Advanced search

Search Results: 260 results for keyword "bad debt".

Thailand’s long-term debt stable: Union Bank of Switzerland

11-10-2023 16:26

The Union Bank of Switzerland (UBS) has rated Thailand’s long-term debt sustainability as stable, despite earlier concerns that it might face a downgrade in its credit rating if there were efforts to stimulate the economy through the 10,000 THB (271 USD) digital wallet scheme.

Banks witness bleak profit results

11-08-2023 14:47

Throughout the first half of this year, many banks – particularly smaller entities – have witnessed a sharp reduction in their profits.

Asset quality crucial to banking sector

07-08-2023 11:16

Tran Thi Khanh Hien, head of Research at MB Securities, delves into the factors impacting bank performances this year.

Banking sector focuses on credit institution restructuring associated with bad debt settlement

29-06-2023 15:24

The banking sector should take more drastic measures to restructure credit institutions in association with the settlement of bad debts to contribute to curbing inflation and stabilising macro-economic factors, according to insiders.

Averting the consequences of slowing flows in capital

21-06-2023 11:34

Low credit demand might be an early indicator that bad debt will increase. Nguyen Thi Phuong, deputy general director of Agribank, talked to VIR’s Nhue Man about the issue in the domestic market.

How bad debts influence lending rates

30-05-2023 18:38

Last week the State Bank of Vietnam continued reducing diverse regulatory interest rates in a bid to help remove impediments for borrowers, as well as support credit institution efforts to drive down input costs, and from there be able to reduce lending rates.

Falling interest rates likely in H2

26-05-2023 16:09

On May 23, the SBV announced additional adjustments to a series of key interest rates, effective from May 25. This move marks the third round of reductions designed to boost the economy in less than three months. Interest rates are predicted to soften in the second half of the year, due to several factors in both the domestic and international markets.

Vigilance over bad debt essential

20-05-2023 10:00

As bad debts continue to pose a threat to the banking sector's performance, financial authorities are implementing a host of measures to keep tabs on credit quality and mitigate risk to optimise the efficiency of credit institution restructuring.

Bad bank debts cast shadow over profit outlook

06-05-2023 12:10

Several banks have posted low profit growth in the first quarter (Q1) of this year, with some even seeing negative growth, mostly due to a spike in non-performing loans (NPLs), leading to soaring provisioning costs.

Credit growth slowing down, raising fear of business contraction

13-03-2023 14:47

Credit growth in the first months of this year slowed significantly due to high interest rates and firms’ poor health, raising concerns about rising bad debts.

Rising bad debt threat looms large

09-02-2023 12:33

Despite a bright business outlook, non-performing loans are causing significant concerns to banks amid a challenging environment in both the domestic and global market, according to industry experts.

Bad debts continue to soar at commercial banks

06-02-2023 12:21

The rate of bad debt is rising at commercial banks and is expected to increase further amid real estate market woes.

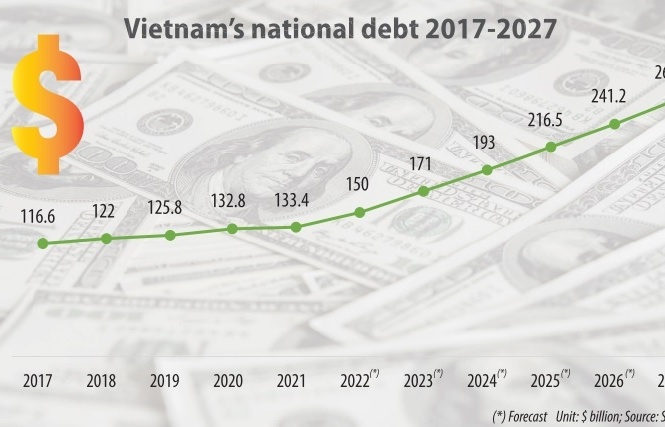

Debt rates set to remain lower than planned limits

28-12-2022 17:04

With Vietnam’s borrowing plan revealed and budget landscape finalised for next year, Vietnam is expected to see its public debt stay within the permissible limit, ensuring financial security for the nation.

Growing bond market illustrating bad debt snags

13-12-2022 18:39

While the bad debt market in Vietnam is still in its infancy and positive conditions have converged, stronger steps need to be taken.

VAT refund delays cause fear of bad debt for wood groups

17-11-2022 16:00

As VAT refunds represent a crucial part of the cash flow of timber processors, the current delay is throwing a wrench in the operations of woodchip, furniture, and other timber-based producers, leading related associations to call for easier regulations.

Mobile Version

Mobile Version