Advanced search

Search Results: 51 results for keyword "global minimum tax".

Vietnam set to implement global minimum tax

14-11-2023 09:01

Vietnam is poised to adopt global minimum tax (GMT) regulations, a move set to impact 122 foreign investment conglomerates and strengthen the country's fiscal framework in line with international standards.

Vietnam envisages GMT application by early 2024

01-11-2023 18:49

Deputy general director of the General Department of Taxation Dang Ngoc Minh delves into the factors that are instrumental in Vietnam applying the global minimum tax (GMT) scheme from 2024.

Indonesia pledges continued tax incentives for foreign investors

30-10-2023 09:27

Indonesian Investment Minister Bahlil Lahadalia confirmed that his government will keep granting tax holidays to attract foreign investors so long as the global minimum tax (GMT) policy is not yet rendered, local media has reported.

Global tax shift forces inevitable adjustment

12-10-2023 11:00

As the country adapts to the global minimum tax, Vietnam’s future as a prime investment destination is under the lens. Duong Hoang, partner and head of Tax at KPMG in Vietnam, offered VIR’s Luu Huong insights into this transformative phase, highlighting the synergies between Vietnam’s tax strategy and its quest to remain a magnet for foreign funding.

Knock-on effects of global minimum tax regime

07-09-2023 12:36

A global minimum tax (GMT) policy aims to prevent tax avoidance and tax competition, and to ensure that all countries get a fair share of the tax revenues from the global profits of these organisations. The policy consists of two pillars, with Pillar 2 establishing the 15 per cent rate.

How will GMT affect FDI in Vietnam?

28-08-2023 16:00

Vietnam has offered generous tax incentive policies to foreign investors in recent years to encourage them to establish manufacturing plants and processing facilities across the country. In return, such policies have strengthened Vietnam’s position as one of the region’s large manufacturing hubs and key participants in global supply chains.

Plans manifest to balance GMT impact

09-08-2023 15:16

Appropriate and sturdy policies relating to the upcoming implementation of a global minimum tax could ensure that Vietnam quickly recovers foreign investment attraction.

Overcoming challenges of global minimum tax

03-08-2023 09:43

Global minimum tax (GMT) now worries businesses due to its impacts on their future activities. Takeo Nakajima, chief representative of the Hanoi Office of the Japan External Trade Organization (JETRO Hanoi) spoke to VIR’s Bich Thuy about Japanese investment trends and solutions to overcome the challenges.

Global Minimum Tax: a call for strategic revisions in Vietnam's special zones

27-07-2023 16:36

Loc Huynh, a lawyer from Dentons LuatViet, a Vietnamese law firm, delves into the implications of the incoming Global Minimum Tax for Vietnam's special zone developers, suggesting strategic shifts towards infrastructure quality, investment costs, and human resources to maintain competitiveness.

Vietnam sets October for move towards global minimum tax adoption

13-07-2023 16:18

The Vietnamese government is slated to table the proposed legislation regarding global minimum tax before the National Assembly in October, with the General Department of Taxation (GDT) forecasting an implementation timeline commencing at the outset of 2024.

UK investors confident in Vietnam’s GMT response

12-07-2023 09:54

Many British investors in Vietnam are large multinational corporations, who view the country as an emerging market or an increasingly promising place for future investment. That said, Vietnam will find many of them to be in the scope of the global minimum tax (GMT) regime and Pillar 2 by the Organisation for Economic Co-operation and Development (OECD).

Vietnam sets out stall on GMT impacts

12-07-2023 09:42

Concerns among multinational corporations about new global tax impacts are expected to be eased by Vietnam’s efforts to facilitate the foreign business community.

Changes to special consumption tax must be studied carefully

11-07-2023 16:02

The impacts of the imposition or increases of special consumption tax on several products must be studied carefully to ensure State budget revenue and the development of production and business, experts said.

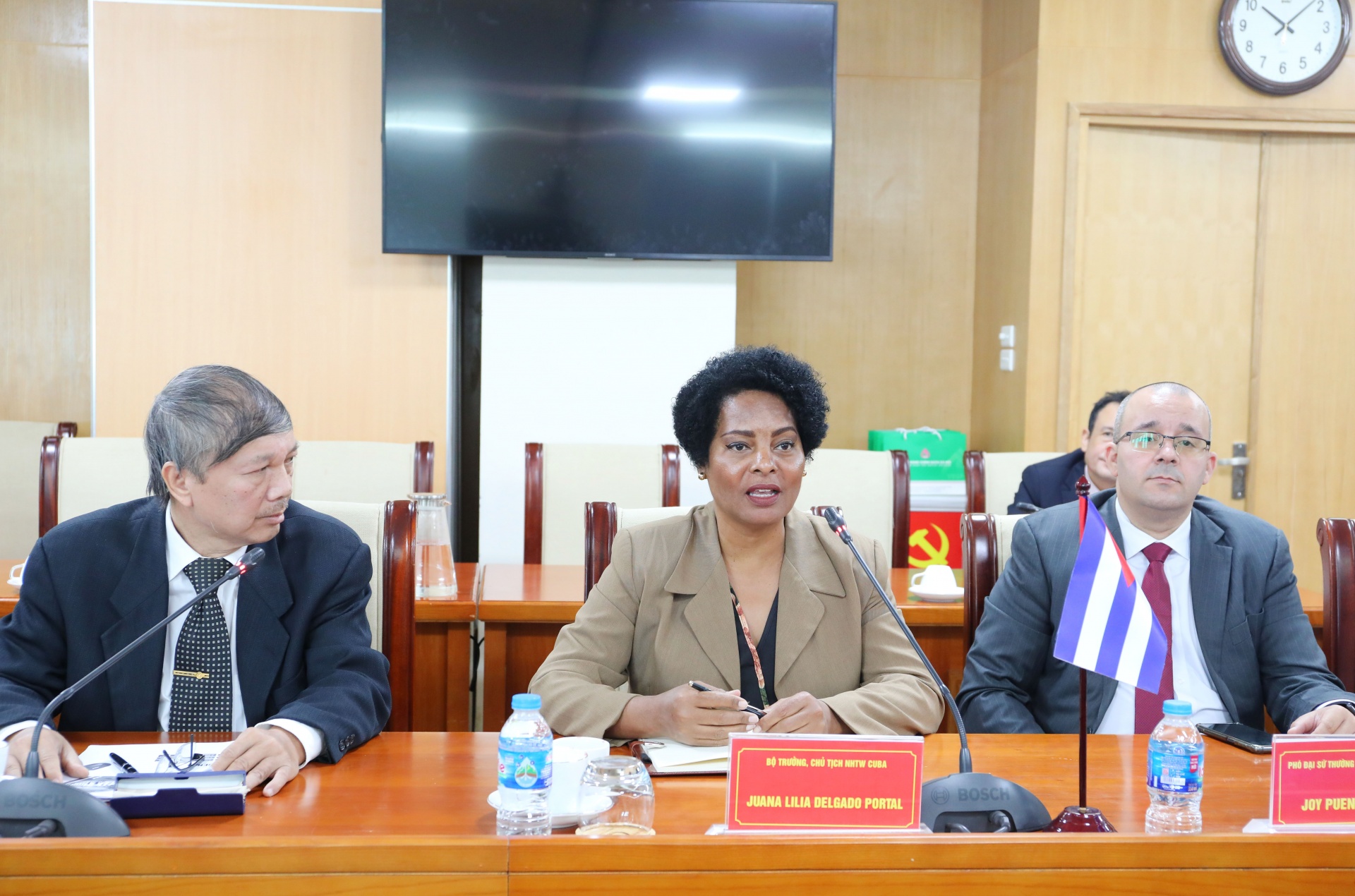

Vietnam seeks Belgian advice on global minimum tax policy

10-07-2023 17:42

Vietnam is engaging with Belgian support to navigate the complexities of implementing the global minimum tax (GMT) amid strengthening economic ties.

Lessons for Vietnam in global corporate tax transformation

28-06-2023 17:00

Countries such as Thailand, Malaysia, Indonesia, and others have announced many drastic moves to find solutions to deal with and retain investors in anticipation of possible impacts of the global minimum tax (GMT).

Mobile Version

Mobile Version