Focused spending can set a solid base for positive outcome

The absence in adjustment of power rates, tuition, and hospital fees contributed to an extremely low growth rate of GDP in 2020–2021 or an excessively high one in 2022, as well as relatively moderate inflation throughout 2020–2022. In the first two months of 2023, average core inflation climbed to 5.08 per cent, outpacing the average consumer price index (CPI) growth of 4.6 per cent.

|

| Dr. Vu Dinh Anh - Market Price Research Institute Ministry of Finance |

For 2023, public investment is seen as an economic boost. Investment capital generated from the state budget in February 2023 was anticipated to be almost $1.3 billion, an increase of 36.9 per cent compared to the same month last year. The expected amount of newly registered foreign direct investment up to February 20 was $1.76 billion, which was 2.8 times more than that in the same period in 2022. Slowdown in industrial development and a lack in investment capital are barriers that must be resolved to prevent a downturn in development this year.

Estimated state budget revenues for February 2023 were $5.24 billion, and the first two months of the year brought in an estimated $15.2 billion, or 22.4 per cent of the projection.

Nonetheless, the state budget projection for 2023 was formulated prudently from the perspective of a partial loosening, including a significant increase in development investment expenditure to boost economic growth while maintaining a focus on inflation management.

Overall state budget expenditures in 2023 are estimated to be $87.29 billion, an increase of about $12.26 billion, or 16.3 per cent, from the forecast for 2022. Compared to the amount of state budget expenditures generated in 2022, which totalled $85.57 billion, the rate of loosening state budget expenditures is modest and has little effect on the capacity to control inflation.

Due to the possibility of crisis, rising inflation, and restrictive monetary policy worldwide, increasing spending on development is crucial. To guarantee the reliability and efficacy of public investment, raising development investment expenditure can only be beneficial if the issue of sluggish disbursements is addressed and losses are avoided.

Consumer spending could be a notable major element of growth in 2023; consumer services revenue in February 2023 declined by 6 per cent compared to the previous month but climbed by 13.2 per cent over the same time period year, and was projected at $20.26 billion. The overall retail sales of consumer goods and services grew by 13 per cent in the first two months.

Hence, although investment and the state budget spending are comparatively low, domestic consumer demand has rebounded remarkably and is poised to become the major economic engine in 2023. The expected export turnover of commodities in February was $25.88 billion, up 9.8 per cent from the previous month and 11.1 per cent from last year.

Imports and exports have a negligible effect on demand-pull inflation in 2023, but exports will be the primary source of economic expansion.

The required tightening of monetary policy starting in the fourth quarter of 2022 will continue to impact inflation. At the end of 2022, the overall payment instruments rose by only 3.85 per cent compared, and the capital mobilisation of credit institutions grew by only 5.99 per cent, but the growth of credit in the economy reached 12.87 per cent.

Rising costs in 2023 are under pressure because the USD price index in December 2022 jumped by 5 per cent compared to the same month in 2021, and averaged 2.09 per cent in 2022. Particularly useful for limiting inflation in 2023 is expertise in managing pricing policy. Adapting the cost of healthcare amenities and medical treatment offerings in accordance with new government circulars raised the cost of hospital facilities by 4.65 per cent, and ramping up tuition fees raised the average CPI by 0.18 per cent.

To achieve the socioeconomic targets of 2023 and control inflation, it is essential to uphold consumer confidence as well as investment across society while endorsing exports and imposing import restrictions. It is also important to stabilise the macroeconomy, sustain an adequate financial-monetary market and bank credit, and foster a business- and investment-friendly environment.

On the other hand, it is requisite to be assertive and adaptable in tightening monetary policy, clearly targeted at controlling inflation while loosening fiscal policy by decreasing the burden of the government’s budget revenue and ramping state budget expenditure schedule. Guaranteeing public spending is a crucial element for economic progress not just in 2023 but the years to come.

| Digital economy hoped to make up 20pc of Vietnam’s GDP by 2025 Vietnam expects its digital economy to account for 20 percent of GDP by 2025. |

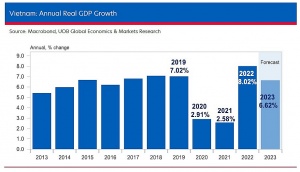

| Anticipated GDP growth rate for 2022 hits 8.02 per cent This is the highest growth rate in over a decade, indicating a robust economic rebound this year. |

| Potential for 6.6 per cent GDP growth in 2023 Overall growth momentum is likely to moderate further this year, as policy tightening from major central banks weighs on external demand. With that, UOB has kept its 2023 GDP growth forecast at 6.6 per cent. |

| World Bank says Vietnam's GDP growth to moderate in 2023 Vietnam's GDP growth is projected at 6.3 per cent in 2023, according to the latest Global Economic Prospects report by the World Bank. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Mobile Version

Mobile Version