Flexible sales methods push e-commerce sellers ahead

|

| E-commerce groups know that shoppers often seek a fun time rather than simply good deals, Photo: Shutterstock |

Through the TikTok Shop platform, Bac Giang province set a record last month by selling out of 23 tons of lychees, bringing in more than $52,000 after only four hours.

The scheme was part of a series of activities carried out by TikTok Vietnam to support sellers to promote local craft villages and products on this application’s digital platform, with the participation of 40 TikTokers and witnessing 1.7 million views.

From a globally popular video-sharing platform, TikTok is gradually showing the advantages of entering the e-commerce field through the so-called “shoppertainment” model.

“TikTok Shop offers a fun shopping experience for customers who buy for the excitement and aren’t too fixated over the prices,” said TikTok Vietnam representative Nguyen Lam Thanh.

After only a year of joining the e-commerce field, TikTok Shop has quickly become a familiar and favourite shopping channel for many Vietnamese consumers, especially the younger generation.

According to a Connected Consumer report published by Decision Lab and MMA in Q1, TikTok Shop use has increased steadily by 5 per cent every quarter since it launched in Vietnam last year.

The popularity of Gen-Z consumers for the platform is also increasing, reaching a rate of 7 per cent regular use in Q1, higher than both Tiki and Facebook.

Meanwhile, the biggest names in e-commerce here, Shopee and Lazada, recorded a decline in usage rates of 2 and 3 per cent respectively compared to the end of last year.

TikTok Shop is expected to spend more than $12 million over the next three years to support more than 120,000 sellers and businesses in the region.

Category manager in Vietnam for TikTok Shop Daniel Nguyen said, “We will continue to improve management tools and increase the experience with affiliate marketing, along with supporting shipping prices to make it easier for users to buy, while sellers can also optimise costs.”

Unique advantages

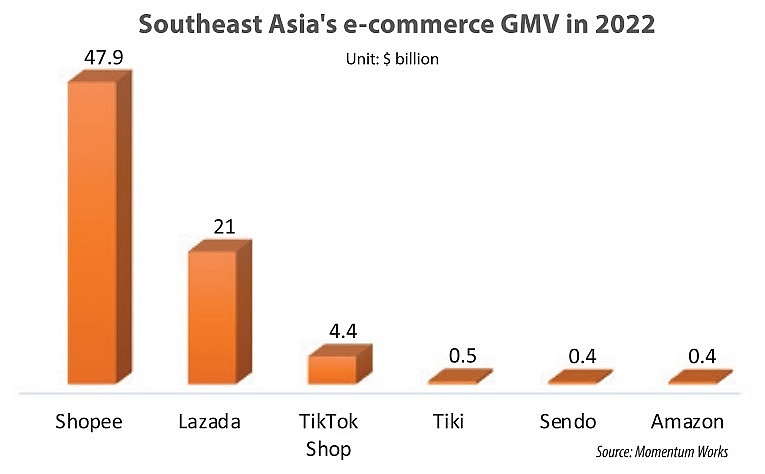

The rapid growth of the shoppertainment model has made the e-commerce market more competitive. According to new data published in a report on e-commerce in Southeast Asia by Singaporean tech consulting firm Momentum Works, gross merchandise value in 2022 at Vietnam’s five-largest multi-industry e-commerce groups reached $99 billion.

In which, Shopee’s market share dominated with 63 per cent, 2.7 times higher than Lazada’s. Tiki ranked third with 6 per cent market share, while TikTok Shop and Sendo share the same position with 4 per cent.

Thanks to the support of parent corporations possessing abundant financial potential, Shopee of Sea Group, Lazada of Alibaba Group, and Tiki of Tiki Global have stepped up investment in new tech such as AI and chatbots to enhance the user experience and improve interaction between customers and businesses.

The e-commerce platforms are also investing in building their own logistics system with respective forwarding units including Shopee Express, Lazada Express, and Tiki Now as a way to increase benefits for customers, complete the logistics supply chain, and save on costs and delivery times.

The use of flexible sales methods, responding to new trends through discounts, and live-streaming from content creators also helps sellers on Shopee and Lazada increase revenues.

Dang Anh Dung, deputy general director of Lazada Vietnam, told VIR that retailers often face many obstacles in getting adjusted to the e-commerce environment.

“We established Lazada University to provide training and support for small retailers to get used to the online business environment, as well as provide some tools for them to set up shop on the e-commerce platform and convert orders faster,” Dung said.

“We also provide a number of solutions to interact with customers and link with banks, such as on- and off-exchange advertising solutions, so that retail sellers have more opportunities to grow with us,” he added.

According to the Vietnam e-commerce ranking in 2022 by Reputa’s network information monitoring system, Shopee ranks first in popularity, followed by Lazada.

The dominance of these two names extends to Southeast Asia as Shopee also leads the market share in Indonesia, Malaysia, Thailand, the Philippines, and Singapore, while Lazada ranks second in five markets.

|

Not falling behind

Despite their own advantages, e-commerce platforms also face the risk of being replaced in a volatile and ever-changing market.

Sendo is one example. This e-commerce platform ranked fourth in terms of market share, but also slipped out of the top 10 most popular social networking platforms in July last year, according to Reputa’s statistics.

However, some e-commerce platforms are content with their own development strategies and do not follow the shoppertainment trend.

Cho Tot is the second-hand buying and selling platform from Carousell Group, an Asian unicorn with online classifieds trading platforms in eight different markets.

Hoang Thi Minh Ngoc, chief growth officer of Carousell in Vietnam, explained that after 10 years in the Vietnamese market, Cho Tot has gone through the fiercest competitive periods of e-commerce but has always kept separate development goals.

“With the nature of the category being different from other e-commerce sites, we chose not to follow the shoppertainment trend but put our top priority on focusing resources to build a reliable and effective factor for both buyers and consumers, so that customers can feel secure and confident,” Ngoc said.

Cho Tot currently focuses on four main categories: property, vehicles, electronics, and jobs. Its business activities in the first half of 2023 showed positive signs, reaching the same level as the same period last year. Ngoc said that the number of monthly users accessing the platform has increased by 10 per cent and the revenue of the Vietnamese market was still in the top three for the group.

According to data from the Ministry of Industry and Trade’s E-commerce and Digital Economy Agency, the size of the business-to-consumer retail e-commerce market in Vietnam reached $16.4 billion last year. Nearly 80 per cent of internet users in Vietnam participate in online purchases, equivalent to over 50 million people, with total spending reaching $12.4 billion last year.

Vietnam has the second-highest e-commerce growth rate in Southeast Asia and is expected to rise to the top by 2026, according to a survey by Facebook and Bain & Company. Data from Statista shows that the growth rate of e-commerce in Vietnam can increase to 29 per cent by 2025 with a value of up to $234 billion.

| E-commerce competition: a story of past and future E-commerce investment activities in Vietnam can be divided into three main phases. In the first phase, Vietnam’s e-commerce industry started from the mid-2000s to 2010 with early generations of e-commerce platforms such as Vat Gia, En Bac, Cho Dien Tu, and 123mua.vn. |

| Tiki CEO Tran Ngoc Thai Son steps down, casting shadows over IPO plan According to a report by DealstreetAsia, Tran Ngoc Thai Son, CEO and co-founder of Tiki, has tendered his resignation to the company's Board of Directors. |

| Tiki battles to keep up with financially muscular rivals Amid the resignation of Tiki’s co-founder, Vietnam’s e-commerce landscape faces a challenging period underscored by intense competition, performance challenges, and the pressing need for a strategic overhaul. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version