New PPP rules to drive development

|

| Vaibhav Saxena and Tu Hue Anh from Vietnam International Law Firm |

The current legal framework for public-private partnerships (PPPs) mainly governed by 2018’s Decree No.63/2018/ND-CP on investment in the PPP form consists of numerous outdated circulars, decrees, and decisions. The lack of a unified legal framework has undoubtedly presented risks to foreign investors, thereby lowering the attractiveness of such transactions in Vietnam.

The new law on PPP investment is set to take effect on January 1, hoping to act as the key piece of legislation governing related transactions in the country.

The incoming law has, for the first time, codified provisions on PPP projects at the legislative level, unifying the current patchwork of laws into a standalone legislative instrument. Further, it has successfully addressed some of the shortcomings existing in Decree 63 and other relevant regulations, thereby, providing more clarity and comfort to prospective foreign investors who wish to fund PPP schemes in Vietnam but are unfamiliar with the Vietnamese legal landscape.

|

However, the law may not completely meet international standards when tested at the hotplate of bankability and from project finance aspects.

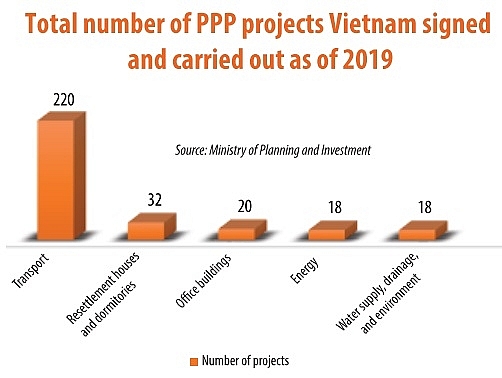

As similar to many other developing countries, the main focus of development remains on the transport sector and over the last two decades in Vietnam it has been road construction and rehabilitation. Vietnam’s rapid pace of economic development has increased the need for the government to provide quality infrastructure to support the flow of goods and services.

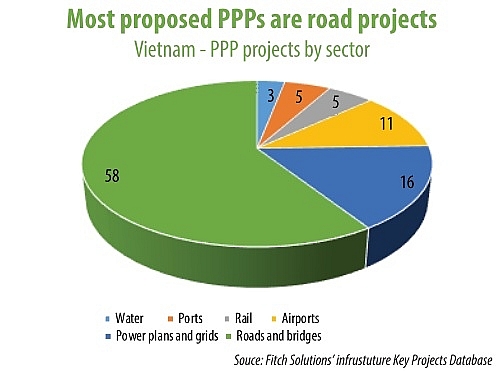

According to Fitch Solutions, it is forecasted that the country’s road and bridge sector will steadily grow at an annual average rate of 6.7 per cent over the next eight years, driven by a large pipeline of road projects. According to its Key Projects Database (KPD), there are a total of almost 140 road schemes currently in the planning or construction phases, representing 60 per cent of all pipeline ventures.

It is positive that most of these will be implemented progressively over the next few years, given a projected surge in demand for road infrastructure supported by sustained and robust economic growth averaging 6.5 per cent annually till 2028.

Growing strongly

Driven by increased business activity within the country, the amount of freight transported via road has been increasing over the years and similar observations are made with regard to the number of passenger traffic on roads. These positive trends are expected to continue, supporting the need for continued investment in Vietnam’s road infrastructure.

Despite the fact that the road sector here represents abundant potential to foreign financiers, the private sector has seemingly played a marginal role in infrastructure over past decades. According to a World Bank report published in June, about 90 per cent of the nation’s residential infrastructure is invested in by the state. Meanwhile, private funding has remained low at just under 1 per cent of GDP during the past decade, with most of this being poured into the energy sector.

Vietnam has made several attempts to encourage the private sector to participate in PPP transactions by introducing several legislative documents. However, such attempts have not yet yielded expected results, since investors keep waiting for a unified legal framework as well as a risk sharing mechanism between them and the state.

As a result, the private sector has not participated heavily in infrastructure investment. The World Bank data also shows that, since 1990, only 116 PPP projects with a total value of $19.4 billion have been approved in Vietnam, equal to less than 10 per cent of total infrastructure funding since then. Additionally, approximately 75 per cent of related schemes were implemented in the energy sector.

Notably, in the road sector, there have been a few concessions for national roads awarded on a direct contracting basis. Nevertheless, many of these road projects had to be renegotiated, leading to the state ultimately bearing most of the risk because of lack of increase in the appetite for the investor to bear risks which they do not have to shoulder in other jurisdictions.

|

Burden of financing

Huge demand for development of the road sector results in escalated need for equivalent capital, which is now heavily increasing problems for the government.

According to an estimate the Ministry of Transport in 2019, the total capital needed for the country’s transport infrastructure has been equivalent to about $48 billion from 2016 through 2020. Besides this, road infrastructure projects according to the National Power Development Plan VII also require a total investment of approximately $148 billion until 2030, with this number likely to even increase further.

Despite the huge investment demand for infrastructure, Vietnam’s government needs an extra boost from the private players and cannot directly pour capital into such giga projects. Limitation in budget is the first reason, in addition to the government’s policy on tightening public expenditure. The pandemic this year has adversely impacted the economic development in Vietnam as well.

The incoming new law on PPP investment can drastically change the investment picture in the road sector. In light of the increasing demand for infrastructure in the country, together with the fact that the government urgently needs private capital to share the burden of financing, there will continue to be opportunities in this sector.

The new law provides more clarity and protection for foreign investors. A lack of a unified PPP legal framework has acted as the main factor that Vietnam’s infrastructure sector growth potential is capped at 6.1 per cent per year through 2029, despite having one of the fastest growing economies in the world, according to Fitch Group.

Therefore the incoming comprehensive law on PPP investment, with the introduction of the risk-sharing mechanism between the state and the private sector as well as the legal improvements, if successfully implemented will ease risks for investors and invite geographically-based interest into such projects.

This would lead to a more vibrant market, boosting growth of the road sector, as most projects are planned for procurement via PPPs. However, the expectations and abilities to digest risks from the private sector will remain a key concern to landmark the success for the new law.

According to the 2019 Global Infrastructure Investor Survey conducted by the EDHEC Singapore Infrastructure Institute, Vietnam is among the top five emerging countries worldwide for infrastructure market potential in the next five years, together with India, China, Brazil, and Indonesia.

In addition, Fitch’s KPD notes there are currently 98 major infrastructure projects at the planning stage earmarked as PPPs. Almost 60 of these projects belong to the roads and bridges sector, with an estimated value of $20.8 billion.

The data shows that the expansion of Vietnam’s road network will steadily continue to grow in the next decade – therefore, road sectors present fruitful opportunities for investors. The incoming new law on PPP investment shall further serve as an efficient tool to best facilitate funding in the road sector by financiers and at this preliminary stage they may encounter unique issues, but as the market evolves the policies will better shape up to address business needs.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

- Haiphong welcomes long-term Euro investment (February 16, 2026 | 11:31)

- VIFC in Ho Chi Minh City officially launches (February 12, 2026 | 09:00)

- Norfund invests $4 million in Vietnam plastics recycling (February 11, 2026 | 11:51)

- Marico buys 75 per cent of Vietnam skincare startup Skinetiq (February 10, 2026 | 14:44)

- SCIC general director meets with Oman Investment Authority (February 10, 2026 | 14:14)

- G42 and Vietnamese consortium to build national AI infrastructure (February 09, 2026 | 17:32)

Tag:

Tag:

Mobile Version

Mobile Version