Legal due diligence and major red flags for energy projects

|

| Vaibhav Saxena, lawyer at Vilaf |

Driving any merger and acquisition (M&A) deal through is a challenging task for not only the lawyers but for financial and technical advisors. The key remains to have an eagle eye to sight the red flags and provide a workable solution for investors. Negotiations, on the other hand, play a vital role in convincing the transacting parties to agree and not to agree to disagree on the table.

The outcome of legal due diligence (DD) decides the fate of the planned deal. Lawyers play an important role to row the boat to the shore in high and low tide scenarios while conducting the due diligence.

The industry should be mindful of some major issues that strike during the legal DD process in terms of recent conventional, renewable energy and infrastructure M&A transactions in Vietnam.

Business lines and M&A deals

Local targets may not face issues while subscribing for business lines under its constitutional documents with respect to the restrictions that might be applicable to foreign investors due to foreign ownership caps in certain business areas. Such restrictions could be based on the international commitment of Vietnam and/or the local laws of permissibility for foreign access in a particular sector.

The definition of foreign-invested enterprise organisation under the Law on Investment of Vietnam leads to a change in the legal form of the target after the acquisition by a foreign investor.

A solution could be to have a condition precedent (CP) under the transaction documents to obligate the seller for removing such unnecessary business lines in order to ensure accessibility for the foreign investor to acquire planned percentage of shares/capital in the target.

Similar to any other M&A, in the power sector for majority stake acquisition, an approval is required if the planned acquisition stake crosses the threshold of 50 per cent.

However, even for a minority stake acquisition transaction, an approval could be required from the provincial planning and investment department – the reason being that certain lines linked to the power generation business might be subject to market access conditions for foreign investors.

It is noted that the transaction cannot proceed without such an approval and thus, making this approval as a CP under the transaction documents could be necessary.

|

| Some energy projects will be seeking amendments so that implementation schedules can be extended, photo: Le Toan |

Charter and equity capital

A thin line between the registered charter capital and contributed charter capital may often surprise during the legal DD process. When the enterprise is incorporated, the registered charter capital should be contributed by the owner/shareholders within a timeline of 90 days from the issuance of the enterprise registration certificate (ERC).

However, a glitch in law relates to any subsequent contributions, meaning there is no timeline under the laws of Vietnam for contribution of any subsequent increase in the charter capital of an enterprise.

Foreign investors often fall into this trap when they review the registered charter capital amount under the ERC of the special purpose vehicle (SPV).

A safer method could be to request with the seller to provide proof of capital contribution, and if the seller fails to meet such requests from the foreign investors they could either be asked to contribute fully the registered charter capital. If this is not possible, then a CP for decreasing the charter capital amount equalling to the actually contributed capital amount should be put in the transaction documents.

Project capital is mainly divided in two forms under the investment registration certificate (IRC): equity capital and mobilised capital. The equity capital of the project should be injected as per the contents under the IRC. Foreign investors could request the seller to provide clear information on this matter to avoid later hassles.

Targeted shares/capital should ideally be free from any encumbrances to enable a smooth transfer. If the target shares are mortgaged with the lenders, then a prior assent from the lenders may be required in accordance with the terms of the mortgage agreements.

Further, any existing loans to the shareholders should be reviewed closely if such shareholder plans to exit the SPV after acquisition by the foreign investor.

Updating approvals

An approved project comes with an implementation schedule by way of milestones under the IRC. An investor is required to comply with the said milestones to avoid sanctions from the authorities, which may even lead to venture revocation in extreme cases.

Often, it is seen that a project can face delays due to a number of reasons including but not limited to administrative delays from the authorities, financing hurdles, EPC delays, land clearance, and unexpected challenges with the terrain.

If the SPV is unable to comply with the contents of the investment in-principle approval and the IRC, the SPV needs to apply for the required amendment to the said approvals.

It is noted that pursuant to the provisions under the Law on Investment, for a project which is issued with an investment in-principle approval, the investor is not permitted to extend the implementation schedule of the initiative beyond 24 months as compared to the implementation schedule of the project provided in the initial in-principle approval.

This is not so in the following cases: remedying the consequences of an event of force majeure; if implementation is extended due to late allocation or lease of land or late permission to convert land; if the schedule is changed pursuant to a request of the state administrative agency; if the project is amended as a result of master planning amendments; and if the objectives of the in-principle approval are changed.

Further, there are a number of issues in relation to the estimated commercial operation date (COD) of the project as mentioned under the power purchase agreement, for example. Such estimated COD also requires amendment to the agreement and related documents to avoid breach circumstances.

Another linked matter relates to escrow deposit that is paid by the SPV as a security to implement the project in accordance with the in-principle approval.

If a venture faces delays and is unable to begin with construction activities, it could be likely that it would be unable to be put into operation by the approved COD timeline. As such, so as not to forfeit the escrow deposit amount, an amendment to the approval to extend the schedule for implementation of the project shall be required.

Land issues

Land is the most crucial part for the project and it is always a complex matter to handle with in almost all jurisdictions, and Vietnam is no exception.

Land approvals are prolonged and often be the star for delays. It is not merely from the administrative side but also from the land resettlement costs that is majorly challenging to meet the expectations of the current land users. Then comes the compensation phase, which is a tedious task even for the authorities in many cases.

Further, land could attract complications based on its type that further prolongs the process and may require repurposing of the land into the relevant land master plan.

Approvals in this area comprise land decision, land lease agreement (LLA), land handover minutes signing with a public ceremony, and land use rights certificate.

Land decision inks that the land parcel belongs to the project and which is perfected with the signing of LLA. Remaining ones could be time-consuming due to administrative formalities on the authorities part. Foreign investors should also closely review the land area under the land approvals.

In addition to the aforementioned matters, there could be possible issues related to labour, financing, material contracts, environmental aspects, intellectual property, and more besides.

While conducting legal DD, such issues are prominent and based on the negotiations among the transacting parties. These matters are generally resolved by agreeing to appropriate CPs and condition subsequent under the transaction documents.

On some matters, for an added layer of security, the parties could consider adding appropriate representation, warranties, and indemnities under the transaction documents.

Depending on the transaction structure, CPs are linked to payment milestones. It acts as key performance indicators for the seller to fulfill before the payments are released by the buyer.

| Super Energy Group powers ahead with expansion Thailand’s Super Energy Group is demonstrating its commitment in the Vietnamese market through expanding investment and its portfolio. |

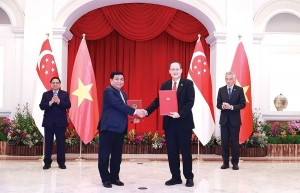

| Singapore and Vietnam ties on track Vietnam and Singapore are intensifying their bilateral ties in new fields, focusing on digital economy and innovation, infrastructure, and energy, which will help businesses in both economies to benefit from new forms of cooperation. |

| Assessing the dual features of nation’s energy plan and PDP8 Vietnam’s immediate prime concern is to conclude its energy plans and establish a blueprint for sustainable growth. The Vietnam Academy of Science and Technology’s Dr. Bui Huy Phung, a former member of the Power Development Plan VII (PDP7) Appraisal Council, responded to VIR’s Hai Van on this topic. |

| AFD to continue supporting Vietnam's energy sector Rémy Rioux, director general of AFD Group, visited Vietnam from February 17-18 to discuss energy transition. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- $100 million initiative launched to protect forests and boost rural incomes (January 30, 2026 | 15:18)

- Trung Nam-Sideros River consortium wins bid for LNG venture (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Envision Energy, REE Group partner on 128MW wind projects (January 30, 2026 | 10:58)

- Vingroup consults on carbon credits for electric vehicle charging network (January 28, 2026 | 11:04)

- Bac Ai Pumped Storage Hydropower Plant to enter peak construction phase (January 27, 2026 | 08:00)

- ASEAN could scale up sustainable aviation fuel by 2050 (January 24, 2026 | 10:19)

- 64,000 hectares of sea allocated for offshore wind surveys (January 22, 2026 | 20:23)

- EVN secures financing for Quang Trach II LNG power plant (January 17, 2026 | 15:55)

- PC1 teams up with DENZAI on regional wind projects (January 16, 2026 | 21:18)

Tag:

Tag:

Mobile Version

Mobile Version