Pandemic turmoil a golden opportunity for companies to change for the better

|

| By Le Khanh Lam-Chairman, RSM Vietnam |

As distressing as the recent turmoil has been, the COVID-19 pandemic and the social unrest should ultimately drive corporations to become more dedicated to sustainable practices that benefit not just their investors and employees but also the community as a whole.

In August 2019, Business Roundtable, a group of CEOs from some of the largest companies in the United States, redefined the purpose of a corporation to benefiting a range of stakeholders, such as customers, staff, suppliers, communities, and shareholders than merely earning profits for shareholders. Years of rising pressure on businesses to pay greater attention to how they operate, particularly when it comes to their practices regarding environmental, social, and governance (ESG) problems, prompted this declaration.

This commitment, though, is facing perhaps its greatest test yet.

The COVID-19 pandemic has turned all public attention to the urgent need to build a stronger global economy and a safer, more sustainable world. All over the world, the public at large has watched closely as political, community, and business leaders have reacted to the human and economic toll of COVID-19 and the social unrest. What the public has seen, reflected in a quick adoption of new workplace policies like social distancing and working from home, suggests that the Business Roundtable’s message is gaining some traction.

Companies’ ESG efforts may not only be about the environmental component but also put their focus on the social and governance components. In this recent uncertain context, companies should not ignore social concerns and worker safety, not to mention disaster preparedness, continuity planning, and employee treatment through benefit programmes. All of this should only propel interest in sustainability reporting.

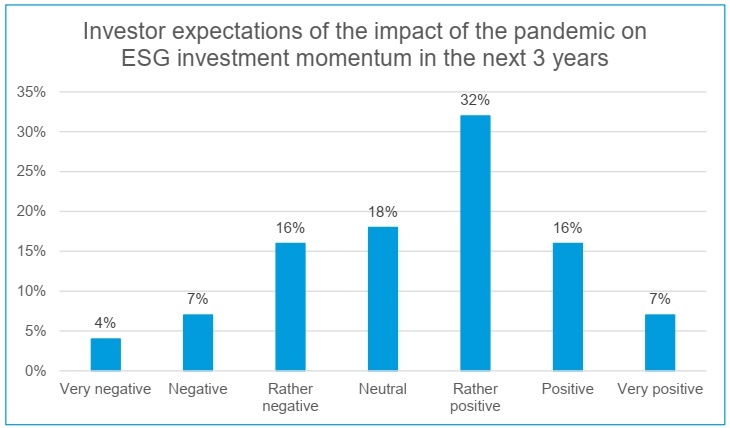

The Institute of International Finance forecast that the growth rate of assets in ESG funds will be faster in 2021, especially when US President Joe Biden implements the environmental protection agenda (see Figure).

In particular, in the context of the COVID-19 pandemic, this trend has caused the investment strategy to shift to ESG, instead of traditional financial indicators. According to Morningstar, in 2020, ESG funds attracted record cash flows, double that of a year earlier. Net money from investors pouring into sustainability funds totalled $51 billion, rising to a record high for the fifth year in a row.

Potential for implementing ESG factors in Vietnam

According to the World Bank, Vietnam is one of the five countries most likely to be affected by climate change because most of the population lives in low-lying coastal areas. As such, it is clear that the “E” in the ESG is of prime importance for a country so familiar with threats from climate change such as damage from floods and storms like Vietnam.

In addition, the “S” and “G” elements of ESG are also increasingly important to Vietnam. Many investors will be surprised to learn that Vietnam already has a detailed set of corporate governance rules and is on track to meet many of the 17 Sustainable Development Goals (SDG) of the United Nations.

Corporate governance is an essential component of the ESG framework which dictates the rules, procedures, and processes by which a business is managed and directed to achieve a balance of stakeholder interests. There are a few companies in Vietnam that have excellent work-life balance policies but they are few and far between.

In Vietnam, although ESG investment is not too popular, it is not new either. In July 2017, the Vietnam Sustainable Development Index was officially introduced by the Ho Chi Minh City Stock Exchange to select 20 companies with the best ESG activities. This index also shows the investment efficiency of sustainable stocks, attracting international institutional investment funds operating under ESG investment principles.

ESG investment may provide a silver lining amid the health crisis and gives companies a chance to make lasting change. However, most businesses in Vietnam are still focusing on growth without focusing on investment in resources to integrate ESG factors into production and business activities.

None of the change is easy, of course. With the shortcomings of so many businesses on display, companies can begin to address their weaknesses with the understanding that good corporate practices are not only the right thing to do but also the trademark of sustainable and resilient businesses.

|

| Source: J.P. Morgan, results from the survey “Tracking the ESG implications of the COVID-19 crisis” |

Who makes change happen?

The auditing profession, which puts an emphasis on accountability, standards-based analysis, and objectivity, is ideally positioned to be a part of this movement. Auditors understand how to measure and verify indicators that drive performance, conduct analysis, as well as provide reporting solutions to the corporate community. After all, those metrics are important, and they will lead to more responsibility.

Companies will increasingly focus on social equality, climate action, and innovation. However, how each is measured will differ depending on how the corporation perceives its role in creating outcomes that benefit society. What will also emerge are businesses that are dedicated to the cause against others that seek more assets from investors.

Around Vietnam, there are some corporations that have added sustainability reporting to their focus areas. Investment funds such as Tundra Frontier, Asia Frontier Capital, or Dragon Capital have also focused on investing and applied eight ESG criteria to evaluate investment opportunities in businesses. However, without widely established ESG reporting standards, many business leaders are sceptical of its effectiveness.

There is still work to be done

Many challenges remain, such as which framework fits best with an organisation’s goals, how to assure data integrity, and what level of assurance best supports stakeholder communications. Many businesses have been eager to provide easy solutions, but many are still struggling to develop long-term solutions. Auditors will have to contribute to the solution.

Business leaders may consider referring to the following resources for guidance and insights for developing an ESG framework for their organisations.

The first is Resolution No.136/NQ-CP issued in 2020 by the Vietnamese government on sustainable development through 2030. The resolution, which followed the national action plan for the implementation of the 2030 sustainable development agenda published in 2017, envisions the overall goals of conserving economic growth while also guaranteeing social progress and justice, environmental and ecological preservation, effective natural resource management and use, and a proactive reaction to climate change.

The second resource that businesses may want to refer to is Principles for Responsible Investment (PRI), a UN-supported international network of investors. The PRI’s Sustainable Development Goals, which have gained broad adoption among asset managers, include 17 important sustainability topics facing the world.

Last but not least is reports and publications of the United Nations Environment Programme (UNEP) and the UNEP Finance Initiative (UNEP FI).

Standard-setting is a marathon, not a sprint, and auditors will have the chance to play a critical role in developing sound practices. Of course, market feedback will be needed to develop a new generation of ratings, analyses, and products to achieve sustainability goals. As this occurs, investor behaviour will change and adjustments will be needed.

On the other hand, investors’ interest in transparency and performance is unlikely to alter. Auditors will need to understand the sustainability challenges that businesses are experiencing and then provide flexibility in order to evaluate which practices create the most long-term value.

The takeaway

As the world continues to deal with the pandemic, we expect to see more bold business statements that are rooted in scientific research and address the most critical sustainability issues. Such commitments set an expectation for other companies to follow. Companies have the potential to reshape the world, and we need every business to accelerate and magnify its positive impact; after all, there can be no healthy economy without healthy people and a healthy planet.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Implementation of the circular economy in Vietnam (November 13, 2023 | 11:30)

- Banking’s development in data and digitalisation era (November 07, 2023 | 15:24)

- ESG enabling real estate businesses to attain funds (June 16, 2023 | 15:25)

- RSM Vietnam stays ahead of the changing business environment (March 14, 2023 | 10:07)

- What might the Vietnamese economy look like in 2023? (January 02, 2023 | 21:37)

- Neobanking: a trend-setting model for the digital revolution (December 19, 2022 | 14:30)

- Evaluating the prospects of M&A upswings next year (November 28, 2022 | 08:00)

- RSM Vietnam celebrates opening new office in Ho Chi Minh City (September 20, 2022 | 19:29)

- RSM Vietnam taking advantage of central region recovery to expand operations (September 19, 2022 | 08:00)

- Firm grasp of rules crucial in handling customer info (August 29, 2022 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version