How will GMT affect FDI in Vietnam?

But the introduction of Pillar 2 of the upcoming global minimum tax (GMT) has rattled emerging markets, including Vietnam, and it has been a subject of discussion in the last two years. In general, financial and economic experts have opined that the GMT would not lessen Vietnam’s investment attractions because the country has many other socioeconomic elements to offer and thus, would unlikely have a significant impact on foreign direct investment (FDI) into Vietnam soon.

|

| Vu Ngoc Thang - Tax manager Dezan Shira & Associates |

While we agree with most of the experts’ opinions on this subject, we would like to supplement a few points from a tax advisor’s perspective and based on our experience in assisting many foreign investors to enter Vietnam’s market over the years. In a nutshell, the GMT applies to the entities in Vietnam of which annual consolidated turnovers of ultimate parent companies exceed the €750 million ($816.4 million) threshold and allows the tax jurisdictions of such companies to impose a top-up tax equal to their shortfall taxed income. Such implementations would likely have a significant impact on the potential FDI inflows from large investors that Vietnam is seeking to entice.

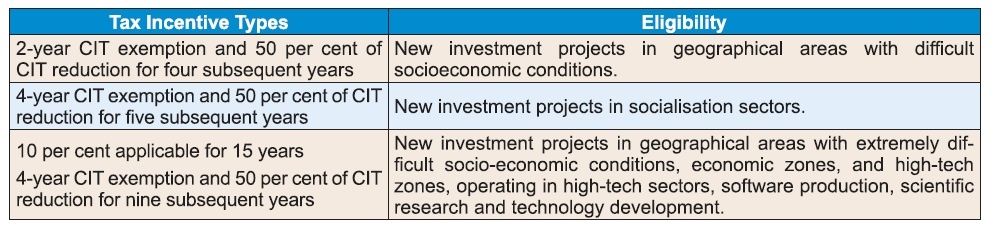

According to the Ministry of Finance (MoF), there are over 1,000 foreign-invested enterprises (FIEs) in Vietnam that will be subject to GMT upon implementation. The main question of whether it will negatively affect decisions to invest in Vietnam of large international conglomerates is unpredictable. Firstly, the implementation of GMT measures will negate the benefits of the key tax incentives that most large foreign investors are interested in (see table).

We can see that if tax incentives are invalidated in Vietnam and there are no appropriate measures in place, other countries will benefit from top-up taxes and the nation will miss out on billions of US dollars of tax outflows to other countries’ budgets.

Secondly, we need to see from the Vietnamese government’s perspective. In the global context, the major stakeholders are quickly responding to the adoption of Pillar 2. Specifically, it is being implemented by the EU, the UK, and South Korea in 2024. Vietnam desires investors from these countries, as well as the United States and other powerhouses. On the other hand, Malaysia and Thailand are implementing Pillar 2 in 2024 and 2025 respectively. Moreover, these countries will likely apply a qualified domestic minimum top-up tax and they are deemed competitors of Vietnam in wooing FDI inflows. In this respect, Vietnam must devise certain measures to protect its taxing rights and maintain sustainable FDI inflows by offering alternative incentives.

As of August, the MoF released a draft resolution to adopt GMT for public comments before submitting it to the National Assembly for ratification in October. Two primary rules are proposed, which are a qualified domestic minimum top-up tax that targets foreign inbound investors in Vietnam and an income inclusion rule that targets outbound investments from Vietnam.

On the other hand, there have not been any announced alternative incentives to compensate for additional burdens borne by FIEs subject to GMT. The current information about alternative policies is still vague. At this point, the public only knows that such incentivised policies are related to land, research and development expenditures, and administrative reforms.

Finally, we can now view the scenario from the potential foreign investors’ point of view. Whilst assisting potential foreign investors to explore their investment options and strategies in Vietnam, the most common questions are related to available tax incentives and tax rebate schemes.

If we had the slightest doubt about their ineligibility for tax incentives, we could tell that such investors’ enthusiasm in Vietnamese markets would remarkably reduce and almost disregard the fact that Vietnam has many competitive advantages in terms of labour costs, young demographics and strategic location in the Asia-Pacific region.

Moreover, interested foreign investors and our clients have provided a lot of direct and constructive feedback regarding the challenges that they have faced during operations and market research stages. Some notable feedback is that the current minimum wage level does not provide a fair view of actual living standards, which often results in disputes between FIEs and their factory workers. Such companies rely on statutory data and are not obligated to understand the basic living standards of their workers. To rectify this matter, the minimum wage levels must be reviewed and adjusted periodically so that they can actually cover the workers’ basic living costs.

The VAT refund processes have been painfully slow over the last three years. VAT refund is one of the crucial elements in the cashflow planning strategy of an exporting entity or a new investment project. Simplifying and accelerating the VAT refund process is also an alternative benefit that Vietnam can consider offering, along with other business support policies. Last but not least, although Vietnam has anti-corruption laws, the enforcement of such laws is not on par with the investors’ expectations, and it is one of the main reasons for them to self-question their decisions to enter the Vietnamese market.

While tax incentive is not the sole factor for investors to consider before entering Vietnam, it has been instrumental in attracting large tranches of FDI inflows to date. Given the GMT will take effect next year and tax incentive is no longer an effective option to woo big investors, Vietnam should focus on rectifying the current core issues and consider offering alternative incentives to enhance the country’s investment climate.

|

| Global Minimum Tax: a call for strategic revisions in Vietnam's special zones Overcoming challenges of global minimum tax Plans manifest to balance GMT impact |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version