Power price hike on the cards in Vietnam

On the websites of the Ministry of Industry and Trade (MoIT) and its affiliates, there are an increasing number of articles analysing the high power costs of several nations in the region and around the globe. The majority of information connects to the MoIT’s consideration of a proposal to raise the average retail price of energy as a means to assist EVN in rebalancing its finances after a $1.34 billion loss in 2022.

|

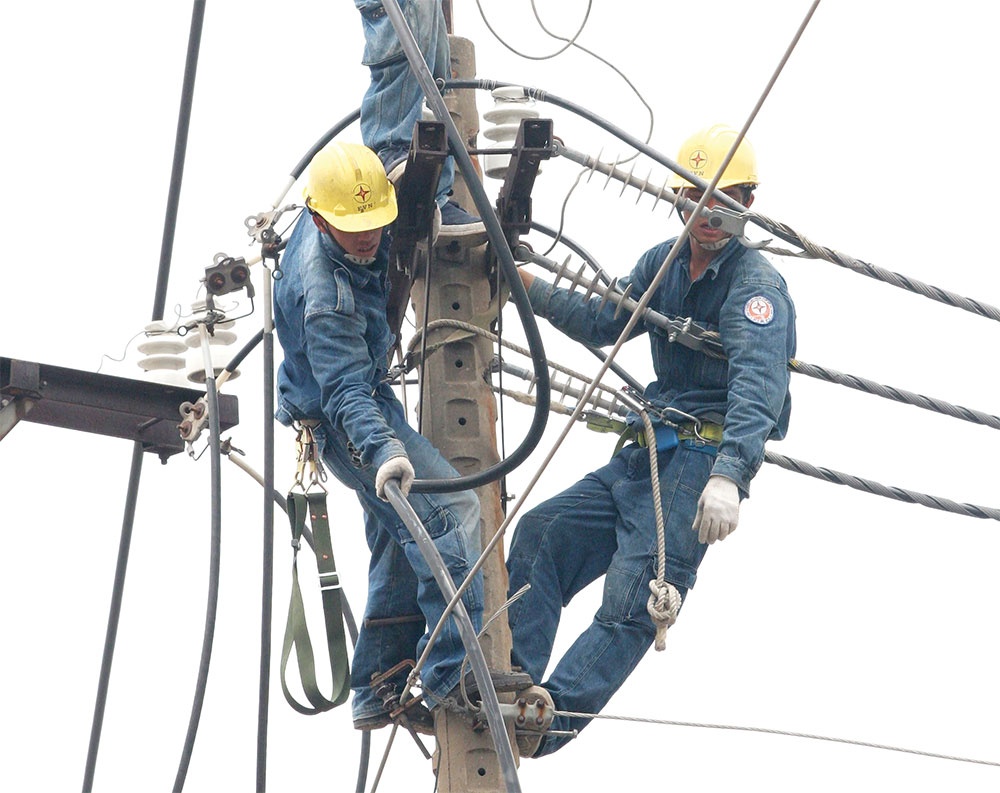

| There is a possibility of financial imbalance due to failure to change energy rates in a timely manner. Photo: Le Toan |

In December, EVN proposed to the MoIT that the selling price of electricity be raised in order to alleviate hardships and ensure financial balance in 2023 and subsequent years due to high fuel costs. EVN said that it is awaiting “a decision from the appropriate authorities”.

EVN estimates that the average retail price of energy in 2022 was 8.2 US cents per kWh (excluding the exchange rate difference of the remaining power purchase contracts in 2019-2021 of generating units). This is 2.74 per cent more than the average retail power price applied in early 2019 and which has not been altered since.

The continued high price of coal on the global market is regarded as an external factor that is increasing the cost of producing power in Vietnam. The Vietnam National Coal and Mineral Industries Group (Vinacomin) predicts that the quantity of imported coal will vary around 70-75 million metric tonnes per year by 2025, while local coal production capacity can only cover 40-45 per cent of demand.

Nguyen Tai Anh, deputy general director of EVN, said that the abrupt surge in fuel prices has caused EVN’s power production and purchasing costs to skyrocket to $2.27 billion. This effect led to a $580 million loss last year. Together with PetroVietnam and Vinacomin, EVN accounts for around 40 per cent of Vietnam’s yearly power output, and it spent almost $1.07 billion on power in 2022.

About 84 million kWh of energy was bought from coal power, both domestic and imported, last year. Compared to 2021, the average purchase price of energy from coal power plants rose by 2 US cents per kWh and by almost 9 US cents per kWh for imported coal plants. Vietnam imports 35-36 million metric tonnes of coal a year for energy generation.

In addition, EVN purchased over 29 million kWh of petrol at high costs, with the price correlated to global oil prices. In 2022, the price of oil was 2.2 times higher than it was in 2020 and 1.3 times higher than it was in 2021.

According to EVN, this effect increases the possibility of a financial imbalance owing to a failure to change energy rates in a timely manner, threatening the capacity to provide sufficient power for production, business, and consumption in 2023. The state-run group generated around $19.65 billion in sales last year, an increase of nearly 4.3 per cent compared to 2021, but was unable to overcome financial troubles.

Meanwhile, Power Generation Corporation 3 (GENCO3) is projected to generate 31.7 trillion kWh of power this year. However, general director Le Van Danh is still worried that volatility in the global market will continue to impact company operations since “fuel sources, particularly coal, may influence power production pricing”.

Last year, GENCO3, which generates almost 13 per cent of EVN’s power, failed to provide adequate coal for Vinh Tan 2 thermal power plant. According to Danh, GENCO3 was short of coal for power generation during portions of the first and second quarters. For the year, the corporation’s energy production reached 32.2 trillion kWh as a result of “efforts to locate coal supplies for power generation”.

Vietnam has maintained a strategy of diversifying energy sources for years. The director of the National Load Dispatch Centre, Nguyen Duc Ninh, said that they had to completely mobilise hydropower sources at cheaper rates in order to minimise expenses, producing 95-96 billion kWh – the greatest production in 10 years and almost eight times the plan.

However, by the end of 2022, hydropower accounted for just over one-third of the source structure. In the second half of the year, the hydrological situation changed erratically, with less water in the nation’ lakes than at the beginning of the year. As a result, hydroelectric power plants had to discharge more than 10 billion cu.m of water, equivalent to approximately two billion kWh, for the drainage and satisfy the inter-reservoir process, according to Ninh.

Ninh added that there have been restrictions to mobilising energy from other sources, such as natural gas and renewables. The quantity of gas delivered to power plants falls short of the units’ capacity by 30 per cent. “Frequently, the National Load Dispatch Centre must deploy additional power units powered by expensive oil,” Ninh said.

“On the present power generating market, the majority of factories’ asking prices exceed the average retail electricity price imposed since 2019. Some factories have bid as high as 13-17 US cents,” Ninh explained.

In 2022, the capacity price and ceiling price grew dramatically, causing the payment price per kWh to rise by about 20 per cent compared to 2021 and by 36 per cent compared to 2019. Last year the capacity price – the cost to compute capacity payments for producers in the electrical market – climbed by over 250 per cent compared to 2021 and by almost three times compared to 2020.

In addition, the ceiling price in the power market hit a new high of 7 US cents, a rise of 7 per cent from 2021 and 19 per cent from 2019.

| Do Thang Hai - Deputy Minister of Industry and Trade |

| The costs of electricity have a significant influence on individuals and the whole economy. The government tasked the MoIT with coordinating with agencies, analysing EVN’s proposed plan, developing a road map to increase electricity prices, and simultaneously assessing the impact before submitting a report to the appropriate authorities in order to minimise the impact of an electricity price adjustment. In the rainy season, hydroelectricity will be less expensive than in the dry season. This is a property of power rates. It has been explicitly stated that the electricity adjustment period is a minimum of six months; nevertheless, the last time it was changed was in March 2019. When the price of inputs like coal rises, the selling price of power sometimes jumps by more than 50 per cent in Vietnam. In recent years, there have been unpredictably fluctuating energy prices around the globe. As a result, some nations have been forced to cut power intermittently, while others have seen their electricity costs grow. |

| Tran Dinh Nhan - General director Electricity of Vietnam |

| We have recommended adjusting the retail price of electricity in a timely way in compliance with the legislated requirements, while simultaneously using the market mechanism for electricity pricing. When input factors rise, the price of electricity increases and vice versa, in accordance with a method comparable to the petrol price adjustment mechanism. In 2022, the price of coal surged by 600 per cent compared to the beginning of 2021, although the price of electricity has been consistent since 2019. This year and in the future, our financial condition will be complicated, leading to the group’s credit rating being underestimated. Additionally, it would be very tough to get bank financing for power development investment projects. This circumstance will significantly impact the nation’s energy security. |

| Prof. Tran Dinh Long - Vice president, Vietnam Electrical Engineering Association |

| The price of electricity consists of four components: the price of energy production, the transmission cost, the distribution fee, and the supplementary service fee. The price of energy production, or the source of power, accounts for around 65 per cent of Vietnam’s circumstances. Electricity generation costs will increase in the future. The benefit of inexpensive hydroelectricity in Vietnam is diminishing. Currently, opencast coal has been completely utilised, resulting in a shift to underground coal mining, which has increased coal prices. In addition, the re-import price of coal is affected by the currency rate, not to mention the global energy market’s volatility. Therefore, price increases for electricity must be dependent on the price variations of these commodities and foreign currency rates. If the price of raw materials rises, the labour rate increases, and the exchange rate increases, it is required to compute an equivalent increase in power rates. |

| Coal-fired schemes on ice The doors for coal-fired power projects in Vietnam are narrowing shut as international institutions and banks tighten financing and even exit coal-fired ventures, piling pressure on the country to create reasonable power sources for Vietnam’s future energy mix. |

| Debate intensifies on future of coal After one major South Korean coal-fired power financier decided last month to withdraw its participation in foreign markets in the sector, questions have arisen on the feasibility of planned coal-based ventures. However, several experts evaluate the move as a signal for Vietnam to step up the transition from fossil fuels to renewable energies. |

| Influential institutions look to wind down coal activities Some international lenders, funds, and insurers are joining a growing list of financial institutions across the globe retreating from coal-fired power plants, particularly projects in Vietnam and other Asian nations, as concerns grow over the role that fossil fuels play in exacerbating the adverse impacts of climate change. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version