M&A in real estate hikes early in year

|

According to Su Ngoc Khuong, investment director of Savills Vietnam, mergers and acquisitions (M&A) by foreign investors continued along a strong development course in 2017, especially for investors hailing from China, Japan, Hong Kong, South Korea, and Singapore.

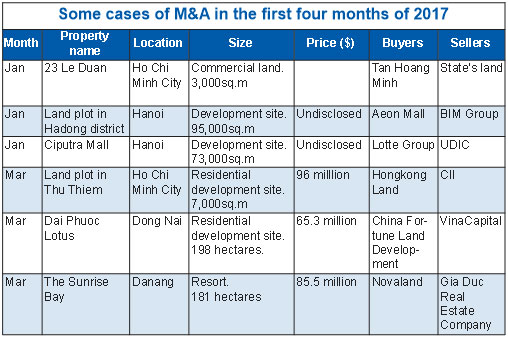

VinaCapital’s two investment funds, VinaCapital Vietnam Opportunity Fund Ltd. (VOF) and VinaLand Ltd. (VNL), sold their entire stake (18 and 54 per cent respectively) in Dai Phuoc Lotus – a large-scale urban area project in the southern province of Dong Nai – to Chinese real estate group China Fortune Land Development. The Dai Phuoc Lotus development consists of 332 high-end semi-detached and fully-detached villas. So far, around 200 villas in the first phase have been handed over to buyers.

According to VinaCapital, the transactions recouped $16.5 million and $48.8 million for the two funds respectively.

Another big fish, Novaland, acquired a 99.9 per cent stake ($85.5 million) of Gia Duc Real Estate Company’s 181-hectare The Sunrise Bay development in the central city of Danang.

The Sunrise Bay development will contain an international-standard urban resort, entertainment facilities, and retail trading centre when it opens post-2020. The Sunrise Bay will be developed under the same format as the Marine Bay Sands in Singapore, with leading global designers such as Moshe Safdie and Aedas taking part in the project’s design.

Singaporean developers are also making waves in Vietnam’s real estate market. Keppel Land has acquired from its Vietnamese partner, Southern Waterborne Transport Corporation, an additional 16 per cent stake in Keppel Land Watco I to V, the joint venture entities for Saigon Centre in Ho CHi Minh City. Keppel Land has also signed a memorandum of understanding with Vietnam’s State Capital Investment Corporation to collaborate on investment opportunities in Vietnam.

Meanwhile, another Singaporean real estate developer, CapitaLand – which has developed more than 9,000 units in Hanoi and Ho Chi Minh City – recently announced its plan to set up a new commercial fund to acquire more residential development sites.

Vincent Wee, deputy CEO of CapitaLand Vietnam, said the firm has established a $500 million fund to invest in secured seed commercial properties, mainly in Ho Chi Minh City and Hanoi.

Increased M&A in the market is evidence of high investor confidence and signals a new sustainable development cycle in the local property market, according to Khuong.

“With many high-potential projects available, M&A will continue to be a popular model for investors to join the local market and implement their goals in the development of the local property market,” he added.

Khuong said M&A would continue to be essential as the market develops, and investors have to prove their skills, experience, and class to achieve co-operation opportunities and make high-value deals.

“Domestic investors also play an important role in M&A and development cooperation. Vingroup, Van Thinh Phat, Novaland, and Sun Group became strategic investors when they acquired projects or land to develop property products,” he said.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

- BRIGHTPARK Entertainment Complex opens in Ninh Binh (January 12, 2026 | 14:27)

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

- Why Vietnam must build a global strategy for its construction industry (December 31, 2025 | 18:57)

- Housing operations must be effective (December 29, 2025 | 10:00)

Mobile Version

Mobile Version