How new rules will change the securities basket of VN DIAMOND index

|

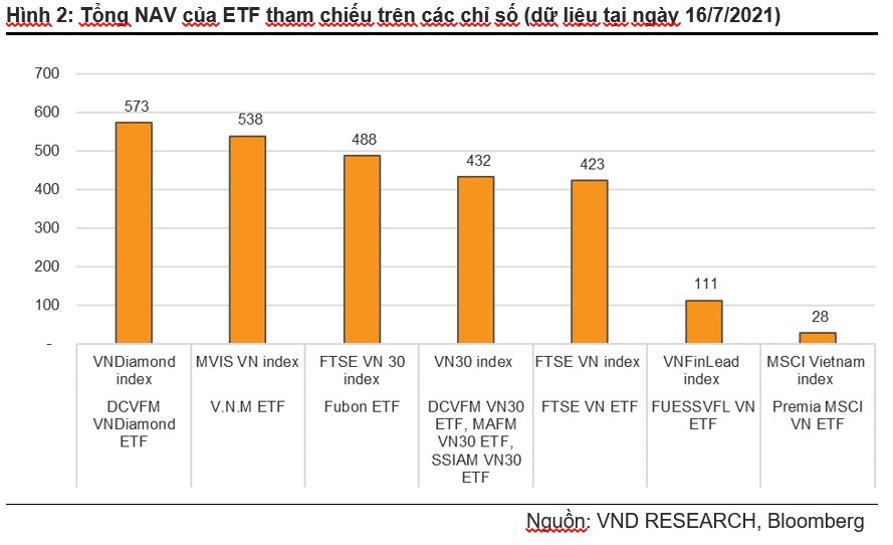

| Net asset value of seven exchange-traded funds in Vietnam as of July 16, 2021 (Source: Bloomberg, VNDIRECT) |

VNDiamond ETF, which tracks the VN Diamond index, has recorded an impressive growth of 149.1 per cent year-to-date in net asset value (NAV) by reaching $573 million and becoming the largest ETF so far in Vietnam. Besides, the VN Diamond index has surged 35.9 per cent year-to-date, outperforming the VN Index (10.7 per cent) and VN30 Index (25.9 per cent), according to VNDIRECT.

The Ho Chi Minh City Stock Exchange (HSX) has announced some changes in the rules for the VN Diamond index on June 15 and is expected to take effect in October. According to VNDIRECT, the new rules will criteria for listing time, capitalisation, liquidity, and foreign ownership limit in order to enhance the quality of index.

According to VNDIRECT's estimates, some stocks will be affected by the new rules.

First and foremost, new rules require stocks to have freefloat adjusted market capitalisation above VND2 trillion ($86.96 million) to be eligible for inclusion in VN Diamond. This mean listed companies like Coteccons (HSX: CTD) and Thanh Cong Textile Garment Investment Trading JSC (HSX: TCM) may be excluded from the index in the next review period.

Second, new rule adds liquidity ratio into the index calculation, meaning stocks with lower liquidity ratio will have their weight reduced in the VNDiamond index. Based on data from June 2021, the weight of Eximbank (HSX: EIB), VIB (HSX: VIB), Mobile World Group (HSX: MWG), and PNJ (HSX: PNJ) will likely be reduced due to their current low liquidity ratio.

"Third, the new rules also tighten VN Diamond’s foreign ownership limit (FOL) ratio screen. This will make it more difficult for stocks with a set foreign ownership limit to enter VN Diamond. For example, SHB (HNX: SHB) and Viet Capital Bank (UPCoM: BVB) are planning to lower their FOL to 10 and 5 per cent, respectively, and are planning to move to the HSX in the future. Even though these stocks always fill out their FOL, they will also not be eligible to enter VN Diamond," the brokerage noted.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Banks roll out God of Wealth Day promotions (February 26, 2026 | 17:10)

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

Tag:

Tag:

Mobile Version

Mobile Version