Advanced search

Search Results: 2,239 results for keyword "banks".

Delay forecast for banks’ capital hike plans

21-03-2020 08:00

The Government’s plans to increase capital for large State-owned commercial banks in the first quarter of this year could be delayed due to the Covid-19 outbreak, analysts predicted.

Reference exchange rate continues going up

19-03-2020 15:51

The State Bank of Vietnam set the daily reference exchange rate at 23,242 VND per USD on March 19, up 10 VND from the previous day.

ECB brings €750b bazooka to coronavirus fightback

19-03-2020 13:26

The European Central Bank on Wednesday (Mar 18) unexpectedly said it would spend €750 billion on "emergency" bond purchases, as it joined other central banks in stepping up efforts to contain the economic damage from the coronavirus.

Banks cut savings rates to ensure lower-interest loans

10-03-2020 19:21

A number of commercial banks have lowered their interest rates on savings accounts by 0.1-0.4 percentage points in order to offer loans at a lower interest rate to businesses and individuals affected by the COVID-19 outbreak.

Banks take action to bolster business

10-03-2020 10:00

With the COVID-19 epidemic showing no sign of slowing down, and continuing to inflict hardship on businesses, global central banks and local commercial lenders have joined the race to help lift economies up from a downward spiral.

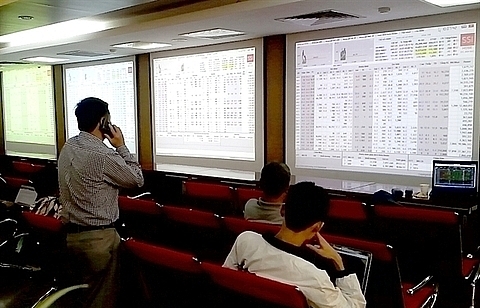

Shares gain narowly as banks' growth tempts investors to sell

06-03-2020 10:51

Vietnamese shares gained narrowly as investors took use of intra-day growth to stave off risks and foreign investors remained net sellers.

Reference exchange rate down 1 VND on March 5

05-03-2020 16:59

The State Bank of Vietnam set the daily reference exchange rate at 23,203 VND per USD on March 5, down 1 VND from the previous day.

Global events hinder bank IPO plans

04-03-2020 14:00

Concerns over the lacklustre market have played a part in weakening investors’ appetite and could pose risks for Vietnamese banks going public this year.

Vietnamese banks see improved solvency

03-03-2020 21:22

Banks in Vietnam posted solid profit growth and asset quality improvements in 2019, benefitting from the country's robust macro-economic environment, Moody's Investors Service said.

South Korean banks apply caution amid relief moves

03-03-2020 11:00

South Korean lenders are continuing to play the waiting game in regards to measures to combat damage caused by the coronavirus outbreak, though domestic banks and investors have been placing growing bets on rate cuts or tolerance to loans.

Banks step up with willing support for COVID-19 times

03-03-2020 08:36

Many banks have rolled out soft credit packages in a bid to help customers, both retail and corporate ones, to mitigate the adverse impacts of COVID-19.

Reference exchange rate down 5 VND at week’s beginning

02-03-2020 14:05

The State Bank of Vietnam set the daily reference exchange rate at 23,219 VND per USD on March 2, down 5 VND from the last working day of previous week (February 28).

Reference exchange rate down 10 VND on February 28

28-02-2020 09:50

The State Bank of Vietnam set the daily reference exchange rate at 23,224 VND per USD on February 28, down 10 VND from the previous day.

Banks speed recruitment to meet expansion plans

24-02-2020 09:51

Many banks have announced the recruitment of a large number of personnel to meet business expansion plans in 2020.

SBV orders banks to cut or delay interest payments to cushion economy

22-02-2020 13:24

Commercial banks in Vietnam will likely cut or delay interest payments on loans in a bid to cushion the domestic economy against a global slowdown amplified by the wide-spreading coronavirus contagion, following directions from the State Bank of Vietnam.

Mobile Version

Mobile Version