MB makes impressive breakthrough in first half

|

| MB stocks are buoyed up by several factors |

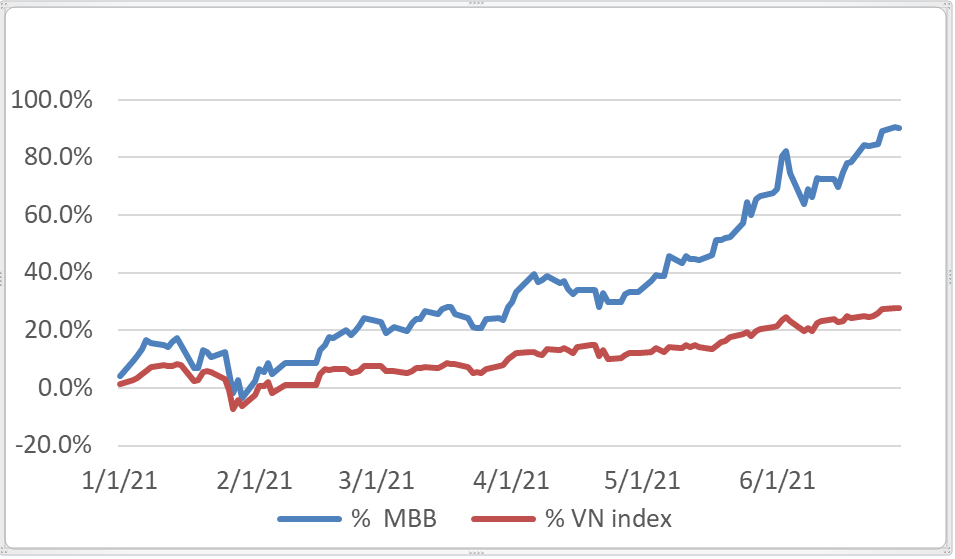

The stock of MB raised by 4 per cent last week to peak at VND43,450 ($1.89) on June 30, a rise of 90 per cent over the VND22,700 (99 US cents) on January 1. This stellar rise is underpinned by four core factors.

Amid low interest rates and high economic growth, banking stocks are major winners. Thanks to high credit growth combined with low funding costs, banks' net interest margin (NIM) is forecast to improve this year as profits will soar.Outstanding business results

In 2021, MB targets to gain VND13.2 trillion ($573.9 million) in consolidated profit, up 20 per cent on-year, with total assets and credit growing 11 per cent and bad debt ratio controlled below 1.5 per cent.

In the first quarter of 2021, MB reported VND4.58 trillion ($199.13 million) in pre-tax profit, doubling on-year and reaching 35 per cent of the yearly plan. Of this, the profit from banking activities (not including insurance, or added-value services) was also more than twice as high as in the same period in the year prior, reaching VND4.1 trillion ($178.26 million).

These results speak of standout performance, with return on assets (ROA) standing at 2.71 per cent (it was 1.59 per cent in the same period last year) and return on equity (ROE) at 27.24 per cent (against 16.09 per cent). The bank's bad debts ratio decreased by 33 points. Current account savings account (CASA) has risen 3.8 points on-year to 36.9 per cent, one of the best figures in the sector. New account openings at MB soared sharply thanks to attractive campaigns.

In a report for the second quarter released on July 5, SSI Securities Corporation estimated MB's pre-tax profit in the second quarter at VND4-4.5 trillion ($173.9-195.65 million), a rise of 37-50 per cent on-year, thanks to credit and deposit growth at the parent bank reaching 10 and 6 per cent as of the end of May compared to early 2021. Meanwhile, bad debts are being controlled (under 1 per cent at the parent bank) and NIM is increasing.

|

| MB has been consistently outperforming the VN-Index this year |

Business strategy for 2021

2021 is the closing year of MB's 2017-2021 strategy and would set the tone for the next five years.

In order to make quick and steady progress in digital transformation and improve service quality, this year, MB is making continuous investments in the comprehensive digitalisation of all activities like business, operations, as well as risk and human resources management. This improves labour productivity and reduces costs.

At present, MB is developing in Hanoi and the northern provinces, however, the bank is also building an office in Ho Chi Minh City to improve its brand identity and growth in the south.

Next week (July 13), MB will fix the list of shareholders for dividend payment by shares at the rate of 35 per cent. After the payment, MB's charter capital will raise to VND38.6 trillion ($1.7 billion) from VND27.987 trillion ($1.2 billion), rising to second place in the banking industry in terms of charter capital.Vietinbank is going to raise charter capital to VND48 trillion ($2.1 billion) soon. While Vietcombank is planning to raise to VND50 trillion ($2.2 billion) from VND37.039 trillion ($1.6 billion). Techcombank's charter capital is VND35 trillion ($1.5 billion) and has no plan for an outstanding rise this year.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

- IFC to grant $150 million loan package for VPBank (February 13, 2026 | 09:00)

- Nam A Bank forms position as strategic member at VIFC through three key partnerships (February 12, 2026 | 16:39)

- Banks bolster risk buffers to safeguard asset quality amid credit expansion (February 12, 2026 | 11:00)

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

Tag:

Tag:

Mobile Version

Mobile Version