Advanced search

Search Results: 1,372 results for keyword "KPMG tax partner Le Thi Kieu Nga and senior tax manager Er Say Hun".

Two foreign subjects exempted from personal income tax

17-08-2016 08:53

Foreign experts in non-governmental aid programs and projects and Vietnamese working at representative offices of the United Nations system in Viet Nam enjoy personal income tax (PIT) exemption in Viet Nam.

Businesses hail 3% corporate tax cut

16-08-2016 10:50

Entrepreneurs are hailing a national plan to reduce corporate income tax for small- and medium-sized enterprises from 20% to 17% starting next year.

NA mulls more agricultural tax exemption, reduction

16-09-2016 14:26

Law makers yesterday discussed the Government’s proposal on further tax reduction and exemption for agricultural land use.

Viet Nam announces tax rules for Uber

13-09-2016 19:55

The Ministry of Finance has issued a document on tax payment rules for Dutch-based Uber International Holding BV for its car hailing service in Viet Nam.

M&A tax payments vex authorities

18-08-2016 09:28

Tax in a merger and acquisition (M&A) is a complicated matter, but Nguyen Van Phung, head of the Big Corporate Tax Department of the General Department of Taxation under the Ministry of Finance and speaker at the 2016 Vietnam M&A Forum: “M&A in Wider Economic Boundaries”, told VIR’s Manh Bon that the tax authorities will make sure to collect their dues one way or another.

IT workers likely to enjoy 50% income tax cut

02-06-2016 09:05

The Government has proposed the National Assembly (NA) reduce the personal income tax by 50% for workers in the information technology sector.

Messi due to go on trial in Spain for tax fraud

29-05-2016 20:01

Argentina star Lionel Messi, one of the world's highest-paid athletes, goes on trial in Barcelona on Tuesday for allegedly defrauding Spain of over four million euros in unpaid taxes.

MOF eases regulations for VAT tax refunds

18-03-2016 10:01

The Ministry of Finance has asked local tax authorities to refund value-added tax (VAT) to enterprises if the amount of tax they default on is less than the amount of tax refund that they will receive.

MoF addresses recent public tax claims

01-03-2016 10:14

Responding to a recent widespread public claim that as much as 40 per cent of businesses’ profits are taken away by tax contributions, a Ministry of Finance representative noted that the claim is inaccurate in as much as it dubs other contributions, such as social and health insurance, unemployment insurance, and trade union fees, as tax payments to erroneously inflate the figure.

Amway tax payments break into top 200

31-10-2015 17:01

Amway is ranked 119th amongst the top 200 companies making the largest contributions of corporate income tax in Vietnam in 2015, according to the V1000 ranking list conducted by Vietnam Report, Vietnamnet, and Tax Journal under the General Department of Taxation.

Ministry announces goods exempt from tax under TPP

09-11-2015 10:05

The Ministry of Finance yesterday officially announced the list of goods which would enjoy tax reduction when the Trans-Pacific Partnership (TPP) is signed and comes into effect.

New special consumption tax on 24-seater cars

04-11-2015 15:10

The government will levy a special consumption tax on cars with 24 seats and below from January 1, 2016, according to the prime minister's new decree.

NA deputies worried about revised tax on cars

17-11-2015 09:26

Many National Assembly delegates have expressed concerns about difficulties domestic automakers would face if the special consumption tax is deeply reduced.

Reduction in import tax on auto spare parts likely

19-11-2015 15:01

Import tax on auto spare parts and components may be down to zero per cent next year, two years before schedule in 2018, under the ASEAN Free Trade Agreement (FTA).

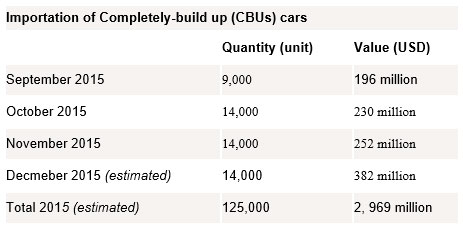

Car importers in a rush before tax hikes

30-12-2015 13:36

It will come as no surprise that the spending of Vietnamese people on completely built cars imported from foreign manufacturers marked a record level of nearly $3 billion in 2015.

Mobile Version

Mobile Version