Gun primed on credit growth race

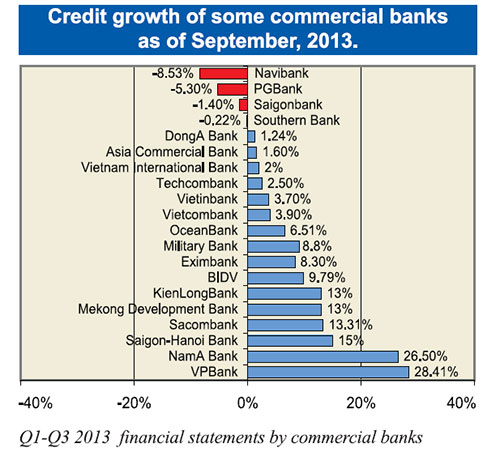

By the end of the third quarter many commercial banks were still behind their credit growth targets, some were under 50 per cent. A few are facing negative growth including Navibank, Saigonbank, PGBank, and Southern Bank.

In terms of the national credit growth target of 12 per cent, 8 per cent has been achieved. In capital terms, another $760.6 million needs to be lent. Financial experts are worried that in their push to make up the difference, banks may neglect credit quality.

According to economic expert Vu Dinh Anh, a similar problem occurred in 2011 when the State Bank announced a credit growth limit for 2012. The race to lend toward the end of the year resulted in credit shrinking by 2.25 per cent in the first quarter of 2012.

Again this occurred in late 2012 when credit jumped by 6 per cent with an annual national target of 9 per cent. This strongly indicates growth did not reflect true demand.

“Credit growth this year should be only 9-10 per cent. Most important is credit quality, and if this is ignored, bad debts will mount over the next 3-6 months,” said Anh. “The biggest issue is if the State Bank loosens monetary policy, the economy may suffer serious consequences,” he added.

According to Nguyen Thi An Binh, deputy general director of Military Bank, a possible way to grow credit quickly and safely would be to disburse at least some of the vast amount of capital planned for government projects in transportation and construction. Military Bank has achieved credit growth of 8.8 per cent in the first nine months of this year.

Bad debts are still the main obstacle between bank capital and the marketplace. “Banks cannot risk lending to customers who may not pay as they have to provision 100 per cent of the loans,” said Le Xuan Nghia, member of the National Financial and Monetary Policy Advisory Council.

“If NPLs are dealt well, credit growth of next year can reach 14-15 per cent,” said Nghia.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version