Advanced search

Search Results: 51 results for keyword "global minimum tax".

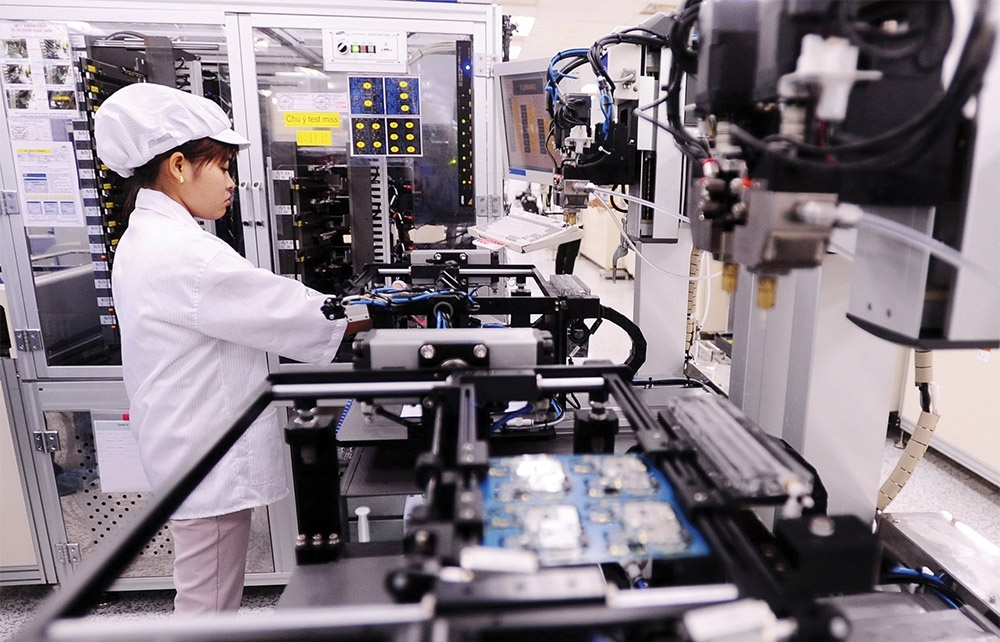

GMT introduction offers upsides for FDI in Vietnam

16-07-2024 09:54

The global minimum tax (GMT) has been officially implemented in Vietnam since January, incorporating the Income Inclusion Rule and the Qualified Domestic Minimum Top-Up Tax (QDMTT).

Fund policies to help boost tech investing

16-07-2024 09:38

New policies related to the global minimum tax are set to come to the fore in Vietnam, as they attempt to woo much more foreign investment, especially in high-tech projects

Multinationals keen to thrash out global tax arrangements

15-05-2024 18:00

Multinational enterprises are willing to pay the global minimum tax in Vietnam, but the calculation and implementation of top-up fees may cause a headache.

Calculation of top-up payable under Pillar 2 global minimum tax

07-05-2024 18:00

The Vietnam Association of Foreign Invested Enterprises (VAFIE) and Washington D.C.-based International Tax and Investment Center (ITIC) held an international workshop themed "Pillar 2 Global Minimum Tax Implementation in Vietnam" today.

Big foreign groups await GMT direction

27-03-2024 14:36

Foreign enterprises are expecting the early implementation of the government’s new investment support fund so that they can boost investment in Vietnam amid the entry into force of the global minimum tax.

Preferential support on cards for GMT alignment

21-03-2024 11:46

Green production and business, a favourable digital environment, high-quality human resources, and a suitable living environment are necessary factors for Vietnam in implementing the global minimum tax.

New fund a solution to GMT concerns

13-03-2024 09:25

The Ministry of Planning and Investment has created a draft decree for a brand new investment support fund, but the scale of the projects and investors under the draft’s purview is the subject of intense debate and discussion.

Preparations for a GMT overhaul

12-02-2024 23:45

The global minimum tax regulations are now under effect. Le Khanh Lam, chairman of RSM Vietnam, explains why preparations for this move will be necessary for Vietnam’s permanent development.

Projected GMT consequences on foreign investment

30-01-2024 14:00

Last November, Vietnam legalised rules regarding the introduction of global minimum tax (GMT). It is set at 15 per cent in Vietnam for enterprises considered as constituent entities of multinational corporations (MNCs) with consolidated revenue from €750 million (around $815 million) in two of four consecutive years.

Mission now clear in journey to adapt to GMT rate

23-01-2024 10:00

Now could be a good time for Vietnam to review investment incentives and raise diversified policies in line with international practices.

The tax policy impact on luring in fresh investment

19-01-2024 10:30

New tax policies in recent years have contributed significantly to building confidence from foreign investors and creating a competitive and sustainable business environment, directly contributing to Vietnam’s foreign investment growth in 2023.

Vietnam races to stay competitive with new GMT

27-12-2023 14:00

The international community is speeding towards the implementation of a global minimum tax, and Vietnam is no exception. With countries around the world revamping their tax systems, Vietnam must also navigate this new landscape in order to stay competitive and draw in new foreign investment.

Vietnam primed for GMT adoption

08-12-2023 11:15

With a long-awaited resolution adopted by the legislature, Vietnam now has a legal framework for applying top-up corporate income tax under a new international system.

Vietnam to develop initiatives to sustain FDI flows

05-12-2023 15:19

Vietnam will set up a support fund to encourage and lure strategic investors and multi-national groups, making it more attractive in attracting foreign direct investment, as the National Assembly recently approved a resolution on applying additional corporate income tax in accordance with the Global Anti-Base Erosion Rules (global minimum tax).

Vietnam will remain FDI magnet with global minimum tax in place

30-11-2023 11:00

On November 29, the National Assembly of Vietnam approved a resolution on applying additional corporate income tax following the Global Anti-Base Erosion Rules, which is expected to have an impact on foreign direct investment (FDI) inflows into Vietnam.

Mobile Version

Mobile Version