Learning from business models to face down today's challenges

|

| Dam Nhan Duc - Head of Research and Corporate Development, MB |

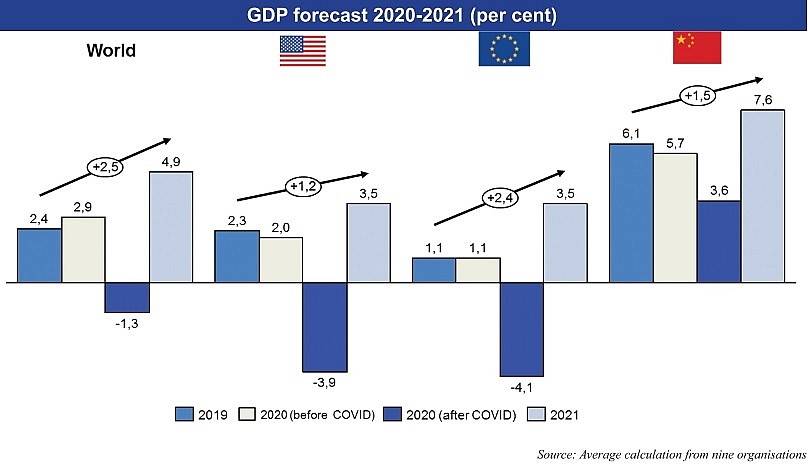

The pandemic has caused a shock to the global economy and changed social behaviours deeply. According to the average forecasts of organisations including Moody’s, UBS, Citibank, HSBC, and Goldman Sachs, global GDP growth in 2020 is projected to be -1.3 per cent. The US and Europe, the two top engines for growth, are forecast to be -3.9 per cent and -4.1 per cent in this regard, respectively.

Most economies are fore-cast to be in serious down-turn. In the second quarter of 2020, the decline of real GDP in the US is projected to be nine times higher than the 2009 financial crisis and three times higher than the most serious recession in US history in 1958.

This new context brings a large number of challenges to policymakers, businessmen, and bankers. However, it is also an opportunity for organisations to look back on themselves, review social behaviours to design new dfrections to create break-throughs, or simply better meet customers’ needs.

It is hard to deny that business activities of banks as well as any other economic organisations are not influenced by the important factors of legal environment, competitive environment, technology, and customer needs.

The press and analysts have discussed much about the fierce competitive envi-ronment with the appearance of new foreign rivals and non-bank players, including fintech companies in a tighter and more transparent policy environment with higher standards. Therefore, in a new context, the trend of technology in Industry 4.0 is taking place rapidly and customer behaviours are changing drastically due to epidemics occurring with increasing frequency, so this insight tentatively analyses and discusses two aspects.

Firstly, the most import-ant goal of business is to capture and serve customer needs. Secondly, companies must learn from successful business models in order to revise their own strategies as well as develop post-crisis scenarios.

|

|

Clearer than ever

The emergence of the coronavirus pandemic is changing the behaviours of customers and society very quickly. The concepts of working from home and online meetings were still strange to most bankers and the general public in Vietnam a few months ago, but now

they are becoming more and more familiar. Along with that is the explosion of online learning solutions, transac-tions, online shopping and delivery services, and more.

These changes are bring-ing enormous opportunities for pioneering organisations which dare to change and catch up with the emerging trend to meet the urgent needs of customers. However, factors from the past must also be taken into consideration.

Perhaps, the first lesson is that failure comes from being too conservative, refusing to innovate and capture the tendency to meet customer needs, which has led to the near-demise of famous brand names such as Nokia and Kodak. During this period, we have also witnessed the rapid development of new empires such as Facebook, Uber, Amazon, or Ant Financial in the financial industry. So what are the keys to their success?

The first factor for these empires that no-one can deny is the platform. Everyone knows that Facebook is the largest social-networking company in the world without a content production team, and Uber is the largest transportation company in the world despite owning no single taxi. It can be said that they own nothing except for a platform and technologies.

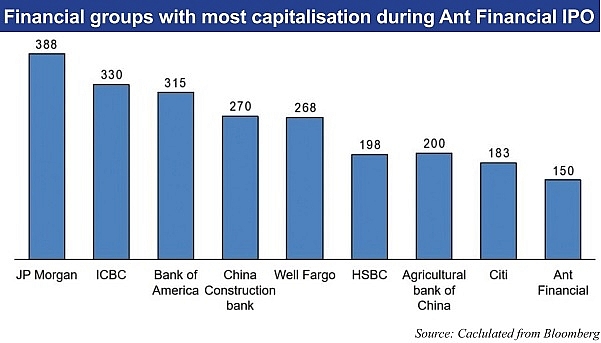

Ant Financial is another typical example in the financial industry. Founded in 2004 in Hangzhou, China with core operations in the payment field, by the end of 2019 Ant Financial had become a financial group operating in payment, asset management, banking ser-vices, and credit scores with capitalisation among the top 10 largest financial groups in the world when it prepared for its initial public offering in 2018.

After just 14 years, Ant Financial was ranked along-side global financial corpora-tions with hundreds of years of experience such as HSBC, Citibank, and JP Morgan in term of market capitalisation. By the end of last year, Ant Financial accounted for 54 per cent of mobile payments in the Chinese market, worth $5.5 trillion and providing about $300 billion in loans to 16 million customers. These were mainly small- and medium-sized enterprises (SMEs) with an average loan value of only about $1,500 and with a non-performing loan ratio always lower than 1 per cent - while this ratio in the Chinese market is about 2.75 per cent. This success is due to the ability to assess the credit status of SMEs based on big data collected previ-ously by Alipay and Alibaba. Thanks to big data analysis, Ant Financial is able to provide banking services through the website and mobile application with the “3-1-0” model, meaning that customers can create a loan application in three minutes, and have approval result in one second with no human intervention.

Connections

In the field of asset man-agement, Ant Financial pro-vides investment services based on mobile platforms to customers to buy products in the money and stock markets, products of invest-ment funds, or make savings online. Because of its ability to act as an intermediary, Ant Financial is able to provide more than 5,000 financial products from more than 80 reputable financial institu-tions, not only in the Chinese market but also in the US and elsewhere, to any type of customer.

Another key success of Ant Financial is the appli-cation of Al technology to exploit big data to provide a wide range of services to businesses and individuals in the field of banking services, asset management, insur-ance, and credit ratings. It is also thanks to the technology application that Ant Financial can serve a number of cus-tomers 10 times higher than the largest US banks with only one-tenth of the staff.

Unlike traditional banks, investment funds, and insur-ance companies, Ant Finan-cial has been built based upon a digital platform, which has no employees involved in its operations, no credit approval staff, and no financial consultants. Those functions are implemented under the smart control of Al, which gives Ant Financial a unique competitive advantage in all areas where the group participates, with which no other rivals can compete.

In addition to digitalising traditional business activities, commercial banks in Vietnam have also quickly prepared for themselves important platforms and con-nections. For example, Mili-tary Commercial Joint Stock Bank (MB) or Techcombank, with an application installed on smartphones, are support-ing customers to carry out many things online.

In addition to traditional banking functions such as money transfer and bill payments, these apps support customers to use new services like sending gifts, giving lucky money, making a saving, applying for a loan, withdrawing money from ATMs without a plastic card, or buying bonds, insurance product stocks, and many other investment products.

Remarkably, advanced Vietnamese banks have suc-cessfully built up a financial services model in which Viet-namese family members can interact with each other and with the bank through the banks’ mobile apps and plat-forms. Top banks, like MB Bank, also successfully dig-italise customer services and serve most customer needs in a digital ecosystem.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version