Advanced search

Search Results: 211 results for keyword "fintech".

Value of BIDV’s major support spending recognised

30-11-2020 09:24

As one of the many enterprises honoured this year, state-owned BIDV has been recognised within the Vietnam Value Programme for its efforts in fintech and user experience, with the bank offering multiple applications for its customers to conveniently use in everyday life.

Alibaba fintech arm gets nod for record IPO listing in Hong Kong

20-10-2020 09:00

The financial arm of Chinese e-commerce titan Alibaba received Monday a green light from Chinese regulators to list in Hong Kong, according to data published online, another step towards the biggest IPO in history.

Mobile money regulations explained

26-09-2020 09:00

As businesses in Vietnam race to provide financial services for the unbanked and underbanked population through various fintech solutions, the Vietnamese government is closely following this industry trend and has initiated a pilot scheme for mobile money.

Ant Group, the silent investor in Vietnamese fintech, files for IPO in Shanghai and Hong Kong

26-08-2020 10:46

Ant Group, an affiliate of China-based multinational technology corporation Alibaba, has just announced its ambition to file for an initial public offering (IPO) in Shanghai and Hong Kong.

E-wallet 9Pay licensed by State Bank of Vietnam

22-08-2020 16:51

The State Bank of Vietnam (SBV) has approved the official licence for intermediary payment service provider 9Pay.

Everpia JSC joins forces with Hyojung Soft Tech JSC to enrol fintech

05-08-2020 10:32

Everpia JSC, known for its matress brands Everon and Kingkoil, has invested in Hyojung Soft Tech JSC in a move to boost its growth and turn it into a leading company in one of the most promising industries in Vietnam.

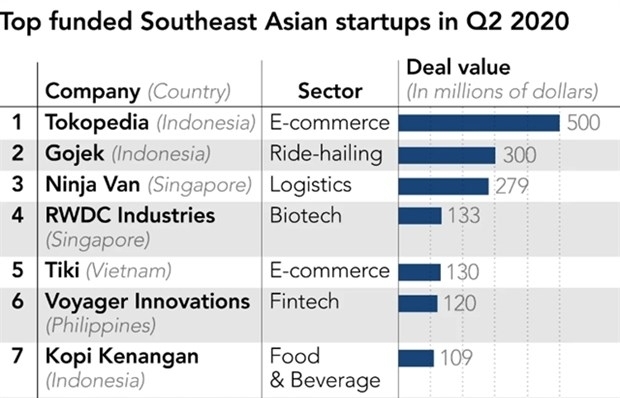

Capital inflows to Southeast Asian startups up 91 per cent despite outbreak

02-08-2020 21:07

Southeast Asian startups, especially e-commerce and fintech companies, have witnessed a significant increase in their investment attraction between April and June with the global public health challenge continuing to exert pressure on the whole economy.

VNPAY gets certified at highest level of international security standards

02-08-2020 21:05

Recently, VNPAY has received certification for PCI-DSS version 3.2.1 Level 1 for its VNPAY Payment Gateway from ControlCase, an international company specialised in PCI–DSS compliance.

Start-up investment in Southeast Asia doubles despite COVID-19

29-07-2020 08:00

Investment in start-ups in Southeast Asia soared in the second quarter of this year despite the COVID-19 pandemic, led by e-commerce and fintech companies.

Unlocking Vietnam's immense fintech potential

28-07-2020 20:00

With immense potential and removal of foreign ownership limits, Vietnam could become a darling for multinational and local fintech firms alike that want to reap the fruits of the booming market.

Bankograph takes strategic relation with National Citizen Bank to new level

15-07-2020 20:56

Bankograph Financial Group has signed an memorandum of understanding (MoU) with NCB bank for the the next phase of its existing card processing partnership with National Citizen Bank (NCB) where it will power third party credit distribution delivery with its innovative, AI-driven risk management solutions to provide scalability in terms of distribution of credit and asset servicing.

Vietnam plans to launch regulatory sandbox for fintech

07-06-2020 10:33

The State Bank of Vietnam (SBV) is mulling over a pilot regulatory sandbox for fintech – particularly fintech companies providing banking services from 2021.

How the pandemic is altering fintech

19-05-2020 10:24

Fintech will most likely be one of the few eminent sectors benefiting from the coronavirus pandemic, yielding growth for businesses and investment opportunities.

Mobile money: moving closer to official deployment

18-05-2020 08:02

After years of delay, mobile money – a technology that allows people to receive, store, and spend money using a mobile phone – is highly likely to be pressed into service from the middle of this year in Vietnam, entailing the opportunities to promote non-cash payment among the more than 50 per cent Vietnamese population who are unbanked.

Mobile transactions in Vietnam expected to increase by 400 per cent by 2025

12-05-2020 15:44

Mobile transactions are expected to experience 400 per cent growth in the next five years, according to the Fintech and Digital Banking 2025 report by Backbase and IDC.

Mobile Version

Mobile Version