High pedestal to reach for 2023’s growth ambitions

|

| High pedestal to reach for 2023’s growth ambitions |

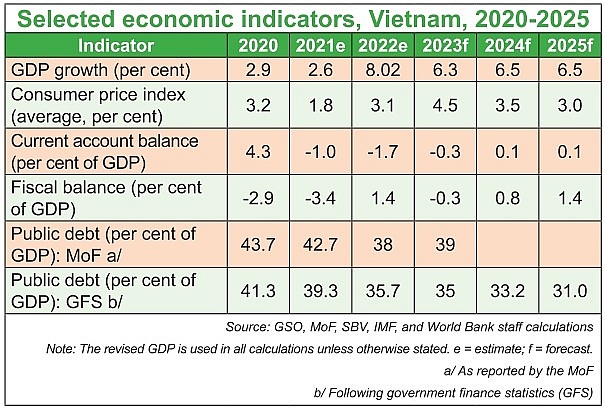

Vietnam’s economic growth is projected to ease to 6.3 per cent in 2023 from a robust 8.02 per cent last year, as services growth moderates and higher prices and interest rates weigh on households and investors, according to the World Bank’s latest Taking Stock report released last week.

Growth is expected to pick up to 6.5 per cent in 2024 as the economies of Vietnam’s main export markets gain strength, the report said.

The outlook for Vietnam reflects heightened uncertainty in the global economy. Downside risks include weaker-than-expected growth in Vietnam’s major export markets, which include the United States, China, and the Eurozone, tightening financial conditions, higher domestic inflation, weaknesses in the balance sheets of corporate, banking and household sectors, and financial sector vulnerabilities.

The Vietnamese government has set a target that GDP will increase 5.6 per cent in Q1, 6.7 per cent in Q2, 6.5 per cent in Q3, and 7.1 per cent in Q4. The whole-year rate will be 6.5 per cent.

“While the tourism sector continues to recover thanks to the gradual return of Chinese tourists, who accounted for about 30 per cent of total tourists to Vietnam before the pandemic, service sector growth will moderate as the post-pandemic low base-effects fade,” the report stated.

“Domestic demand is expected to be affected by higher estimated inflation (4.5 per cent average) in 2023. In the first half of 2023, manufacturing exports will moderate as demand from the US and Eurozone weakens, while the path to China’s economic recovery is uncertain.”

Challenging headwinds

Currently, 2023-2024 global prospects are facing hurdles with growth projected at around 1.7 and 2.7 per cent, respectively. Continued elevated inflation and monetary tightening in advanced countries to fight inflation are expected to persist into mid-2023.

Heightened uncertainties weighed on the global economy in 2022, as it grappled with low growth and high inflation, the lingering effects of the pandemic, and the ongoing war in Ukraine. Despite these challenges, the global economy registered a weak expansion of only 2.9 per cent last year, with the US and the euro area registering 1.9 and 3.3 per cent GDP growth, respectively.

According to the World Bank, Vietnam’s domestic demand is expected to be affected by higher estimated inflation (4.5 per cent average) in 2023, which may erode household purchasing power. Rising interest rates may weigh on private investment. Amid softer external demand, the contribution of net exports to growth is estimated to be negative (-0.6 percentage points).

“But as the commodity price shock dissipates and global inflation-risks recede, and as China’s economic recovery gathers speed, global demand is expected to recover and exports from Vietnam will regain momentum. In the meantime, remittances are expected to contribute substantially to the current account,” said Dorsati Madani, senior country economist from the World Bank in Vietnam.

“The expected recovery of Vietnam’s major export markets during the second half of the year will positively impact exports. Growth is expected to reach 6.5 per cent in 2024 onward as exports strengthen further in response to recovery in all three of Vietnam’s primary markets including the US, Eurozone, and China,” Madani added.

Fitch Solutions also takes caution about Vietnamese economic outlook projection.

“Vietnam’s real GDP growth slowed sharply from 13.7 per cent on-year in Q3 of 2022 to 5.9 per cent in Q4 of 2022, and we remain cautious about the outlook for 2023,” Fitch Solutions said. “While the economy will receive support from a likely rebound in demand from China, it will not be enough to offset the impact of a further weakening in global demand. With domestic inflation also set to rise a little further and monetary tightening underway, we expect GDP growth to slow from 8.02 per cent in 2022 to 6.5 per cent in 2023, below the pre-pandemic average of 7 per cent.”

|

New expectations

Meanwhile, FocusEconomics panellists expect Vietnam’s GDP to expand 6.1 per cent in 2023 and 6.5 per cent in 2024.

“Economic momentum will slow as exports, investment and consumption growth moderate this year. That said, accelerating government spending and China’s reopening will add support. In any case, Vietnam will likely remain ASEAN’s best performer in 2023,” FocusEconomics told VIR. “Exchange rate fluctuations and banking liquidity are important factors to watch.”

“After a swift expansion in Q3 last year, economic momentum weakened in Q4 as slowdowns in services, industrial activity and construction more than offset an acceleration in the agriculture, forestry and fisheries sector. Higher inflation, dwindling exports and tighter financial conditions dragged on activity,” FocusEconomics added.

Meanwhile, Vietnam’s index for industrial production (IIP) increased merely 1.06 per cent in January and 3.6 per cent in February, on-year. The government has set a target that the IIP will climb 5.5 per cent in Q1 of 2023, 8 per cent in Q2, 8.2 per cent in Q3, and 8.8 per cent in Q4. The rate for the whole year will be 7.7 per cent.

“In 2023, the economy will continue having to be challenged by difficulties, especially when it remains quite open to the world’s economy,” said Nguyen Thi Huong, general director of the General Statistics Office (GSO).

The economy’s GDP was valued at $409 billion in 2022 when total export-import turnover hit $732.5 billion, which was 1.8 times higher than GDP.

According to the GSO, last year, the number of businesses with halted operations reached 73,800 - up 34.3 per cent on-year. In addition, the number of those with suspended operations and waiting for dissolution hit 50,800 – up 5.5 per cent; while the number of those having completing dissolution procedures stood at 18,600 – up 11.2 per cent. On average, each month witnessed about 11,900 businesses withdrawing from the market.

In the first two months of this year, the number of enterprises whose performance was halted touched 3,800, up 9.7 per cent on-year. Furthermore, the number of businesses with suspended operations and awaiting dissolution hit about 2,640, up 37.5 per cent; while the number of those that completed dissolution procedures was 1,170, down 5.4 per cent.

HSBC in December revised down the Vietnam forecast for 2023 from 6 to 5.8 per cent due to lingering risks including trade headwinds. The Asian Development Bank also stated that there are indicators of weakening global demand for the country’s exports. Growth for 2023 has therefore been adjusted down to 6.3 per cent as major trade partners weaken.

| Carolyn Turk-Country director in Vietnam World Bank

Global conditions in 2022 were highly volatile and uncertain, affected by slowing down growth and demand, high inflation, tightened monetary and financial conditions, and of course the heightened geopolitical complexity. These continue to be risks to global macroeconomic performance in 2023, and also to Vietnam, which is a highly open economy. We saw just a few days ago the closing down of Silicon Valley Bank, the 16th largest bank in the US. The impact of this event is to unfold in the coming days and weeks and may lead to more volatilities in global monetary and financial markets, requiring close attention and prompt actions by policy makers around the world, including in Vietnam. Against this backdrop, Vietnam’s economy continued to grow in 2022 – registering a robust growth rate of 8.02 per cent, the highest in the region. This strong growth was partially due to the low-base effect of 2021. The country’s demand recovered from the lockdown, and exports also had solid performance in the first three quarters of the year.However, it should be highlighted that Vietnam’s economy could have performed at an even higher level if budget execution, especially on public investment, had become more effective. The role of supportive fiscal policy and effective execution will continue to be critical to Vietnam’s economic recovery and growth, especially in the context of highly uncertain global conditions. There was much turbulence in the Vietnamese monetary and financial markets last year. While authorities acted promptly to restore market confidence, many systemic weaknesses in the banking and financial markets were revealed – and they could potentially affect the macroeconomic stability of the country. Addressing these weaknesses with decisive and coordinated reforms will not only ensure stability for Vietnam, but also the economy’s efficiency and long-term growth. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version