SCT law options being calculated carefully

At a conference on tax amendments to promote business activities hosted by VIR last week, Chu Thi Van Anh, vice president and general secretary of the Vietnam Beer-Alcohol-Beverage Association (VBA), said the draft amended Law on Special Consumption Tax (SCT) could see the highest tax increase in the history of the industry, if approved.

|

| Businesses and lawmakers understand the importance of choosing the most optimal tax regime path |

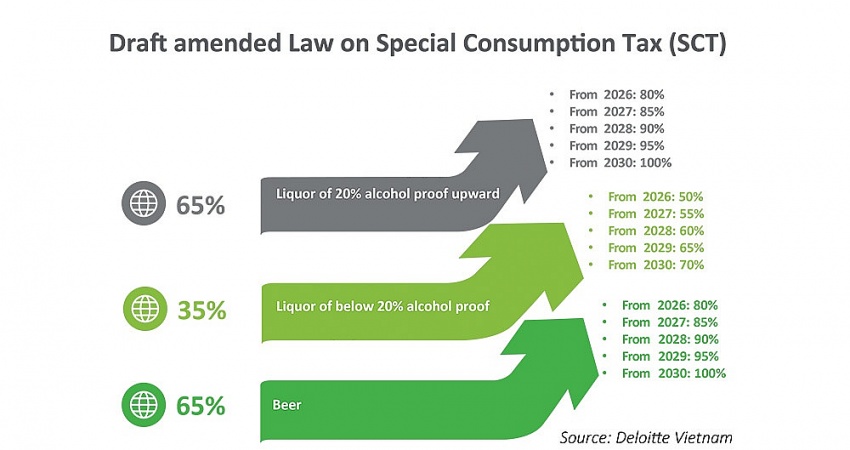

The draft has proposed two options for increasing the tax rate on alcohol (see chart). Vietnam currently applies an SCT rate on alcohol of 35-65 per cent, with beer at 65 per cent. Under the plan, the rate on beer will increase to 80 per cent from 2026 and towards 100 per cent by 2030.

“It is not yet possible to fully assess the major impact of these proposals, but there are many concerns. The Ministry of Finance (MoF) is basing proposals on the recommendations of the World Health Organization (WHO), which are recommendations for countries with different goals, economic conditions, and cultures, and not specific to Vietnam. The MoF has assessed the impact, but it is qualitative and lacking in quantity,” Van Anh said.

According to the WHO, tax on alcohol in Vietnam accounts for only about 30 per cent of the retail price, while in many countries, the rate is 40-85 per cent. This is one of the reasons why the WHO recommends that Vietnam should increase the SCT by at least 10 per cent to reduce consumption, thereby controlling the harmful effects of alcoholic beverages.

The VBA complained that firstly, with each litre of beer price increase, the impact on the labour force in the alcohol industry’s ecosystem has not been assessed.

“Secondly, what will happen to consumers’ health when the tax increases? There may be a large gap between official and unofficial goods,” Anh said. “When there is a hike in taxes and prices of official products, consumers will shift to using more unofficial goods, creating potential risks related to consumer health.”

Bui Ngoc Tuan, partner of tax and legal at Deloitte Vietnam, said, “We fundamentally support the drafting committee’s decision to increase SCT on goods that have negative impacts on health and the environment in Vietnam. However, the implementation of this policy also needs to be carefully considered from a socioeconomic perspective, especially when considering feedback from businesses in the industry.”

According to Tuan, although increasing the excise tax can help increase budget revenue, a too rapid rise can lead to unwanted consequences. Tax hikes can reduce the production scale of enterprises, leading to waste of production lines and funded equipment, as well as increasing unemployment due to labour cuts.

“According to the Laffer curve principle and the theory of the relationship between tax rates and government tax revenues, increasing taxes too high beyond the limit point will reduce the total budget revenue of the government,” Tuan explained.

Le Tuan Anh, director of the Department of Industrial and Service Economics under the Ministry of Planning and Investment, said at last week’s conference that although the tourism industry is recovering, some areas in the service industry, such as the beverage industry, still face many complexities.

According to a report from the VBA, consumption and production have not met expectations, and some businesses have even accumulated losses across many quarters. This indicates that the overall picture of the beverage industry still has many issues that need to be solved.

“From the perspective of a state management agency, we find that the roadmap for applying SCT as proposed by the MoF is reasonable. However, to achieve the original goal, we need to consider more carefully the factors of revenue increase, behaviour change, and fairness,” said Tuan Anh. “We need to choose the right timing, level of increase, and expansion to ensure sustainable development of the service industry as well as the entire Vietnamese economy.”

The MoF has noted that the main approaches to imposing excise duties on goods and services globally are ad valorem tax, specific tax, and compound tax.

“However, through the process of research and receiving feedback from the business community and experts, the method of calculating compound tax or specific tax on wine and beer is not suitable in current conditions in Vietnam,” the MoF said.

The ministry explained that currently, the domestic beer market has a specific feature of up to 80 per cent of the market share consisting of popular and local beer, with a considerable price difference compared to premium beer.

Therefore, if mixed tax and absolute tax are applied, it will lead to unfairness in taxation, in that popular beer businesses will have to pay more tax. The amount of revenue will decrease and indirectly affect social security, and specifically jobs in the segment.

In 2023 the industry contributed about $2.5 billion, equivalent to about 3.4 per cent, to state budget revenues.

|

| Phan Duc Hieu, standing member National Assembly Economic Committee

Tax increases are necessary, but the problem is how to calculate taxes appropriately. Firstly, it is necessary to consider the tax roadmap. It is impossible to have two options as proposed, but there must be an additional different tax roadmap. The roadmap must have a 2-3 year gap before starting to levy taxes so that businesses have enough time to adapt. In my opinion, taxes should start from 2027. It is also necessary to clearly define the highest tax rate towards 2030. If the tax rate is too high, it will cause business revenue to decrease, affecting tax collection activities. Moreover, there must be a convincing basis to propose the highest tax rate. The tax rate applied to beer must be different from the tax applied to other alcohol products. In addition, we should review the import tax rate applied to imported alcohol. If tax exemption is currently applied to products with alcohol concentration below 20 proof, we must review it to create equality for domestic products. Finally, if increasing tax is not enough, we must consider other measures – for example, strengthening the handling of commercial fraud, or controlling the production of handmade alcohol to ensure food hygiene. Hoang Van Cuong, member National Assembly Finance and Budget Committee

The goal of the policy is to collect budget revenue, however, each tax has other goals attached to it, and the goal of the SCT is to regulate consumer behaviour. If the SCT is to regulate consumer behaviour for products that are not essential, not popular, or not necessary, then it should be adjusted, and resources should be allocated to other developments; or to regulate consumer behaviour for products that are not good for health, harmful to the environment and society, then it will help reduce costs for society and consumers. A cautious assessment, both qualitative and quantitative, is needed to determine whether the new tax policy helps regulate consumer behaviour and how it changes. It is reasonable to extend the roadmap to 2-3 years before increasing, both to reduce the burden on businesses, but also a break to change consumer awareness because this is a product that is not good for health. On the other hand, increasing taxes may encourage consumers to change their habits towards unofficial products, switching from consumption in restaurants to consumption at home. This shift needs to be carefully assessed. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Mobile Version

Mobile Version