Flexibility headlines finance for 2022

Talking to VIR, economist Dr. Nguyen Tri Hieu said that Vietnam’s economy was a huge fluctuation in 2022 which was beyond the expectations of the government and the State Bank of Vietnam (SBV).

The US raised interest rates seven times in 2022. Each interest rate hike has increased the value of the USD, which pushed down the value of VND and caused the exchange rate to increase forcefully, especially in the last months of the year.

“In response to the instability in the foreign exchange market, the SBV increased interest rates twice to increase the value of VND and balance the foreign exchange market. This helped the market become relatively stable again, but it is still a big change compared to the beginning of the year,” Hieu said.

|

| Some banks have attempted to raise new capital |

At the same time, while the SBV used the national reserve tool but could not keep selling foreign currencies, it adjusted the trading band from 3 to 5 per cent. As a result, the foreign exchange market stabilised again, according to Hieu.

Regarding credit policy, Hieu believed that the government and the SBV have been somewhat passive, and the main reason is the US Federal Reserve’s management of monetary policy. In addition, there are domestic factors caused by recent property-related incidents that have created a thirst for capital.

“The SBV’s intention was to fight inflation while not opening more credit, and limit supply so that the economy wouldn’t heat up. However, under a lot of pressure, everything had to change in the last minute,” Hieu assessed.

Since 2020, banks in Vietnam were allowed to restructure debt while not transferring customer debt groups. When this regulation expired in July last year, bad debts hiked up causing capital flows not to return to banks, so banks had to raise new capital to repay customers and were forced to increase interest rates.

Allowing for adaptability

Meanwhile Tran Thi Khanh Hien, director of VNDirect’s Securities Analysis, said that entering the first months of 2023, interest rate and exchange rate pressure will still be considerable when the Fed maintains the momentum of interest rate hikes at least 125 basis points more and the liquidity test for mature corporate bonds is still there.

“Pressure on interest rates and exchange rates will be partly relieved from mid-2023, when the Fed being less hawkish and the improvement of Vietnam’s foreign exchange reserves will prevent the devaluation of the VND, and interest rates will tend to decrease gradually,” Hien said. “Credit growth will be slow in the first half of the year and more prosperous in the second half, with the whole year being at 11-12 per cent.”

Andrea Coppola, the World Bank’s chief economist, said that the current global context, characterised by uncertainty, puts Vietnamese policymakers in a difficult position in balancing the need for continued policy support to underpin the recovery with the need to contain inflation and emerging financial risks. High levels of uncertainty will require the policy mix to adapt to changing circumstances.

“If the Fed continues to raise interest rates and exchange rate pressure persists, the Vietnamese monetary authority may consider allowing for more exchange rate flexibility, including the decrease in the reference rate being faster. With persistent exchange rate pressures, direct foreign currency sales can be used very conservatively to maintain foreign exchange reserves,” Coppola said.

In the event that a faster price slide leads to a significant increase in inflation and an increase in inflation expectations, the SBV may consider using the reference interest rate again, Coppola added. However, policy space is limited due to the already high interest rates. Close coordination between monetary policy and fiscal policy will help minimise the increase in interest rates.

“Local authorities can consider limiting public spending while prioritising spending on human resource development and speeding up the implementation of selected public investment projects that have the highest expected impact on economic growth. Effective public investment management is crucial for promoting economic growth in the context of inflation,” Coppola said.

Although the country has largely succeeded in controlling inflation according to the targets for 2022, the data of headline inflation and core inflation over the same period still tended to increase from January to November and is likely to continue to increase in the near future.

Meanwhile, an open economy like Vietnam faces challenges when the world economy slows down and a number of countries and Vietnam’s main markets are likely to fall into recession.

Close coordination

In order to control inflation and stabilise the macroeconomy, the SBV said it will continue to operate to stabilise the currency and foreign exchange markets, and ensure the liquidity of the credit institutions system. Specifically, the central bank will have to rationally and synchronously manage both interest rates and exchange rates, and credit growth in line with market and macroeconomic developments.

In difficult circumstances, it may be necessary to have a priority goal and it is necessary to continue to ensure the safety of the operation of credit institutions and stabilise depositors’ psychology.

That is according to Pham Thanh Ha, Deputy Governor of the SBV. Ha said that the capital supply for the economy comes from either bank credit, the stock market, or investment, including public investment. Accordingly, monetary policy needs to continue to be synchronised and closely coordinate with fiscal policy and other macro policies, as there is a clear connection between the money market, capital market, and real estate market.

“Bank credit tries to meet the capital needs of the economy at a high level, but the ability to supply credit depends on capital mobilisation and credit quality assurance. A developed capital market will help reduce pressure on bank credit,” Ha said. “A boost in funding will help increase liquidity for the banking system and reduce pressure on bank credit. In turn, when the money market is stable, it will create positive conditions for businesses to mobilise capital through the stock market or the government through the bond issuance channel.”

Economist Hieu concluded that the prospects for 2023 depend largely on geopolitical movements, the Ukraine conflict, and oil fluctuations, among other aspects.

“If the situation remains as it is now and inflation in the US is under control, then by mid-2023, the Fed will probably stop raising interest rates. As the rates return to the normal level before the pandemic, it will have a positive impact on the global economy, including the Vietnamese economy,” Hieu forecasted.

According to Hieu, interest rates and exchange rates in Vietnam will be more stable from the second half of 2023. If the SBV maintains its credit growth target in 2023, the regulatory agency may increase the rate up to 17 per cent.

“We still need to be cautious about credit growth because if the growth is too strong, it can heat up the economy and thereby lead to inflation risks,” he emphasised.

| Previous financial crises thus far averted via stable moves The increase of the central exchange rates and adjustment of the exchange rate band of the State Bank of Vietnam are suitable with the trends of other currencies at a lighter level. |

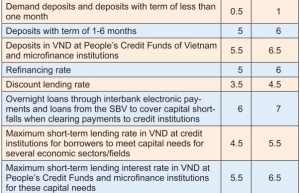

| State Bank of Vietnam alleviates market pressures The State Bank of Vietnam adjusted several operating interest rates last week, with the move deemed necessary in the context of a strong USD and increasing domestic pressure on interest rates and exchange rates. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version