Japanese still eager for mergers and acquisitions

Could you share some insights about recent healthcare mergers and acquisitions (M&As) involving Japanese businesses in Vietnam?

|

| Masataka “Sam” Yoshida, head of the cross-border division of RECOF Corporation and CEO of RECOF Vietnam Co., Ltd |

On average, there have been two such transactions in healthcare and pharmaceuticals per year and, across sectors, 20-30 such deals in recent years, with the healthcare and pharmaceuticals market share lying at about 10 per cent. This includes the acquisition of Hau Giang Pharmaceutical by Taisho Pharmaceutical in 2019, in which Taisho invested more than $200 million until 2019 to gradually increase its stake in Vietnam’s largest listed pharma company. Most other transactions are smaller (up to about $10 million) or without disclosed transaction amounts. However, most of the target companies are small, or the investors purchased only minority stakes.

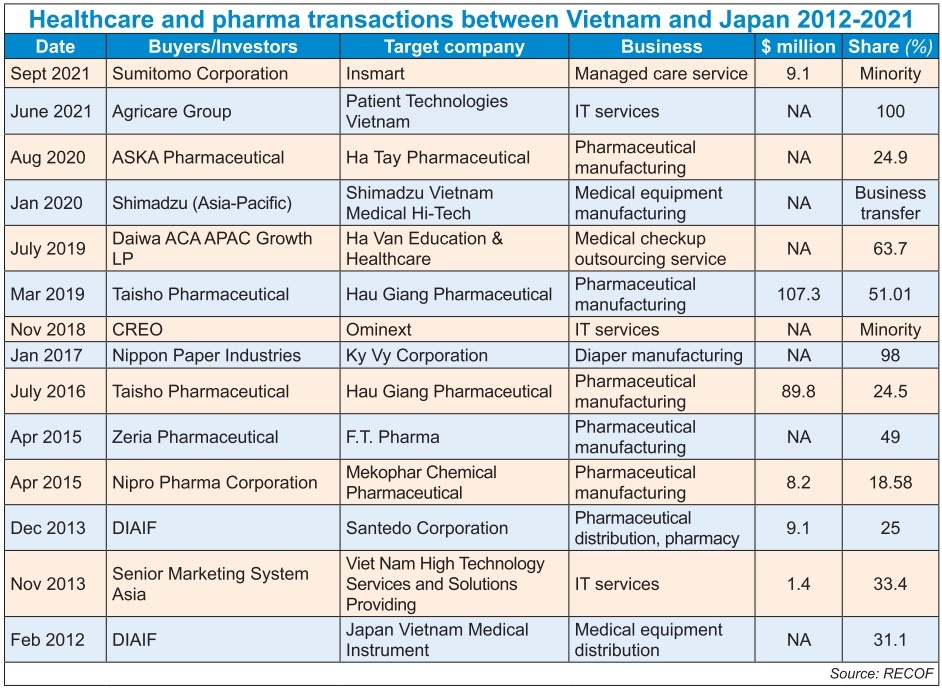

In the last 10 years, 14 healthcare and pharmaceuticals transactions were announced between Vietnam and Japan, of which five were large deals while the remaining ones involved minority shares.

Seven transactions have been in manufacturing (mostly pharmaceuticals), five in IT, and the rest in services and distribution.

Sumitomo Corporation plans to invest in Insmart, a major healthcare intermediary in Vietnam. Do you see an increasing trend of such M&As in Vietnam’s market?

I reckon that the deal will signify the trend of Japanese investments shifting from manufacturing to services. This also reflects the changes and growth of the Vietnamese market, from a low-cost original equipment manufacturing-type country to a more advanced society, which needs services such as those that Infomart is providing. I believe that, as long as there are Vietnamese companies in the market willing to partner with Japanese investors, the number of M&A deals will rise.

What are some legal challenges for Japanese investors who aim to participate in the market?

Many pharmaceutical companies have a large number of shareholders, including state-owned entities, and foreign investors often have difficulties acquiring the majority of stakes, while they would need these to secure strategic relationships. In addition to Taisho, which started with a minor investment and succeeded in acquiring the majority stake over the years, other Japanese companies, such as ASKA and Zeria, also decided to start with minor investments. However, these are rare cases among Japanese pharmaceutical companies, and they found opportunities in the Vietnamese market that no-one else saw.

I find that foreign investors have been placing more attention to low-cost manufacturing strategies towards Vietnam, probably because they were not ready to fully transfer advanced technology to the country.

|

Despite these challenges, why are Japanese firms like Taisho and ASKA continuing to increase their holdings?

Vietnam can attract more Japanese pharma firms with its strongly growing economy, young population, and growing pharmaceutical market.

However, in order to continuously attract foreign investors, attention must be paid to social trends and a more organised social security system, including insurance.

Nevertheless, I believe that legal conditions are not the biggest hurdle. Foreign companies with an already-established expertise in these sectors are waiting for the right time to enter Vietnam, and local companies should remain open towards partnering with them.

The rapid growth of Vietnam’s economy has another aspect though, as lifestyle-related diseases such as diabetes, heart disease, and others are on the rise. And although Vietnam remains a “young country” at the moment with its average age of 31 years, we have to keep an eye on the ageing of society.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- Vietnam’s IFC creates bigger stage for M&As (February 01, 2026 | 08:16)

- Game startup Panthera raises $1.5 million in seed funding (January 29, 2026 | 15:13)

- Cool Japan Fund transfers shares of CLK Cold Storage (January 28, 2026 | 17:16)

- Nissha acquires majority stake in Vietnam medical device maker (January 26, 2026 | 15:40)

- BJC to spend $723 million acquiring MM Mega Market Vietnam (January 22, 2026 | 20:29)

- NamiTech raises $4 million in funding (January 20, 2026 | 16:33)

- Livzon subsidiary seeks control of Imexpharm (January 17, 2026 | 15:54)

- Consumer deals drive Vietnam’s M&A rebound in December (January 16, 2026 | 16:08)

- Southeast Asia tech funding rebounds on late-stage deals (January 08, 2026 | 10:35)

Tag:

Tag:

Mobile Version

Mobile Version