Local retail investors encounter turbulence

|

| Local retail investors encounter turbulence |

Tran Hai Ha, CEO of MB Securities Company (MBS), noted that it would be more challenging for investors to multiply their income at the moment, as the environment is less favourable than it used to be.

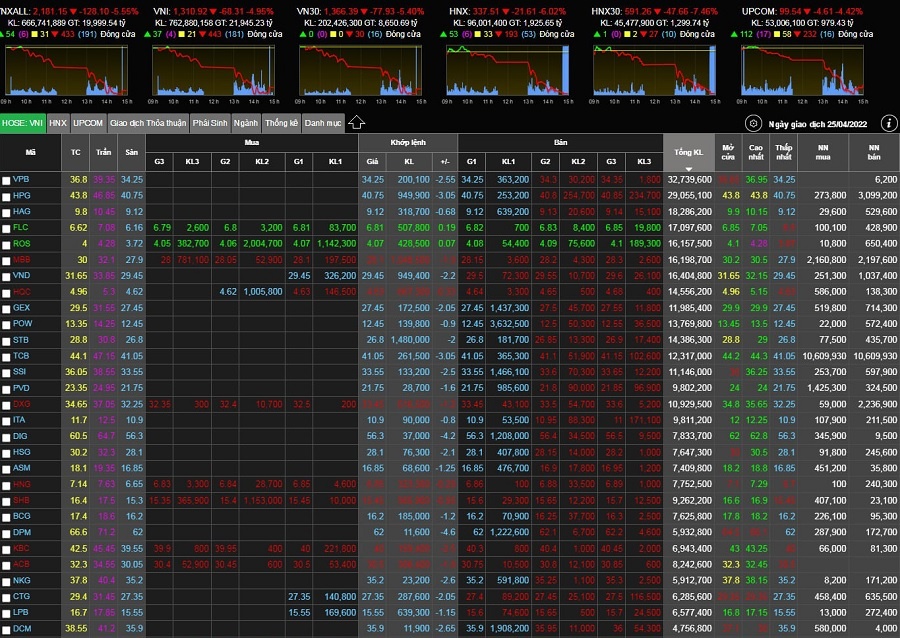

“In my opinion, the local stock market has reached its 22-year record high in Q1/2022, as the VN-Index reached over 1,500 points. There are over 1,500 listed companies in the three major stock exchanges, and the securities accounts are also increasing,” Ha said at VIR’s talk show Response Amidst the Stock Market Whirlwind held last week in Hanoi.

In contrast to other developed markets, local retail investors make up the majority of Vietnam’s equity sector, even as foreign investors maintain their sell-off velocity. This set of traders, on the other hand, is heavily influenced by market swings, culminating in a general downward tendency across the board.

Domestic investors registered around 675,000 new securities accounts in the first quarter of this year alone, nearly doubling the number of new accounts opened in 2020, cited the Vietnam Securities Depository Centre (VSD).

In addition, margin cash flows were also essential for maintaining such a high level of market liquidity.

According to VSD, the number of outstanding loans (primarily margin lending) at the end of Q1/2022 reached $8.7 billion, a record number. The 20 largest securities firms reported a total outstanding loan of more than $7.5 billion in Q1/2022, up 3 per cent on-quarter.

Dao Phuc Tuong, a renowned investment expert, believed that after reaching its record high in June, banking stocks’ attractiveness pale in comparison with other peers such as retail, public investment, and others.

“Furthermore, banks’ profit plans in 2022 would not surprise investors as banks could hardly generate significant profits. In Vietnam, many investors are only keen on something exceptional. In fact, they are dreaming of overnight success instead of steady and fundamentally good stocks,” Tuong said.

Ha of MBS also highlighted that many banks are facing great pressure from their foreign ownership limit ratio, whose ceiling of 30 per cent may cause banks to miss out on development prospects because they lack sufficient capital. Additionally, those non-performing loans (NPL) and provisions would take a huge toll on banks’ performances, especially as some circulars regulating bad debts will soon expire.

NPLs will likely pull strings on bank operations in the longer term. Hence, risk-averse investors are opting for other profitable stock groups, such as public investment, technology, or logistics.

Real estate groups also follow suit. Tan Hoang Minh’s unprecedented corporate bond cancellation has had a negative influence on the industry.

Ha also noted that even though securities companies report upbeat earnings in Q1 2022, their stocks could continue a substantial decline, which is in line with the whole market’s pace.

Brokerages that specialise in digital transformation and enhance customers’ experience could benefit from a rising number of young and digital-savvy customers.

Along with significant measures to ensure a healthy stock market in 2022 and beyond, the regulatory body is continuing to strengthen the industry’s transparency and discipline.

Tuong stated that the market maintains its downward trajectory as a consequence of a series of market infractions, such as the accusation of FLC former chairman Trinh Van Quyet, Tan Hoang Minh corporate bond cancellation, Louis Holdings and Tri Viet Securities’ alleged pump-and-dump schemes.

Last week, the Investigative Police Agency of the Ministry of Public Security announced a decision to prosecute alleged stock market manipulation by Tri Viet Securities JSC and Louis Holdings JSC.

Representatives from the State Securities Commission revealed that the agency has conducted an investigation into the transactions involving Louis Holdings and Louis Land.

There was evidence of pump-and-dump manipulation in the findings on a group of accounts linked to Do Thanh Nhan, chairman of Louis Holdings.

“However, I have noticed that investors are gradually maintaining their calmness amidst recent market fluctuations. This is actually a positive sign, as stringent measures would further boost the domestic stock market’s near-term upgrading prospect,” he said. “Retail investors, especially novices, will feel the effects of a market drop the most acutely. My suggestion for inexperienced investors who are tricked into junk stocks: cut losses and stay away from them.”

VinaCapital assessed that Vietnam’s stock market is trading at a very reasonable price for long-term investment, with a forward price-to-earnings ratio of 12.2 for this year.

“Even though the stock market has seen some setbacks in recent years, it would surmount obstacles to rise to new highs thanks to the economy’s upbeat outlook,” VinaCapital stated.

PYN Elite, a foreign fund management firm, emphasised that the new trading platform of the Vietnamese stock exchange is likely to be deployed in 2022, which could enable the discontinuation of the prefunding practice for share transactions and allow day trading. This would be an important milestone on Vietnam’s path to Emerging Market status.

| As of late March, the VN-Index has dropped approximately 140 points, bringing it below the 1,400-point milestone. Many publicly-traded firms have witnessed a sharp decline, including Hoang Quan Consulting-Trading-Service Real Estate Corporation, FLC Group, and its affiliates VIX Securities, Real Estate 11, and Gelex Group, among others. Numerous stocks, including real estate and bank groups, also experienced considerable losses. Meanwhile, many retail investors have put all of their fortunes into stocks with full margin lending options. Should they cut their losses or try their luck with bottom fishing instead? VIR’s weekly talk show Picking Profitable Stocks will address these concerns, with the participation of high-profile local and foreign advisors. Every Thursday at 3pm, the show will be broadcast live on tinnhanhchungkhoan.vn and the Facebook page Bao Dau tu chung khoan. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version