Spirits high at FE Credit over strong gains

|

| FE Credit constantly creates new products in insurance and credit to advance the consumer experience |

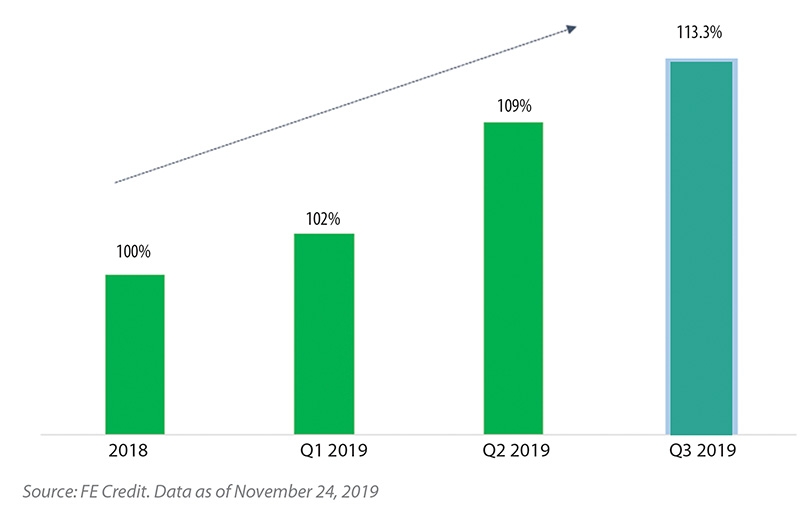

According to a report by FiinGroup, a provider of financial data, business information, and industry research services, in the first nine months of 2019, FE Credit has increased its market share from 53 per cent in 2018 to 55 per cent in the first nine months of 2019. Effective restructuring of their loan portfolio, combined with new technology applications, are the primary contributors to the company’s sustainable development. The third quarter results mark FE Credit’s success in maintaining its sustained growth path while maximising in comparison with benchmark. This achievement was largely due to the solid performance across all key products, channels, and customer segments. Compared to the previous quarter, cross-sell and top-up to existing good customers grew by nearly 5 per cent. Besides the contributions from existing and new customers also contributed significantly to the portfolio’s growth in the third quarter.

Overall, FE Credit’s stable and multi-year growth plan is executed in a strategic and impactful manner. Quarterly net profit grew by 1.44 per cent on-year, whereas net receivables growth in the nine-month period from January to the end of September 2019 increased remarkably by 13.5 per cent on-year.

Mission to improve quality of life

Products such as insurance and credit cards are designed by FE Credit to improve Vietnamese consumers’ quality of life. For instance, instead of resorting to informal credit sources, cardholders may withdraw cash from their credit cards to pay for unexpected costs such as hospital fees, tuition, and emergency needs.

According to reported figures, new credit card issuances increased by 100 per cent on-year, amounting to two million credit cards. The momentum of credit card growth in 2019 is predicted to match last year’s figure. Credit card spending has also increased by 10 per cent on-quarter.

Insurance, a relatively new addition to the product line, recorded double-digit growth on a yearly basis. FE Credit’s long-term goal is to enable low- and middle-income Vietnamese access to insurance products. These customer segments are ignored by most insurance companies and banks. They, however, carry massive potential for consumer finance companies’ future expansion, because more than 80 per cent of the Vietnamese population belongs to these groups.

The two-wheeler loans, another contributor in helping Vietnamese people improve their living standards, grew by 10 per cent in the third quarter this year compared to a year ago. In order to drive higher awareness of the benefits of personal insurance and concurrently deliver impactful corporate social responsibility initiatives, FE Credit also actively engages in activities such as offering free insurance to the families of low-income workers and awarding hundreds of scholarships to poor children each year. Additionally, the lender is one of the top taxpayers in Vietnam.

|

| Quarterly growth rate of FE Credit’s ending net receivables |

Achieving financial goals through technology

FE Credit is striving to become Vietnam’s leading high-tech consumer finance firm, providing a wide range of financial services on demand, anytime, anywhere. The consumer lender’s agenda is to deliver its products and services as quickly as possible, with the best customer experience, and at the moment when the customer needs it. To do so, the roadmap for technology development and application involves focusing on digitising its lending activities and extensive big data analysis.

In the third quarter, cross-sell and top-up to existing customers grew significantly, thanks to increasing penetration of the $NAP app. This achievement can be traced back to FE’s unique ability to analyse and profile past customer behaviour patterns to predict similar behaviours in the future and deliver the right offer to the right customer at the right time through intelligent data-driven marketing via its app platforms.

The application of new technologies in its risk models now also enables FE Credit to offer previously denied applicants some low-risk loans under the new credit score regime.

Technology also contributes in terms of risk management by keeping bad debt levels in compliance with the State Bank of Vietnam’s (SBV) prudential ratio regulations. On a year-over-year basis, the non-performing loan ratio continues to follow a downward trend, decreasing by 0.8 per cent due to two main factors: the successful cross-selling strategy on existing customers and advanced analytics.

In addition, the digitisation process not only reduces risk costs, but also ultimately helps to save on operating costs. As a result, the cost-to-income ratio in the third quarter of this year dropped by 6.8 per cent on-year. To note, this achievement is partially due to the increasing use of $NAP’s fully-automated lending capability, which reduces manual operational costs dramatically. In a nutshell, FE Credit’s growth in the third quarter reveals two important advancements: First, the consumer lender has demonstrated the ability to manage growth effectively, in line with the SBV’s credit growth target.

Second, the sustainable growth strategy has proved to be working well by focusing on improving services to existing customers and the extensive application of technology. With this growth momentum, the company will continue to strengthen its position as market leader further in the year ahead.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version