Paying closer attention to low carbon-emitting groups

|

| Nguyen Thi Cat Tuong - Head of ESG Research Dynam Capital |

This will further facilitate the momentum towards greater urbanisation: Vietnam’s urbanisation levels are currently less than 40 per cent – levels seen in Europe 70 years ago.

In fact, 2020 and 2021 witnessed many welcome improvements in Vietnamese legislation associated with environmental, social, and governance (ESG) issues. The Ministry of Finance’s circular on information disclosure issued in November 2020 requires listed companies to include ESG reporting, with total direct and indirect greenhouse gas (GHG) emissions stated in their annual reports.

The legislative body’s revised Law on Environmental Protection was also passed in November 2020 and includes more detailed provisions on climate change and solid waste management, promoting climate change mitigation, and regulating the roadmap for Vietnam’s pledge to reduce GHGs. And then at COP26 in November 2021, Prime Minister Pham Minh Chinh pledged that Vietnam will reach its net-zero carbon emissions target by 2050.

This January, Decree No.06/2022/ND-CP on regulating GHG mitigation and ozone layer protection was issued. It stipulates guiding details on the implementation of the Law on Environment Protection, and also plans to set up and pilot the operation of a carbon trade exchange from 2025.

To further support implementation of the decree, in January, a decision was issued defining the list of sectors and establishments required to perform GHG inventory. Facilities subject to such reporting obligations are those that consume more than 3,000 tonnes of oil equivalent (TOE) in total per year; solid waste management facilities with a capacity of 65,000 tonnes per year; and industrial production facilities, thermal power plants, transport groups, and commercial buildings that consume 1,000 TOE in total per year.

The regulated facilities are required to implement and report on GHG inventory and reduction activities according to the schedule up to 2030.

These legal documents not only impose obligations on large emitters but also create opportunities for businesses to participate in the carbon market so that they can implement their decarbonisation roadmap at a lower and more effective cost.

With the US rejoining the Paris Agreement, the global community is gaining momentum in pursuing the goal of keeping global warming below 1.5oC. The number of commitments to reach net-zero emissions from local governments and businesses has roughly doubled in less than a year.

Cities and regions with a carbon footprint greater than the emissions of the US, and companies with combined revenue of over $11.4 trillion, are now pursuing net-zero emissions by the end of the century.

|

In June 2021, finance ministers and central bank governors from G7 countries agreed to mandate climate-related financial reporting, aligned with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). For the past two years, public- and private-sector support for the recommendations has accelerated rapidly. By the end of 2021, 12 governments and dozens of central banks, supervisors, and regulators have formally expressed support, and more than 2,600 organisations have endorsed them, an increase of over 70 per cent compared to 2020.

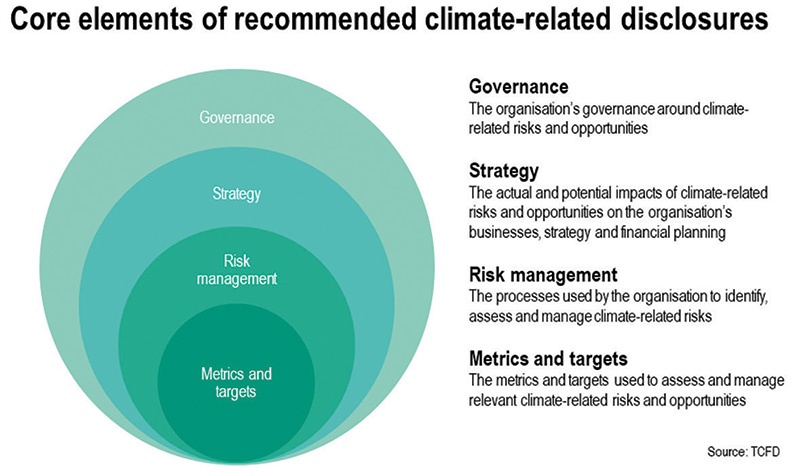

The recommendations are structured around four thematic areas that represent core elements of how companies operate: governance, strategy, risk management, and metrics and targets. The four recommendations are interrelated and supported by 11 recommended disclosures that build out the framework with information that should help investors and others understand how reporting organisations think about and assess climate-related risks and opportunities.

As a signatory of the United Nations for Responsible Investing and a supporter of the Paris Agreement and the TCFD, Vietnam Holding, with its fund manager being Dynam Capital, chooses to invest in companies in Vietnam with high and sustainable growth in the long term while satisfying the criteria of ESG.

We expect that more Vietnamese companies will conduct carbon assessments and disclose their data, because this is the first step that companies need to take before building a roadmap to reduce their emissions.

Better ESG management and disclosure, especially climate-related factors, can lead to tangible capital market benefits such as improved liquidity, lower cost of capital, higher asset prices, more investment, and better corporate decisions.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Bac Ai Pumped Storage Hydropower Plant to enter peak construction phase (January 27, 2026 | 08:00)

- ASEAN could scale up sustainable aviation fuel by 2050 (January 24, 2026 | 10:19)

- 64,000 hectares of sea allocated for offshore wind surveys (January 22, 2026 | 20:23)

- EVN secures financing for Quang Trach II LNG power plant (January 17, 2026 | 15:55)

- PC1 teams up with DENZAI on regional wind projects (January 16, 2026 | 21:18)

- Innovation and ESG practices drive green transition in the digital era (January 16, 2026 | 16:51)

- Bac Ai hydropower works stay on track despite holiday period (January 16, 2026 | 16:19)

- Fugro extends MoU with PTSC G&S to support offshore wind growth (January 14, 2026 | 15:59)

- Pacifico Energy starts commercial operations at Sunpro Wind Farm in Mekong Delta (January 12, 2026 | 14:01)

- Honda launches electric two-wheeler, expands charging infrastructure (January 12, 2026 | 14:00)

Tag:

Tag:

Mobile Version

Mobile Version