New products could benefit in wealth asset environment

Vietnam’s wealth asset management market is emerging as a bright spot in Southeast Asia, with the participation of both domestic and foreign companies. What are the challenges for the Vietnamese market?

|

| Lina Nguyen, country business development manager of Exness Investment Bank |

According to forecasts by McKinsey & Company, Vietnam’s wealth management market could reach a scale of $600 billion by 2027. Several players made efforts to diversify products and services, providing investment solutions suitable to the needs of each customer segment. However, the market lacks some fundamental factors for strong growth.

In terms of legality, incomplete legal regulations and lack of regulations for opening up access to new asset groups in Vietnam leads to too few products and choices for investors

Next is the asynchronous connection between investment and asset management service providers, for example, customers who need to invest in securities must go to the stock exchange headquarters, or those want to invest in foreign currency must go to the bank.

Banks usually have to collaborate with asset management firms or securities companies to offer investment solutions because they are unable to do so directly in the current market environment. It is extremely advantageous for players to have an internal subsidiary that produces financial products because it allows them to capture value within their group ecosystem instead of spreading margins over several outside parties.

Each consulting body aims to optimise personal benefits more than working in the interests of customers, which leads to customers facing problems in maximising their investment portfolio and assets.

What scenarios have been projected for the personal wealth management segment?

Investment cash flow is expected to shift from traditional investment channels such as securities, interest-bearing savings, and real estate to new products.

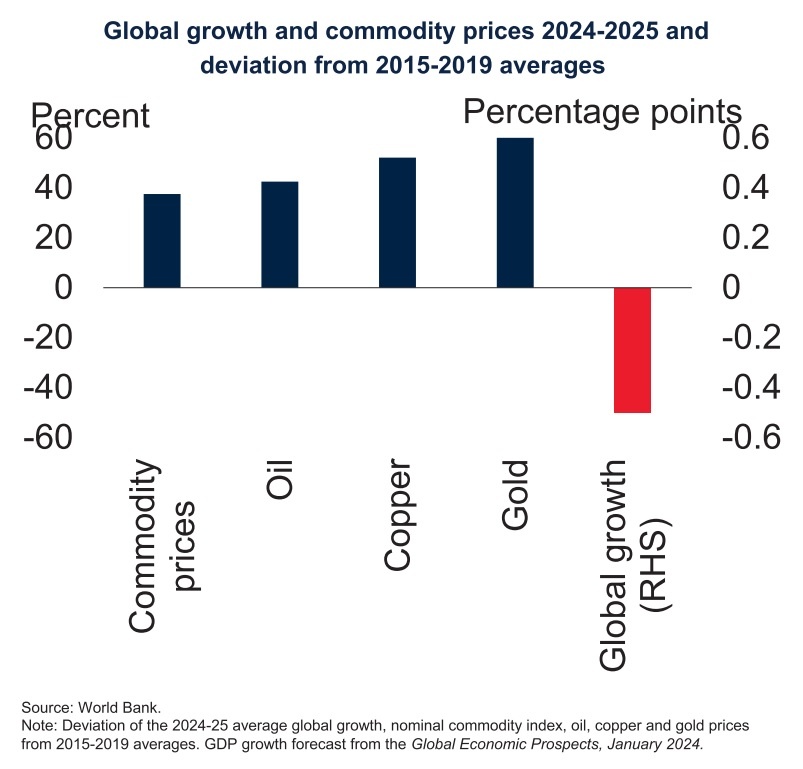

Derivative securities, especially stocks of technology companies, and especially AI technology, are capturing the world’s attention. Commodities are also a bright spot for the economy. Specifically, we saw the development of important commodities in the first four months of 2024.

CME Group experts forecast in May that the market will face a soft landing, as raw material prices continue to fluctuate strongly. Specifically, precious metal products such as silver, platinum, and copper increased sharply in the first half of this year, while the gold and silver also played a safe-haven role when the economy fell into recession.

Besides this, digital assets remain hot. There have been recent predictions that the cryptocurrency market would double in size, reaching $5 trillion by the end of 2024. In January, a Bitcoin exchange-traded fund was given the green light by the US. It is traded on public exchanges, allowing investors to access price fluctuations of assets without direct ownership of the underlying asset required.

The tokenisation market is worth about $300 million and is expected to grow to trillions of dollars, according to Citibank Group, which estimates the trading volume of tokenised digital securities will increase to $5 trillion by 2030.

|

|

Which investment channels are the main choices in 2024, and what are the key trends?

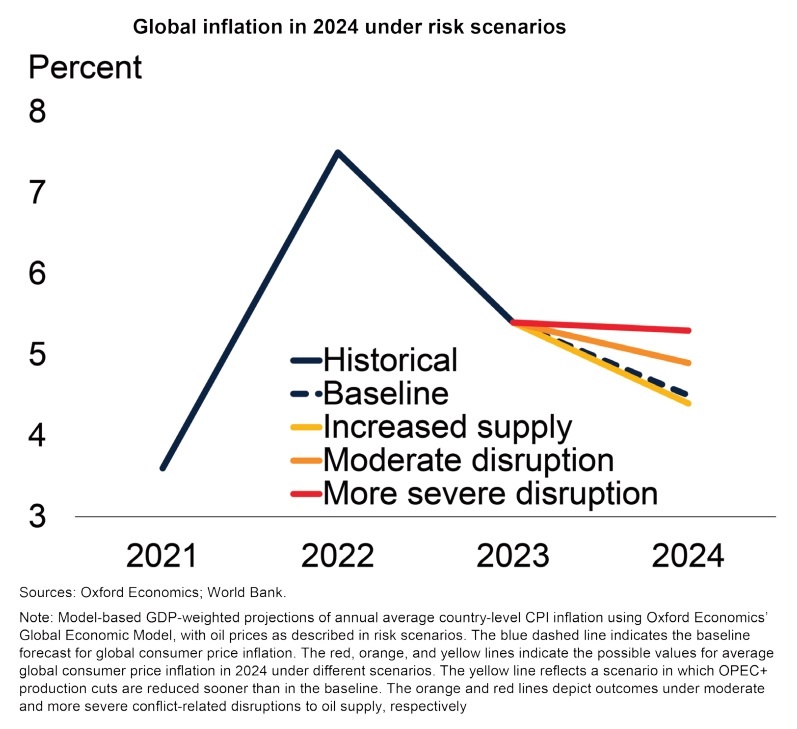

Geopolitical instabilities in the Middle East, Europe, and America have been ongoing for more than two years, and inflation, despite the cooling at the beginning of the year, is still generally higher than in the past two years. The main investment channel is probably still gold.

Besides this, increased demand comes from central banks, especially in emerging markets in East and Central Asia. Amid uncertainty about the US Federal Reserve’s interest rate policy, the central bank is thinking about cutting interest rates later this year, but that hasn’t happened yet.

For the Fed, things haven’t quite gone as planned in recent years as it continued to struggle to hit its 2 per cent inflation target, leading to expected interest rate cuts being delayed.

The gold price is expected to increase about 6 per cent in the next 12 months, up to $2,175 per ounce.

An uptick in the stock market in 2024 may continue and be more inclined towards the end of the year. The market has benefited from good news in the first half of this year, stronger-than-expected economic growth, and breakthroughs in AI, cooling inflation amid expected interest rate cuts.

Do you have any advice on financial management to maximise long-term growth and guarantee safety?

Pioneering markets in financial management such as Switzerland, UK, the US, Hong Kong, and Singapore, with open legal policies and support, have asset management software development technologies that are more advanced, dynamic, and easier to use for investors.

Even if you’re new to investing, you’ve probably heard the adage “don’t put all your eggs in one basket”. This is the main idea behind portfolio diversification, a tried and true investment strategy that aims to minimise risk and enhance overall returns over the long term. But one mistake many investors make is over-diversifying their portfolio.

When you spread your investments across too many buckets, you risk limiting your potential for higher returns and making it difficult to monitor and rebalance your portfolio. If you invest money in more than 10 investment vehicles, you may be at risk of over-diversification and you should simplify your portfolio.

Another common investing mistake is thinking that diversification can eliminate risk. There will always be some level of risk in the market. Diversification can help you manage and reduce risk, but it cannot completely protect you from it.

The second piece of advice is to choose a provider of diverse assets/professional financial management products and services integrating advanced and modern technology, which will help investors access more asset types.

| Profound shift being felt in nation’s wealth management Global asset management is experiencing a significant shift from traditional to emerging markets, with Vietnam poised to become a new goldmine for the industry. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version