RSM Tax in Motion 2021 brings businesses up to speed on tax field updates

|

| RSM Tax in Motion 2021 provided crucial tax updates for businesses |

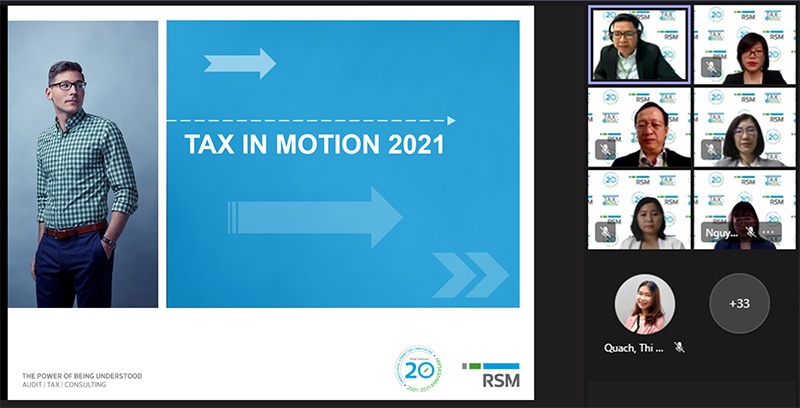

With an aim to update and enhance enterprises’ understanding of changes and issues in taxation, RSM Vietnam organised the Tax in Motion 2021 webinar on December 22, 2021.

No business wants to be surprised, especially when it comes to paying taxes. The virtual event RSM Tax in Motion 2021 provided in-depth discussions of the important updates on numerous tax areas influencing businesses and escalated their confidence to wrap up 2021 and look forward to 2022. This is the first time RSM Vietnam has hosted an event with several tax experts to provide businesses with a comprehensive view and boost their confidence to better prepare for tax filing.

More than 100 business representatives attended the event and actively engaged in discussions with RSM experts on tax trends, corporate tax, transfer pricing, personal tax, mergers and acquisitions, and tax planning which brought to life ideas and insights that could help corporations in their growth.

In 2020, and especially in 2021, we have witnessed more tax regulations than ever before. Le Khanh Lam, chairman and head of Tax and Consulting Services of RSM Vietnam, stated in his presentation on tax policy updates and trends, "Different from a long period of tranquil tax environment with only 1-2 decrees a year, this year along with the new Law on Tax Administration, COVID-19 caused the government to issue a series of additional policies to support as well as delay tax regulations."

Companies have to react quickly to deal with a flood of changes in tax changes.

During the webinar, tax experts from RSM Vietnam delved into some of the updates on key tax areas in 2021, such as COVID-19-related topics (tax support policies, deductible corporate expenses, impacts of the pandemic on business transactions, and transfer pricing), the implications of new tax regulations on corporate operations (labour policies, e-invoice implementation, corporate income tax reduction, VAT refund, and stricter standard arm’s length range in transfer pricing), and tax audit trends as well as mitigating tax risks.

The webinar received many positive feedbacks as well as practical questions from attendees for our experts. With those in the field concerns from businesses, both attendees and speakers had the opportunity to have real-life discussions on current corporate issues.

As Vietnam is moving to a new normal, more business opportunities are waiting ahead in 2022. More tax policies and regulations are expected to be issued in order to help businesses recover from 2022 onwards, which will significantly alter the tax environment.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Implementation of the circular economy in Vietnam (November 13, 2023 | 11:30)

- Banking’s development in data and digitalisation era (November 07, 2023 | 15:24)

- ESG enabling real estate businesses to attain funds (June 16, 2023 | 15:25)

- RSM Vietnam stays ahead of the changing business environment (March 14, 2023 | 10:07)

- What might the Vietnamese economy look like in 2023? (January 02, 2023 | 21:37)

- Neobanking: a trend-setting model for the digital revolution (December 19, 2022 | 14:30)

- Evaluating the prospects of M&A upswings next year (November 28, 2022 | 08:00)

- RSM Vietnam celebrates opening new office in Ho Chi Minh City (September 20, 2022 | 19:29)

- RSM Vietnam taking advantage of central region recovery to expand operations (September 19, 2022 | 08:00)

- Firm grasp of rules crucial in handling customer info (August 29, 2022 | 08:00)

Mobile Version

Mobile Version