How to drive the economy by reforming state-owned debt

|

| By Donald Lambert - Principal private sector development specialist Asian Development Bank |

As a result, many SOEs are no longer borrowing through the government, but they are still using debts sub-optimally. That is a big deal. SOEs accounted for 29 per cent of GDP as of 2016 and comprised seven out of Vietnam’s 10 largest corporations in 2018. They are dominant in infrastructure and other sectors that are key to improving Vietnam’s productivity.

If SOEs struggle, Vietnam will struggle. This is truer now than before the outbreak of the COVID-19 pandemic because government resources are needed more than ever for public health and economic recovery.

To help clarify these issues, the Asian Development Bank undertook a study to identify financially-sound SOEs. A secondary outcome was the identification of broader themes that, if addressed, would better position SOEs to borrow more effectively. The following are six priorities for future action that we identified as part of the unpublished study.

Better structuring: Symptomatic of the bank loans that are available domestically in Vietnam, SOEs rely heavily on floating-rate debt that often carries tenors that are shorter than the economic life of the assets being financed. This introduces interest rate and refinancing risk.

The bond market offers SOEs the best opportunity to secure better structured financing, but SOEs have underutilised it despite the corporate bond market’s rapid growth since 2017.

A related structuring issue, particularly for infrastructure, is project finance. This loan structure relies on the creation of a special purpose vehicle and ring-fenced cash flows.

In many cases, it gives borrowers the comfort to lend for longer maturities than loans to a parent company. Its greater use would also help Vietnamese SOEs to better match loan tenor with the economic lives of assets.

There is a stereotype that SOEs have too much debt. Although there are certainly some highly leveraged SOEs in Vietnam, over-indebtedness is not universal, and paradoxically, too little debt can be a problem.

Yes, more debt increases financial risk, but it also boosts the government’s returns on its invested equity. Moreover, debt can introduce discipline. With cash going to pay interest, there is less temptation to prioritise discretionary expenses. We found quite a few SOEs that can afford a higher proportion of debts, which would free cash for new investments, or for dividends to the government.

Accessible and compatible financial statements: For many SOEs, there is a need to strengthen their financial reporting. Out of the 11 SOEs in the study, not all published their financial statements on their websites and five had qualified audit opinions. The former inhibits transparency. The latter prompts questions, and in some cases, a qualified audit will lead lenders to invest elsewhere.

|

SOE financial statements could also do more to attract international lenders. All the enterprises sampled reported only under Vietnamese accounting standards as opposed to the more globally accepted International financial reporting standards, and to the extent that foreign borrowing is a priority, financial statements need to be available in English. Few in the sample were.

Credit ratings: Another limitation to effective capital raising is the scarcity of credit ratings. Perhaps more SOEs would be rated if there were a well-established domestic credit rating agency.

Currently, Vietnam has licenced to two domestic agencies, but neither has yet itself in the market yet. The sooner one of these two or some later entrant can establish itself, the easier and less costly it will be for SOEs to be rated.

Sovereign ceiling: Our study focused only on financial data and did not consider subjective criteria that would require more intensive interactions with management and a better understanding of the particular industries.

Nonetheless, a surprisingly high number of SOEs – based exclusively on their financials – were positioned for credit ratings that could exceed Vietnam’s country rating. In other words, these SOEs would have higher ratings if Vietnam had a higher rating.

The potential of these SOEs and other corporates in Vietnam to have better ratings underscores the importance of raising Vietnam’s credit rating, which will require less leverage in the banking sector and continued the reduction of the stock of public debt and guarantees.

Divestment: Another drag on the sovereign credit rating, as consistently flagged by rating agencies, is the implicit obligation that the government might have to assist an SOE in financial difficulty. To reduce these potential liabilities, the government needs to reduce its ownership of SOEs.

Equitisation (reducing ownership below 100 per cent) and divestment (reducing ownership below 51 per cent) have other merits too. Multiple studies have confirmed their benefits in Vietnam (as elsewhere) in boosting SOEs’ efficiency, profitability, and revenues.

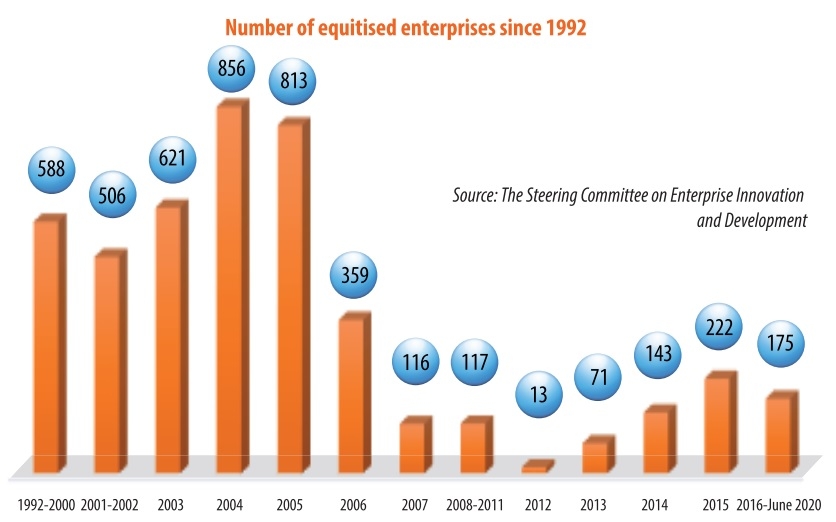

Unfortunately, equitisation and divestment have slowed. According to statistics from Fiin Group, between 2014 and 2016, 197 SOEs in Vietnam were either equitised or divested. Between 2017 and 2019, the total fell by over half.

| From 2016 to June 2020, the whole country equitised 175 enterprises with total state-owned capital volume of VND207.14 trillion ($9 billion) - including VND27.33 trillion ($1.18 billion) in 2016, VND161.94 trillion ($7 billion) in 2017, VND15.54 trillion ($675.6 million) in 2018 – equivalent to 109 per cent of total state capital at equitised enterprises for the 2011-2015 period. Also in this period, the state divested VND25.17 trillion (nearly $1.1 billion) and collected VND171.84 trillion ($7.47 billion), which was 6.8 times higher than the book value. Total money collected from equitisation and divestment since 2016 reached more than 218 trillion ($9.47 billion), which is 2.79 times higher than the total revenue from equitisation and divestment in the 2011-2015 period (about VND78 trillion or $3.4 billion). The money transferred to the state budget under the National Assembly resolution hit VND211.5 trillion ($9.2 billion) out of VND250 trillion ($10.87 billion), tantamount to 85 per cent of the plan for the 2016-2020 period. In addition the country’s efforts to foster the development of the private sector, including small- and medium-sized enterprises, have achieved a number of positive results. The number of newly-established enterprises and total newly-registered capital volume in 2019 and the past five years reached record levels. The ratio of enterprises out of 1,000 people has consecutively increased, at 7.6 in 2019, 7.3 in 2018, 6 in 2017, and 5.4 in 2016. The number of businesses resuming operation in the first eight months climbed 27.9 per cent on-year. However, besides such achievements, there have been some limitations. Specifically, the speed of equitisation remains slow as compared to the initial plan. Under the list already approved by the prime minister in Document No.991/TTg-DMDN dated July 10, 2017 on adopting the list of SOEs that must complete annual equitisation for the 2017-2020 period, only 28.3 per cent of the plan has been completed. The prime minister in 2014 also enacted Decision No.26/2014/QD-TTg approving a list of businesses with equitisation by the end of 2020. The speed of state capital divestment at enterprises also remains slow as compared to the set plan. In the first six months of the year, almost no large-scale equitisation or divestment was conducted. Under Decision No.1232/QD-TTg dated August 2017 on approving the list of state-invested enterprises undergoing divestment, in the 2017-2020 period divestment of 348 enterprises was planned. However, only 26.4 per cent has been completed (92 enterprises). In June, the prime minister promulgated Decision No.908/QD-TTg on approving the list of state-invested enterprises undergoing divestment. Source: Report by the government at an SOE equitisation conference in August |

In August 2019, the government identified 93 SOEs for equitisation or divestment by 2020. It is critical that these reforms continue, particularly for sectors like manufacturing and agriculture where the rationale for state ownership is unclear and the competition from the private sector fierce.

Identifying a handful of SOEs that have strong underlying financials will not usher in a halcyon era of SOE reform. Yet, it is a step.

The more Vietnam’s SOEs can access new and better-structured sources of capital through the strength of their own balance sheets, the more they will benefit from market discipline, the more they can fund infrastructure and other key development needs, and the more the government can prioritise resources for COVID-19 and other exigencies that only it can address.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version