Sustainable finance instruments to grow a greener future

|

| Tim Evans - CEO, HSBC Vietnam |

The World Bank believes Vietnam is one of the Top 5 countries likely to be affected and estimates that climate change will reduce the country’s national income by up to 3.5 per cent by 2050.

Moreover, Vietnam is one of the most carbon-intensive economies in Asia, after China and Mongolia, and it needs to undertake a rapid transition out of high carbon activities to support tackling global warming issues. As the country pursues this ambitious path, its finance sector will have to play a significant role with a wide range of innovative financial solutions.

Positive signs in cmarket

Even during the global pandemic, the demand for green, social, and sustainability bonds continue to hit record oversubscriptions, confirming that both issuers and investors remain keenly focused on green finance as a strategy for ensuring the right investments are put forward to keep environmental and social issues at the top of the agenda.

According to Moody’s Investors Service, global issuance is expected to reach another new record $650 billion in 2021, a 32 per cent increase over last year. This total will be comprised of approximately $375 billion of green bonds, $150 billion of social bonds, and $125 billion of sustainability bonds.

The green economic development model has become a common trend in the global economy but is still new in Vietnam. However, the Vietnamese government has put in place several robust responses and measures, which includes promoting green growth as a key focus in the country’s socioeconomic development strategy.

With the introduction of Decree No.163/2018/ND-CP19 and the growing financial market in Vietnam, the presence of corporate green bonds was expected to increase in the Vietnamese bond market. Decree 163, issued by the government in December 2018, was considered the first-ever legal framework for corporate green bonds in Vietnam. The decree aimed to support the Vietnamese roadmap for bond market development for the 2017-2020 period, setting out mechanisms and policies for the distribution of the green bond market with the objective of enabling issuers to raise capital to implement green projects through bonds.

In fact, Vietnam has been actively progressing towards sustainable finance regulation and harmonisation of green definitions with a number of domestic guidelines for green bond issuances, namely the Ministry of Planning and Investment’s guidelines on the classification of public investment for climate change and green growth or the Ministry of Natural Resources and Environment’s criteria for green projects. Besides, the State Bank of Vietnam (SBV) issued Decision No.1552/QD-NHNN in August 2015 and Decision No.1604/QD-NHNN in August 2018 as the general action plan for green credit growth and developing green banking in Vietnam.

Additionally, in April 2021, the State Securities Commission of Vietnam (SSC) introduced the handbook “How-to Issue – Guide for Green Bonds, Social Bonds and Sustainability Bonds” which was developed with support from the International Finance Corporation (IFC) and the Climate Bonds Initiative. The handbook was expected to help corporate issuers and other market players understand the international and regional practices in issuing green, social, and sustainability bonds, managing the proceeds from those bonds, as well as to follow the related environmental and social impact reporting. Applying the standards of green, social, and sustainability bonds can help them effectively mobilise resources from domestic and international capital markets for social, environmentally friendly, and sustainable projects, which means expanding the funding for Vietnam’s green and sustainable economic growth.

Great potential in green financing

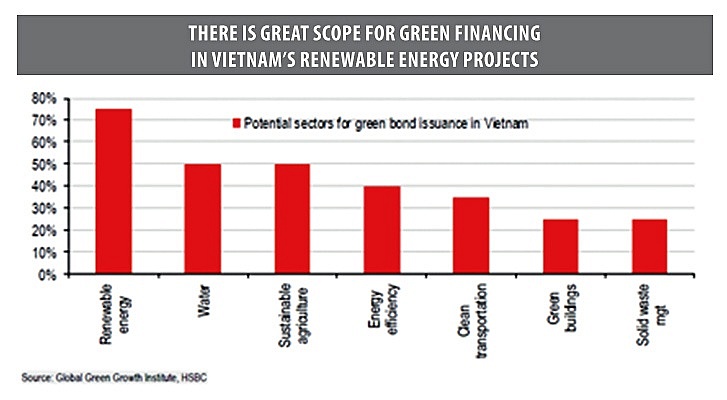

According to the 2017 Global Infrastructure Outlook, Vietnam requires infrastructure investment of $605 billion during 2016-2040, leaving a gap of $102 billion after adjusting for current investment estimates. The Global Green Growth Institute (GGGI), in partnership with Luxembourg and the Ministry of Finance, signed the “VN10 Vietnam Green Bond Readiness” programme in October 2020. This proposal aims to enhance institutional capacity and the regulatory framework, combined with practical experience in piloting green bond issuance. The focus is on: 1) green bond development for both corporate and government/municipal bonds; 2) piloting the issuance of green bonds in two cities/provinces to finance their green investment projects; and 3) sharing global experience and developing knowledge of products. The GGGI estimates implementing a green growth strategy in Vietnam will require $30 billion by 2030.

|

Green bonds and loans

Green bonds and loans are debt instruments used to finance projects, assets and activities that support climate change adaptation and mitigation. They can be issued by governments, municipalities, banks, and corporates. The green bond label can be applied to any debt format, including for example private placement, securitisation, covered bond, and sukuk.

In fact, green bonds are regular bonds with two distinguishing features: the proceeds are allocated exclusively for projects with environmental benefits (understood to be essentially coupled with social co-benefits) and provide clear transparency and disclosure on the management of the proceeds.

While there is no single set of global definitions for eligible projects to be funded with green bond and loan proceeds, the Climate Bonds Initiative uses the Climate Bonds Taxonomy, which features eight use of proceeds categories: energy, buildings, transport, water, waste, land use, industry, and ICT.

Performance-linked instruments

The two main types of instruments are commonly referred to as Sustainability-Linked Bonds (SLBs) and Sustainability-Linked Loans (SLLs).

SLBs are any type of bond instrument for which the financial and/or structural characteristics can vary depending on whether the issuer achieves predefined sustainability/ESG (environmental, social, governance) objectives. Despite still being very small, this market segment started to grow in the second half of 2020, particularly in ASEAN where it was seen to enable issuers to access the sustainable financial market and promote capital mobilisation in a novel way. From the demand side, SLBs present additional opportunities for investors to allocate capital to meet their ESG investment targets and serve the growing demand for eligible financing opportunities.

On the other hand, SLLs can support borrowers in meeting sustainability performance improvements such as significant greenhouse gas emissions reductions or reductions in waste or water usage. If targets are met, borrowers are rewarded with a reduced loan margin, resulting in cheaper cost of capital. SLLs do not require a definition of green assets and projects to be financed, but instead allow all types of entities to commit to company-level sustainability targets linked to the terms of the debt. As such, SLLs can provide an alternative for borrowers in sectors that currently lack clear definitions of green, such as the food and beverage industry. Companies within sectors that may not have specific green assets and projects, but want to decrease their carbon footprint may also be able to utilise this format of debt.

Sustainability and social Bonds

As an alternative to green bonds, the first sustainability bond was issued in 2014 by Unilever. According to the International Capital Markets Association (ICMA), sustainability bonds are defined as bonds whose proceeds are applied exclusively to finance or re-finance a combination of green and social projects, that is, projects with clear environmental and socioeconomic benefits. These projects should link to Sustainable Development Goals (SDGs), socially responsible investing (SRI), ESG, or other considerations.

HSBC has recently supported Vinpearl, a wholly-owned subsidiary of Vingroup, to successfully issue a $425 million Exchangeable Sustainable Bond (ESB), convertible into new shares of Vingroup. This issuance is the world’s first exchangeable sustainable bond. As Sole Sustainability Structuring Bank, HSBC supported Vingroup in developing its inaugural Sustainable Finance Framework, which includes six green and two social project categories across Vingroup’s business segments. Potential project categories include clean transportation, green buildings, sustainable water, and wastewater management, pollution prevention and control, energy efficiency, renewable energy, access to essential services such as healthcare and affordable housing. Sustainalytics, a leading independent company that rates the sustainability of listed companies, commented that the framework has a positive impact on the environment and society.

The second sustainable-debt financing innovation came about in 2015 with the issuance of the first social bond. ICMA defines social bonds as bonds whose proceeds are used exclusively to finance or re-finance social projects. Social bonds may also have environmental co-benefits. In 2018, social bond issuance totalled roughly $11 billion as social bond issuance for the first time exceeded $10 billion per annum.

Transition labels

Transition finance describes instruments financing activities that are not low- or zero-emission (that is, not green), but have a short or long-term role to play in decarbonising an activity or supporting an issuer in its transition to Paris Agreement alignment. The transition label can thus enable the inclusion of a more diverse set of sectors and activities in the sustainable finance universe.

This widely debated concept is built on the premise that “transition bonds” can fill a market gap by extending the labelling to a more diverse set of sectors and activities. Many of the candidates are currently highly polluting, hard to abate, and do not fall within existing sets of green definitions but are key to meeting global climate targets. Example sectors include extractive industries such as mining; materials such as steel and cement; and industrials including aviation.

A high hope for greener Vietnam

According to the IFC Climate Investment Opportunity report, Vietnam’s climate-smart business investment potential is an estimated $753 billion in the 2016-2030 period, with the majority ($571 billion) going towards the country’s transportation infrastructure needs by 2030. Potential investment in renewable energy totals $59 billion, with over half of this ($31 billion) in solar PV and another $19 billion for small hydropower projects. New green buildings represent an almost $80 billion investment opportunity. Those numbers are proving the fact that Vietnam’s sustainable finance market is going to evolve remarkably in light of the ongoing pandemic and heightened attention on sustainable economic recoveries.

With the dedication of the Vietnamese government in growing the sustainable financial market, new strategies, funds, and financing instruments that engage with environmental and social issues are expected to emerge at an accelerating pace in the next few years.

Here are some recommendations to transform finance to finance the transformation:

+ In terms of credit market, the SBV could set a clear requirement for each credit instrument so that banks can develop better green credit frameworks and progress plans for themselves;

+ It is essential to have a clear framework for capital market instruments. The SSC’s handbook to guide the issuance of green bonds is not a binding regulation;

+ The SBV should set out clear targets on green credit performance for each bank, for example, green outstanding balance on total book;

+ The SBV could consider higher credit growth for green sectors or financial subsidies for green credit;

+ More rewards to motivate banks on green journey, including a higher general credit growth cap for banks that comply with or overachieve the target. A lower growth cap for those that do not as a penalty could also be an option to consider; and

+ No or lower Required Reserve Ratio for green outstanding balance could also drive green market growth.

| Blended sustainable finance In Asia, there is a significant funding gap for sustainable infrastructure required to address challenges and opportunities presented by climate change. Many infrastructure projects in the region face varying degrees of barriers to bankability. Neither the private nor the public sector can close the financing gap alone but by joining forces, we can catalyse our capital, multiplying impact and scaling to meet the opportunities. HSBC and Temasek, a Singaporean holding company owned by the government of Singapore, recently teamed up to set up a debt financing platform for sustainable infrastructure projects, with an initial focus on Southeast Asia. The two companies would invest a combined amount of up to $150 million of equity to fund loans in the initial phase, targeting marginally bankable, sustainable infrastructure projects. The Singapore-based platform aims to allocate more than $1 billion of loans within five years. Collaborations matter in the fight against climate change, and this partnership provides an impactful model for others to follow. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Higher rates and stricter credit caps reshape lending landscape (March 02, 2026 | 16:28)

- Capital markets as pillar for Vietnam’s double-digit growth (February 27, 2026 | 17:30)

- Banks roll out God of Wealth Day promotions (February 26, 2026 | 17:10)

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

Tag:

Tag:

Mobile Version

Mobile Version