Institutional reform to enhance economic resilience

What are the key aspects of the German Supply Chain Due Diligence Act?

|

| Prof. Andreas Stoffers, country director of FNF Vietnam (left), and Huyen Nhu Lanh, project coordinator at the Delegation of German Industry and Commerce in Vietnam (AHK Vietnam) |

Lanh: Coming into effect at the beginning of 2023, this legislation applies to businesses operating in Germany with over 3,000 employees. Starting from this year, it now extends to companies with over 1,000 employees.

Under this legislation, businesses falling within its scope are mandated to implement appropriate and effective measures to manage risks and violations to both human rights and the environment across their global supply chains.

Importantly, this law does not establish new standards. Instead, it promotes a “duty of effort” approach, with a focus on continuously enhancing standards related to corporate social responsibility and environmental protection.

Until now, AHK Vietnam has consistently served as a bridge between German and Vietnamese businesses. Now, with its new project on sustainable and climate-resilient supply chains in Vietnam, AHK Vietnam seeks to strengthen this bridge by providing the best possible solutions for both sides.

How could the act influence future EU-Southeast Asian trade agreements?

Stoffers: Focusing on risk management in collaborations with German companies, it is likely to significantly influence future trade agreements and regulations between the EU and Southeast Asian nations.

This act complements existing agreements, notably the European Union-Vietnam Free Trade Agreement, particularly in areas like compliance, purchasing, and contracting. The agreement, with its comprehensive provisions, serves as a model for future agreements, signalling a shift towards more rigorous standards similar to those in the German act.

Consequently, these evolving norms will shape the framework of upcoming EU-ASEAN agreements, making it essential for countries like Vietnam to closely examine and align with these changes.

How will the act impact relationships between German companies and their Vietnamese suppliers, and which Vietnamese industries might be most affected?

Lanh: The act shifts German businesses’ obligation from a “duty of guarantee”, focusing on adequately managing risks in their supply chains, particularly concerning human rights abuses and environmental issues. This approach requires a proactive and systematic effort in due diligence, with companies expected to address these concerns sincerely and within their capabilities.

Section 7 of the law stipulates that ending business relationships is a last resort, necessary only in severe cases of legal or environmental violations, or when all remedial efforts fail. Thus, the act could affect German-Vietnamese supplier relationships only under extreme conditions, such as unfulfilled excessive demands or persistent unaddressed violations.

Industries in Vietnam most likely to be impacted are those deeply integrated into global supply chains or those with higher risks of violations, like electronics, textiles, footwear, agriculture, and fishing. However, the legislation’s primary aim is to improve human rights and environmental standards, which aligns with the United Nations’ Sustainable Development Goals.

Therefore, it is expected to bring about significant, positive changes in Vietnam, especially in these vulnerable sectors.

Are there similar supply chain regulations in other countries, and how have their trading partners responded?

Stoffers: While not introducing a novel concept, the act represents a fresh approach to enforcing social responsibility. This 2021 legislation aligns with Germany’s ongoing commitment to the United Nations’ 2011 initiative on social responsibility, addressing shortcomings identified in the EU’s corporate social responsibility report directive in 2020.

Globally, similar laws have been enacted, including the UK and Australia’s act on modern slavery, and France’s Loi de Vigilance. These laws adhere to the International Labour Organization’s criteria, but Germany’s act expands on this by incorporating principles from other international conventions like Basel, Stockholm, and Minamata.

Germany’s legislation is part of a broader, evolutionary trend towards enhanced sustainability in supply chains. This global movement offers trading partners sufficient time for adaptation, signalling a need for Vietnamese legislators and the business sector to thoroughly engage with these emerging standards in supply chain management.

What advice would you offer to Vietnamese authorities and businesses?

Stoffers: For Vietnamese authorities, enhancing economic resilience involves accelerating institutional reforms, updating legal frameworks, and aligning policies with international standards like the German Act. Embracing these changes can lead to increased sustainability, better working conditions, legal security, and improved risk management.

This alignment also offers reputational benefits for Vietnam, enhancing its image as a reliable investment and trade partner.

Vietnamese businesses, on their part, should actively engage with these new regulations to enhance their competitiveness and reputation in the global market. Understanding and implementing standards is crucial.

Businesses can seek guidance from organisations like AHK Vietnam to navigate these changes effectively and become industry leaders in compliance and sustainability.

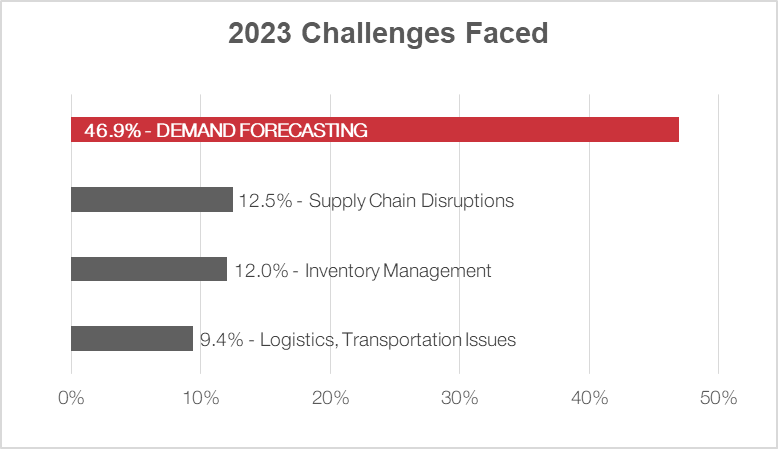

| Vietnam's supply chain leaders reflect on challenges In a survey conducted by CEL, a top supply chain consultancy firm, the sentiments of more than 300 business leaders and supply chain professionals in Vietnam shed some light on the current state of Vietnam's supply chain industry. |

| Supporting industry giants favour Vietnamese market In the last months of 2023, a lot of supporting industry giants have announced their strategies to penetrate the Vietnamese market, given the fact that the country has become a strategic destination in the global supply chain. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- IP alterations shape asset strategies for local investors (January 22, 2026 | 10:00)

- 14th National Party Congress: Vietnam - positive factor for peace, sustainable development (January 22, 2026 | 09:46)

- Japanese legislator confident in CPV's role in advancing Vietnam’s growth (January 22, 2026 | 09:30)

- 14th National Party Congress: France-based scholar singles out institutional reform as key breakthrough (January 21, 2026 | 09:59)

- 14th National Party Congress: Promoting OV's role in driving sustainable development (January 20, 2026 | 09:31)

- 14th National Party Congress affirms Party’s leadership role, Vietnam’s right to self-determined development (January 20, 2026 | 09:27)

- Direction ahead for low-carbon development finance in Vietnam (January 14, 2026 | 09:58)

- Vietnam opens arms wide to talent with high-tech nous (December 23, 2025 | 09:00)

- Why global standards matter in digital world (December 18, 2025 | 15:42)

- Opportunities reshaped by disciplined capital aspects (December 08, 2025 | 10:05)

Tag:

Tag:

Mobile Version

Mobile Version