Listed garment groups predict a prosperous year

TNG Investment and Trading JSC (TNG) last week revealed its profit after tax for Q1 this year reached VND38.37 billion ($1.6 million), up 73.1 per cent on-year in the same period.

“Thanks to investing in machinery, technology, and expansion, TNG’s labour productivity increased, while orders and lack of containers improved to help provide positive results for this first quarter,” said chairman Nguyen Van Thoi.

He added that TNG increased free-on-board buyers and focused on high-end products in the context of customers having transferred orders to Vietnam thanks to the pandemic control since late last year. During 2022-2023, TNG plans to expand its current facilities and add 42 new ones.

TNG may set a revenue target of $256.52 million, and a profit after tax of $12.1 million at its May annual general shareholders’ meeting (AGM), increasing respectively 10 and 20.2 per cent compared to the previous year.

Meanwhile, Thanh Cong Textile Garment Investment Trading JSC (TCM) believed that 2022 will be a prosperous year for Vietnam’s textile and garment industry, and TCM will benefit from this trend.

General director Jung Sung Kwan said at its recent AGM that there is a positive sign for the Vietnamese market due to the unexpected decline in export orders for Chinese-made textiles and garments and diversification strategy, bringing a windfall for Vietnam. “TCM will focus on product and market diversification as well as profits,” Kwan added.

|

|

This year, TCM has set revenues of $177 million, up 20 per cent on-year, while its profit after tax is expected to be $10.8 million, up 88 per cent on-year. According to TCM, it has fulfilled orders until Q3 so far.

At the end of the first quarter, TCM recorded a revenue of more than $47 million and the profit after tax of more than $3 million, up 19 and 17 per cent, respectively.

Among the top 10 listed textile and garment companies, Viet Tien Garment Corporation (VGG) has set targets for 2022 of $287 million in turnover and $6.52 million in the profit after tax.

Other listed groups such as Song Hong Garment JSC (MSH), Garment 10 Corporation (M10), EVERPIA (EVE), and Century Synthetic Fiber Corporation (STK) are looking to a positive outlook for 2022, in which STK has set its highest revenue and profit rises ever of 28 and 8 per cent, respectively.

VNDirect Securities Corporation estimated that the textile and garment industry would ride on the demand surge in the US and the EU markets. It noted that large textile and garment companies such as M10, STK, and TCM have enough orders until Q3.

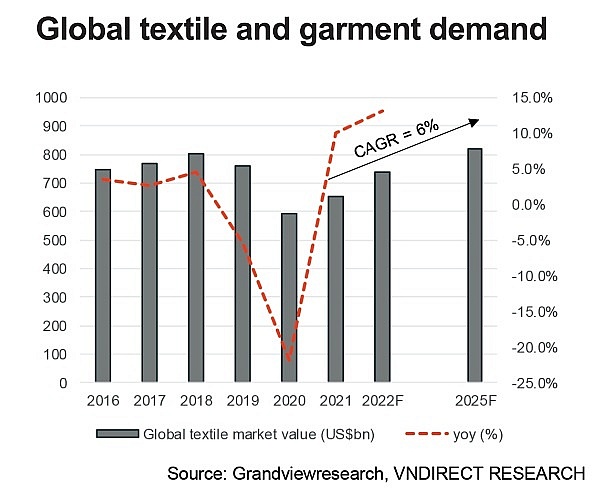

The World Bank forecast global GDP growth to achieve 4.9 per cent in 2022, and the global apparel demand in 2022 will return to 2019 levels, reaching about $740 billion.

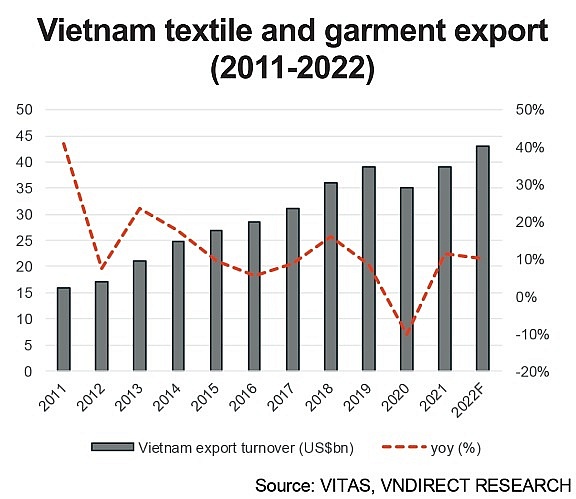

“We believe that the Vietnamese textile and garment export turnover could meet the government’s goal this year of $43 billion, up 10.2 per cent on the year,” said the latest VNDirect report released in February.

However, all these businesses pointed out various challenges including labour costs, logistics, and competition.

For instance, M10 noted that Vietnam is facing a series of challenges such as an imbalance in the labour market, as well as transportation costs three times higher than the average over the past five years. Besides that, the disadvantage of the exchange rate also makes Vietnam’s textiles and garments less competitive against rivals.

Meanwhile, STK’s CEO Dang Trieu Hoa is worried about the uncertain global economy. “In the short term, the ongoing Russia-Ukraine conflict does not directly or indirectly affect STK. However, if the situation does persist, we fear the impact of a global recession. In the long term, if inflation is high, the consumer demand will decrease and it will affect all industries,” he said.

In 2021, Vietnam’s textile-garment export turnover reached $39 billion, making it become one of very few to maintain its growth and accomplish its annual goals. It was an increase of 11.2 per cent on-year, up 0.3 per cent compared to 2019, and much better than the results of 2020 of $35 billion.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Mobile Version

Mobile Version