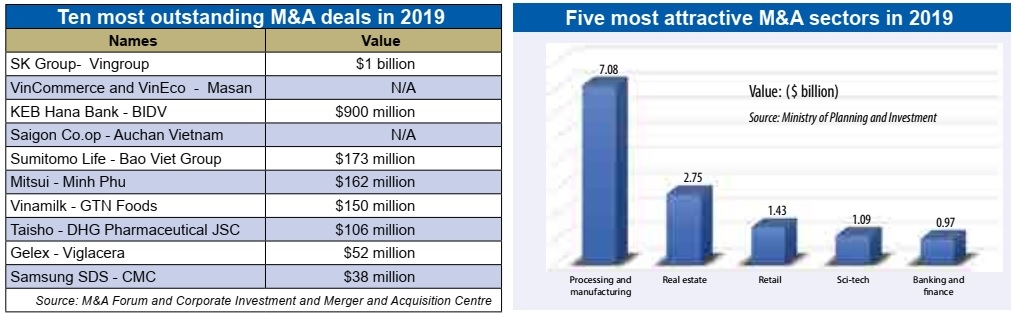

Dang Xuan Minh, general director of AVM – who leads the research team of the M&A Forum and of the Corporate Investment and Merger and Acquisition Centre (CMAC) – said, “In 2019 and the following years, M&A deals will continue to focus on consumer goods, retail, and real estate. Moreover, telecommunications, energy and infrastructure, pharmacy, and education are also expected to gain much of the attention.”

Restructuring-bound trend

To make future M&A deals in these potential areas feasible, ventures are picking out businesses that are carrying out restructuring, making it one of the targets in M&A activities in 2020.

“Many more private-run groups are planning to restructure their future strategies to increase business efficiency after years of making wide-spread investment in non-core businesses. This will bring about opportunities for international financiers,” added Minh.

According to the latest study from the M&A Forum and CMAC Institute, the trend of focusing on restructuring of private-run groups has been occurring for several years, as seen in Hoang Anh Gia Lai Group and Hung Vuong Fisheries Service Manufacturing Trading Co., Ltd. In 2018, Hoang Anh Gia Lai Agricultural JSC, which was in a difficult situation, had to sell a 35 per cent stake to Truong Hai Auto Corporation (THACO) for VND22 trillion ($956.5 million).

In 2019, the tendency continued with some typical deals including the Masan’s latest acquisition of 83.74 per cent in the Vingroup subsidiary that owns the VinMart retail chain. With the move, Vingroup aims to restructure its business strategy, focusing on technology and industry.

Now in other sectors, TTC Land and a number of powerful real estate companies, as well as others such as Loc Troi Group, have announced their restructuring. Similarly, powerful property developer FLC Group is planning to sell stakes to foreign investor in Bamboo Airways.

In addition to the opportunities coming from private companies, big deals are expected from the restructuring, equitisation, and divestment of state-owned enterprises (SOEs) in 2020 when the government’s more concrete actions are made after a slow year of implementation in 2019. Now, members of the European Chamber of Commerce in Vietnam, the Korea Chamber of Business in Vietnam (KorCham), and the Singapore Business Association of Vietnam are among the most eager.

“We are very interested in the equitisation of SOEs, and Vietnam has been planning to do this,” said Hong Sun, vice chairman of KorCham. “However, foreign investors still find it hard to access detailed and accurate information about their operations. If the information was made available in line with international practices, more M&As would be signed, thus contributing to improving their performance.”

|

Asia remains dominant

Investors from the region including Singapore, South Korea, Japan, and Thailand have been playing a crucial role in the M&A scene in Vietnam, and statistics from the Ministry of Planning and Investment showed little change in 2019 in this regard. Hong Kong ranked first with $4.45 billion worth of stake acquisition, followed by Singapore ($2.69 billion), South Korea ($2.67 billion), and Japan ($1.25 billion).

Among the sectors, retail is the third-most appealing to M&A international financiers in Vietnam in 2019, with total registered capital of nearly $2.6 billion, just behind manufacturing ($24.56 billion), and real estate ($3.88 billion).

Strong M&A value reached $15.47 billion last year, contributing to increasing Vietnam’s total registered foreign investment by 7.2 per cent on-year to $38 billion.

While the local market has witnessed some new deals with involvement of Hong Kong and Chinese companies, recent moves in 2019 prove that South Korea will likely continue to be among the biggest M&A ventures in Vietnam in the near future. It is also expected that M&A deals involved European investors will grow this year especially when the EU-Vietnam Free Trade Agreement is ratified and enters into force.

The research team of M&A Forum and CMAC Institute forecasts that the M&A value is likely to reach $7-7.5 billion this year. In 2020, investors will be more cautious in upcoming deals for fears of possible risks about price fixing, legal procedures, and personnel issues arising from previous failures, as seen in cases such as with MobiFone-AVG and Quy Nhon Seaport.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- BJC to spend $723 million acquiring MM Mega Market Vietnam (January 22, 2026 | 20:29)

- NamiTech raises $4 million in funding (January 20, 2026 | 16:33)

- Livzon subsidiary seeks control of Imexpharm (January 17, 2026 | 15:54)

- Consumer deals drive Vietnam’s M&A rebound in December (January 16, 2026 | 16:08)

- Southeast Asia tech funding rebounds on late-stage deals (January 08, 2026 | 10:35)

- DKSH to acquire Vietnamese healthcare distributor Biomedic (December 24, 2025 | 15:46)

- Central Retail refocuses Vietnam strategy with Nguyen Kim exit (December 24, 2025 | 15:01)

- RongViet Securities wins sixth consecutive M&A advisory award (December 22, 2025 | 17:30)

- Kido Group divests from ice cream and frozen foods (December 18, 2025 | 16:49)

- Insurtech startup Saladin wraps up Series A funding round (December 17, 2025 | 09:10)

Tag:

Tag:

Mobile Version

Mobile Version